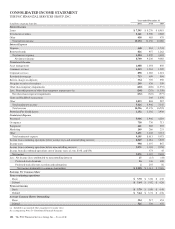

PNC Bank 2011 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Purchase accounting accretion – Accretion of the discounts

and premiums on acquired assets and liabilities. The purchase

accounting accretion is recognized in net interest income over

the weighted-average life of the financial instruments using

the constant effective yield method. Accretion for Purchased

impaired loans includes any cash recoveries received in excess

of the recorded investment.

Purchased impaired loans – Acquired loans determined to be

credit impaired under FASB ASC 310-30 (AICPA SOP 03-3).

Loans are determined to be impaired if there is evidence of

credit deterioration since origination and for which it is

probable that all contractually required payments will not be

collected.

Recorded investment – The initial investment of a purchased

impaired loan plus interest accretion and less any cash

payments and writedowns to date. The recorded investment

excludes any valuation allowance which is included in our

allowance for loan and lease losses.

Recovery – Cash proceeds received on a loan that we had

previously charged off. We credit the amount received to the

allowance for loan and lease losses.

Residential development loans – Project-specific loans to

commercial customers for the construction or development of

residential real estate including land, single family homes,

condominiums and other residential properties. This would

exclude loans to commercial customers where proceeds are

for general corporate purposes whether or not such facilities

are secured.

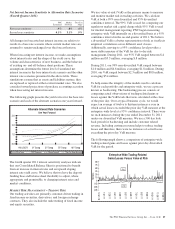

Residential mortgage servicing rights hedge gains/(losses),

net – We have elected to measure acquired or originated

residential mortgage servicing rights (MSRs) at fair value

under GAAP. We employ a risk management strategy

designed to protect the economic value of MSRs from changes

in interest rates. This strategy utilizes securities and a portfolio

of derivative instruments to hedge changes in the fair value of

MSRs arising from changes in interest rates. These financial

instruments are expected to have changes in fair value which

are negatively correlated to the change in fair value of the

MSR portfolio. Net MSR hedge gains/(losses) represent the

change in the fair value of MSRs, exclusive of changes due to

time decay and payoffs, combined with the change in the fair

value of the associated securities and derivative instruments.

Return on average assets – Annualized net income divided by

average assets.

Return on average capital – Annualized net income divided by

average capital.

Return on average common shareholders’ equity – Annualized

net income less preferred stock dividends, including preferred

stock discount accretion and redemptions, divided by average

common shareholders’ equity.

Risk-weighted assets – Computed by the assignment of

specific risk-weights (as defined by the Board of Governors of

the Federal Reserve System) to assets and off-balance sheet

instruments.

Securitization – The process of legally transforming financial

assets into securities.

Servicing rights – An intangible asset or liability created by an

obligation to service assets for others. Typical servicing rights

include the right to receive a fee for collecting and forwarding

payments on loans and related taxes and insurance premiums

held in escrow.

Swaptions – Contracts that grant the purchaser, for a premium

payment, the right, but not the obligation, to enter into an

interest rate swap agreement during a specified period or at a

specified date in the future.

Taxable-equivalent interest – The interest income earned on

certain assets is completely or partially exempt from Federal

income tax. As such, these tax-exempt instruments typically

yield lower returns than taxable investments. To provide more

meaningful comparisons of yields and margins for all interest-

earning assets, we use interest income on a taxable-equivalent

basis in calculating average yields and net interest margins by

increasing the interest income earned on tax-exempt assets to

make it fully equivalent to interest income earned on other

taxable investments. This adjustment is not permitted under

GAAP on the Consolidated Income Statement.

Tier 1 common capital – Tier 1 risk-based capital, less

preferred equity, less trust preferred capital securities, and less

noncontrolling interests.

Tier 1 common capital ratio – Tier 1 common capital divided

by period-end risk-weighted assets.

Tier 1 risk-based capital – Total shareholders’ equity, plus

trust preferred capital securities, plus certain noncontrolling

interests that are held by others; less goodwill and certain

other intangible assets (net of eligible deferred taxes relating

to taxable and nontaxable combinations), less equity

investments in nonfinancial companies less ineligible

servicing assets and less net unrealized holding losses on

available for sale equity securities. Net unrealized holding

gains on available for sale equity securities, net unrealized

holding gains (losses) on available for sale debt securities and

net unrealized holding gains (losses) on cash flow hedge

derivatives are excluded from total shareholders’ equity for

Tier 1 risk-based capital purposes.

Tier 1 risk-based capital ratio – Tier 1 risk-based capital

divided by period-end risk-weighted assets.

Total equity – Total shareholders’ equity plus noncontrolling

interests.

98 The PNC Financial Services Group, Inc. – Form 10-K