PNC Bank 2011 Annual Report Download - page 167

Download and view the complete annual report

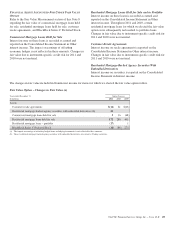

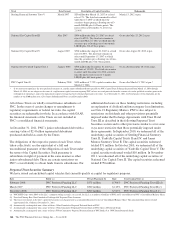

Please find page 167 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.another third-party source, by reviewing valuations of

comparable instruments, or by comparison to internal

valuations.

N

ET

L

OANS

A

ND

L

OANS

H

ELD

F

OR

S

ALE

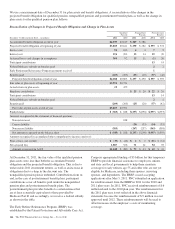

Fair values are estimated based on the discounted value of

expected net cash flows incorporating assumptions about

prepayment rates, net credit losses and servicing fees. For

purchased impaired loans, fair value is assumed to equal

PNC’s carrying value, which represents the present value of

expected future principal and interest cash flows, as adjusted

for any ALLL recorded for these loans. See Note 6 Purchased

Impaired Loans for additional information. For revolving

home equity loans and commercial credit lines, this fair value

does not include any amount for new loans or the related fees

that will be generated from the existing customer

relationships. Non-accrual loans are valued at their estimated

recovery value. Also refer to the Fair Value Measurement and

Fair Value Option sections of this Note 8 regarding the fair

value of commercial and residential mortgage loans held for

sale. Loans are presented net of the ALLL and do not include

future accretable discounts related to purchased impaired

loans.

O

THER

A

SSETS

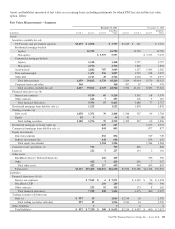

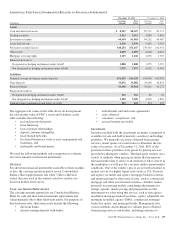

Other assets as shown in the preceding table include the

following:

• FHLB and FRB stock,

• equity investments carried at cost and fair value, and

• BlackRock Series C Preferred Stock.

Investments accounted for under the equity method, including

our investment in BlackRock, are not included in the

preceding table.

Refer to the Fair Value Measurement section of this Note 8

regarding the fair value of equity investments.

The aggregate carrying value of our investments that are

carried at cost and FHLB and FRB stock was $1.9 billion at

December 31, 2011 and $2.4 billion as of December 31, 2010,

both of which approximate fair value at each date.

M

ORTGAGE

S

ERVICING

A

SSETS

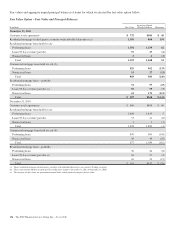

Fair value is based on the present value of the estimated future

cash flows, incorporating assumptions as to prepayment

speeds, discount rates, escrow balances, interest rates, cost to

service and other factors.

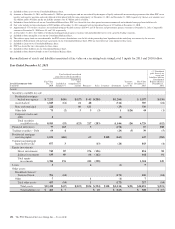

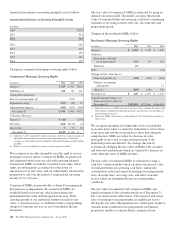

The key valuation assumptions for commercial and residential

mortgage loan servicing assets at December 31, 2011 and

December 31, 2010 are included in Note 9 Goodwill and

Other Intangible Assets.

C

USTOMER

R

ESALE

A

GREEMENTS

Refer to the Fair Value Measurement section of this Note 8

regarding the fair value of customer resale agreements.

D

EPOSITS

The carrying amounts of noninterest-bearing demand and

interest-bearing money market and savings deposits

approximate fair values. For time deposits, which include

foreign deposits, fair values are estimated based on the

discounted value of expected net cash flows assuming current

interest rates.

B

ORROWED

F

UNDS

The carrying amounts of Federal funds purchased, commercial

paper, repurchase agreements, trading securities sold short,

cash collateral, other short-term borrowings, acceptances

outstanding and accrued interest payable are considered to be

their fair value because of their short-term nature. For all other

borrowed funds, fair values are estimated primarily based on

dealer quotes or discounted cash flow analysis.

U

NFUNDED

L

OAN

C

OMMITMENTS

A

ND

L

ETTERS

O

F

C

REDIT

The fair value of unfunded loan commitments and letters of

credit is determined from a market participant’s view

including the impact of changes in interest rates, credit and

other factors. Because our obligation on substantially all

unfunded loan commitments and letters of credit varies with

changes in interest rates, these instruments are subject to little

fluctuation in fair value due to changes in interest rates. We

establish a liability on these facilities related to their

creditworthiness.

F

INANCIAL

D

ERIVATIVES

Refer to the Fair Value Measurement section of this Note 8

regarding the fair value of financial derivatives.

158 The PNC Financial Services Group, Inc. – Form 10-K