PNC Bank 2011 Annual Report Download - page 207

Download and view the complete annual report

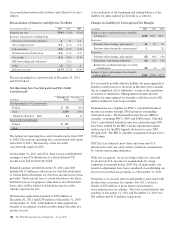

Please find page 207 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.parties. We also enter into certain types of agreements,

including leases, assignments of leases, and subleases, in

which we agree to indemnify third parties for acts by our

agents, assignees and/or sublessees, and employees. We also

enter into contracts for the delivery of technology service in

which we indemnify the other party against claims of patent

and copyright infringement by third parties. Due to the nature

of these indemnification provisions, we cannot calculate our

aggregate potential exposure under them.

We engage in certain insurance activities that require our

employees to be bonded. We satisfy this bonding requirement

by issuing letters of credit, which were insignificant in amount

at December 31, 2011.

In the ordinary course of business, we enter into contracts with

third parties under which the third parties provide services on

behalf of PNC. In many of these contracts, we agree to

indemnify the third party service provider under certain

circumstances. The terms of the indemnity vary from contract

to contract and the amount of the indemnification liability, if

any, cannot be determined.

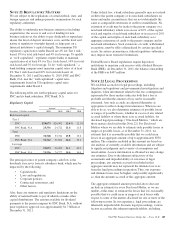

We are a general or limited partner in certain asset

management and investment limited partnerships, many of

which contain indemnification provisions that would require

us to make payments in excess of our remaining unfunded

commitments. While in certain of these partnerships the

maximum liability to us is limited to the sum of our unfunded

commitments and partnership distributions received by us, in

the others the indemnification liability is unlimited. As a

result, we cannot determine our aggregate potential exposure

for these indemnifications.

In some cases, indemnification obligations of the types

described above arise under arrangements entered into by

predecessor companies for which we become responsible as a

result of the acquisition.

Pursuant to their bylaws, PNC and its subsidiaries provide

indemnification to directors, officers and, in some cases,

employees and agents against certain liabilities incurred as a

result of their service on behalf of or at the request of PNC

and its subsidiaries. PNC and its subsidiaries also advance on

behalf of covered individuals costs incurred in connection

with certain claims or proceedings, subject to written

undertakings by each such individual to repay all amounts

advanced if it is ultimately determined that the individual is

not entitled to indemnification. We generally are responsible

for similar indemnifications and advancement obligations that

companies we acquire had to their officers, directors and

sometimes employees and agents at the time of acquisition.

We advanced such costs on behalf of several such individuals

with respect to pending litigation or investigations during

2011. It is not possible for us to determine the aggregate

potential exposure resulting from the obligation to provide this

indemnity or to advance such costs.

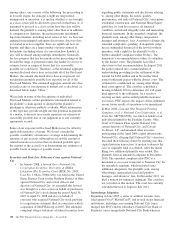

In connection with the sale of GIS, and in addition to

indemnification provisions as part of the divestiture

agreements, PNC agreed to continue to act for the benefit of

GIS as securities lending agent for certain of GIS’s clients. In

such role, we provided indemnification to those clients against

the failure of the borrowers to return the securities. The

market value of the securities lent was fully secured on a daily

basis; therefore, the exposure to us was limited to temporary

shortfalls in the collateral as a result of short-term fluctuations

in trading prices of the loaned securities. In addition, the

purchaser of GIS, BNY-Mellon, has entered into an agreement

to indemnify PNC with respect to such exposure on the terms

set forth in such indemnification agreement. Effective July 18,

2011, PNC Bank, National Association assigned its securities

lending agent responsibilities to BNY-Mellon and no longer

acts as securities lending agent for any of GIS’s clients. Also

in connection with the GIS divestiture, PNC has agreed to

indemnify the buyer generally as described above.

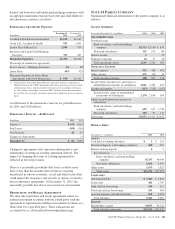

VISA I

NDEMNIFICATION

Our payment services business issues and acquires credit and

debit card transactions through Visa U.S.A. Inc. card

association or its affiliates (Visa).

In October 2007, Visa completed a restructuring and issued

shares of Visa Inc. common stock to its financial institution

members (Visa Reorganization) in contemplation of its initial

public offering (IPO). As part of the Visa Reorganization, we

received our proportionate share of a class of Visa Inc.

common stock allocated to the US members. Prior to the IPO,

the US members, which included PNC, were obligated to

indemnify Visa for judgments and settlements related to the

specified litigation.

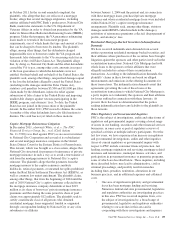

As a result of the acquisition of National City, we became

party to judgment and loss sharing agreements with Visa and

certain other banks. The judgment and loss sharing

agreements were designed to apportion financial

responsibilities arising from any potential adverse judgment or

negotiated settlements related to the specified litigation.

In March 2011, Visa funded $400 million to their litigation

escrow account and reduced the conversion ratio of Visa B to

A shares. We consequently recognized our estimated $38

million share of the $400 million as a reduction of our

previously established indemnification liability and a

reduction of noninterest expense.

In December 2011, Visa funded $1.6 billion to their litigation

escrow account. We consequently recognized $32 million as a

reduction of our previously established indemnification

liability and a reduction of noninterest expense. As of

December 31, 2011, our recognized Visa indemnification

liability was zero. As we continue to have an obligation to

indemnify Visa for judgments and settlements for the

remaining specified litigation, we may have additional

exposure in the future to the specified Visa litigation.

198 The PNC Financial Services Group, Inc. – Form 10-K