PNC Bank 2011 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

These Trust Securities are automatically exchangeable as set forth above under certain conditions relating to the capitalization or

the financial condition of PNC Bank, N.A. and upon the direction of the Office of the Comptroller of the Currency.

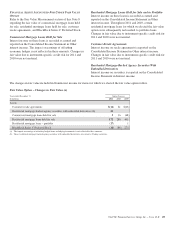

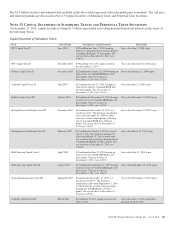

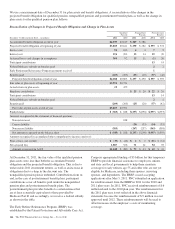

Summary of Replacement Capital Covenants of Perpetual Trust Securities

Replacement Capital Covenant (a) Trust Description of Capital Covenants

Trust I RCC PNC Preferred Funding Trust I Neither we nor our subsidiaries (other than PNC Bank, N.A. and its subsidiaries) would

purchase the Trust Securities, the LLC Preferred Securities or the PNC Bank Preferred

Stock unless such repurchases or redemptions are made from proceeds of the issuance

of certain qualified securities and pursuant to the other terms and conditions set forth in

the Trust I RCC.

Trust II RCC PNC Preferred Funding Trust II Until March 29, 2017, neither we nor our subsidiaries would purchase or redeem the

Trust II Securities, the LLC Preferred Securities or the Series I Preferred Stock unless

such repurchases or redemptions are made from proceeds of the issuance of certain

qualified securities and pursuant to the other terms and conditions set forth in the Trust

II RCC.

(a) As of December 31, 2011, each of the Trust I RCC and the Trust II RCC are for the benefit of holders of our $200 million of Floating Rate Junior Subordinated Notes issued in June

1998.

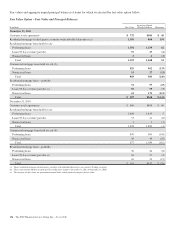

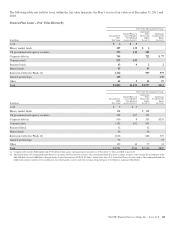

Summary of Contractual Commitments of Perpetual Trust Securities

Trust Description of Restrictions on Dividend Payments (c)

PNC Preferred Funding Trust I (a) If full dividends are not paid in a dividend period, PNC Bank, N.A. nor its subsidiaries will declare or pay dividends or

other distributions with respect to, or redeem, purchase or acquire or make a liquidation payment with respect to, any of

its equity capital securities during the next succeeding period (other than to holders of the LLC Preferred Securities and

any parity equity securities issued by the LLC). (d)

PNC Preferred Funding Trust II (b) If full dividends are not paid in a dividend period, PNC will not declare or pay dividends with respect to, or redeem,

purchase or acquire, any of its equity capital securities during the next succeeding dividend period. (e)

PNC Preferred Funding Trust III (b) If full dividends are not paid in a dividend period, PNC will not declare or pay dividends with respect to, or redeem,

purchase or acquire, any of its equity capital securities during the next succeeding dividend period. (e)

(a) Contractual commitments made by PNC Bank, N.A.

(b) Contractual commitments made by PNC.

(c) Applies to the applicable Trust Securities and the LLC Preferred Securities.

(d) Except: (i) in the case of dividends payable to subsidiaries of PNC Bank, N.A., to PNC Bank, N.A. or another wholly-owned subsidiary of PNC Bank, N.A. or (ii) in the case of

dividends payable to persons that are not subsidiaries of PNC Bank, N.A., to such persons only if, (A) in the case of a cash dividend, (PNC has first irrevocably committed to

contribute amounts at least equal to such cash dividend or (B) in the case of in-kind dividends payable by PNC REIT Corp., PNC has committed to purchase such in-kind dividend

from the applicable PNC REIT Corp. holders in exchange for a cash payment representing the market value of such in-kind dividend, and PNC has committed to contribute such

in-kind dividend to PNC Bank, N.A.

(e) Except for: (i) purchases, redemptions or other acquisitions of shares of capital stock of PNC in connection with any employment contract, benefit plan or other similar arrangement

with or for the benefit of employees, officers, directors or consultants, (ii) purchases of shares of common stock of PNC pursuant to a contractually binding requirement to buy stock

existing prior to the commencement of the extension period, including under a contractually binding stock repurchase plan, (iii) any dividend in connection with the implementation of

a shareholders’ rights plan, or the redemption or repurchase of any rights under any such plan, (iv) as a result of any exchange or conversion of any class or series of PNC’s capital

stock for any other class or series of PNC’s capital stock, (v) the purchase of fractional interests in shares of PNC capital stock pursuant to the conversion or exchange provisions of

such stock or the security being converted or exchanged or (vi) any stock dividends paid by PNC where the dividend stock is the same stock as that on which the dividend is being

paid.

N

OTE

14 E

MPLOYEE

B

ENEFIT

P

LANS

P

ENSION

A

ND

P

OSTRETIREMENT

P

LANS

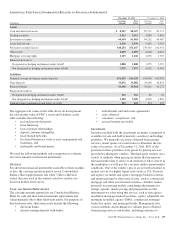

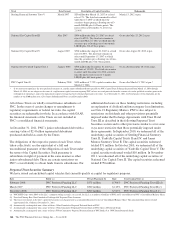

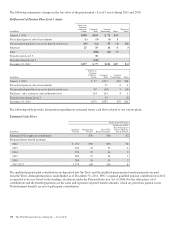

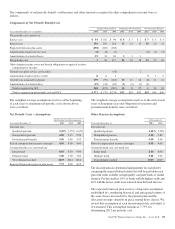

We have a noncontributory, qualified defined benefit pension

plan covering eligible employees. Benefits are determined

using a cash balance formula where earnings credits are a

percentage of eligible compensation. Earnings credit

percentages for plan participants on December 31, 2009 are

frozen at their level earned to that point. Earnings credits for

all employees who become participants on or after January 1,

2010 are a flat 3% of eligible compensation. Participants at

December 31, 2009 earn interest based on 30-year Treasury

securities with a minimum rate, while new participants on or

after January 1, 2010 are not subject to the minimum rate.

Pension contributions are based on an actuarially determined

amount necessary to fund total benefits payable to plan

participants.

We also maintain nonqualified supplemental retirement plans

for certain employees and provide certain health care and life

insurance benefits for qualifying retired employees

(postretirement benefits) through various plans. The

nonqualified pension and postretirement benefit plans are

unfunded. The Company reserves the right to terminate or

make plan changes at any time.

The PNC Financial Services Group, Inc. – Form 10-K 165