PNC Bank 2011 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

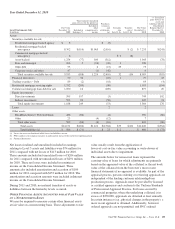

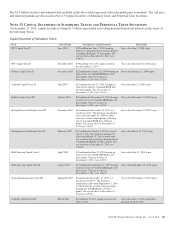

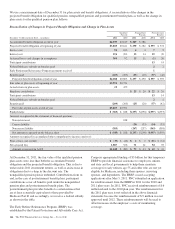

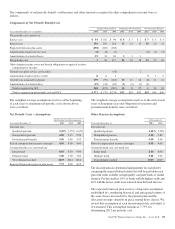

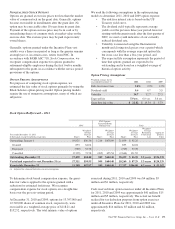

The $2.4 billion of junior subordinated debt included in the above table represents debt redeemable prior to maturity. The call price

and related premiums are discussed in Note 13 Capital Securities of Subsidiary Trusts and Perpetual Trust Securities.

N

OTE

13 C

APITAL

S

ECURITIES OF

S

UBSIDIARY

T

RUSTS AND

P

ERPETUAL

T

RUST

S

ECURITIES

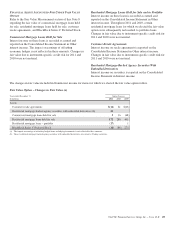

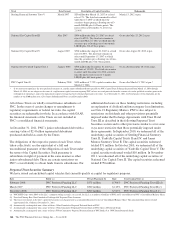

At December 31, 2011, capital securities totaling $2.7 billion represented non-voting preferred beneficial interests in the assets of

the following Trusts:

Capital Securities of Subsidiary Trusts

Trust Date Formed Description of Capital Securities Redeemable

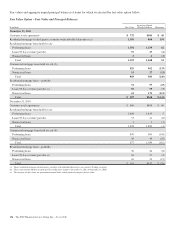

PNC Capital Trust C June 1998 $200 million due June 1, 2028, bearing

interest at a floating rate per annum equal to

3-month LIBOR plus 57 basis points. The

rate in effect at December 31, 2011 was

1.097%.

On or after June 1, 2008 at par.

PNC Capital Trust D December 2003 $300 million of 6.125% capital securities

due December 15, 2033.

On or after December 18, 2008 at par.

Fidelity Capital Trust II December 2003 $22 million due January 23, 2034 bearing an

interest rate of 3-month LIBOR plus 285

basis points. The rate in effect at

December 31, 2011 was 3.278%.

On or after January 23, 2009 at par.

Yardville Capital Trust VI June 2004 $15 million due July 23, 2034, bearing an

interest rate equal to 3-month LIBOR plus

270 basis points. The rate in effect at

December 31, 2011 was 3.116%.

On or after July 23, 2009 at par.

Fidelity Capital Trust III October 2004 $30 million due November 23, 2034 bearing

an interest rate of 3-month LIBOR plus 197

basis points. The rate in effect at

December 31, 2011 was 2.465%.

On or after November 23, 2009 at par.

Sterling Financial Statutory Trust III December 2004 $15 million due December 15, 2034 at a

fixed rate of 6%. The fixed rate remained in

effect until December 15, 2009 at which

time the securities began paying a floating

rate of 3-month LIBOR plus 189 basis

points. The rate in effect at December 31,

2011 was 2.436%.

On or after December 15, 2009 at par.

Sterling Financial Statutory Trust IV February 2005 $15 million due March 15, 2035 at a fixed

rate of 6.19%. The fixed rate remained in

effect until March 15, 2010 at which time

the securities began paying a floating rate of

3-month LIBOR plus 187 basis points. The

rate in effect at December 31, 2011 was

2.416%.

On or after March 15, 2010 at par.

MAF Bancorp Capital Trust I April 2005 $30 million due June 15, 2035 bearing an

interest rate of 3-month LIBOR plus 175

basis points. The rate in effect at

December 31, 2011 was 2.296%.

On or after June 15, 2010 at par.

MAF Bancorp Capital Trust II August 2005 $35 million due September 15, 2035 bearing

an interest rate of 3-month LIBOR plus 140

basis points. The rate in effect at

December 31, 2011 was 1.946%.

On or after September 15, 2010 at par.

James Monroe Statutory Trust III September 2005 $8 million due December 15, 2035 at a

fixed rate of 6.253%. The fixed rate

remained in effect until September 15, 2010

at which time the securities began paying a

floating rate of LIBOR plus 155 basis

points. The rate in effect at December 31,

2011 was 2.096%.

On or after December 15, 2010 at par.

Yardville Capital Trust III March 2001 $6 million of 10.18% capital securities due

June 8, 2031.

On or after June 8, 2011 at par plus a

premium of up to 5.09%.

The PNC Financial Services Group, Inc. – Form 10-K 163