PNC Bank 2011 Annual Report Download - page 95

Download and view the complete annual report

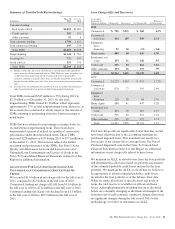

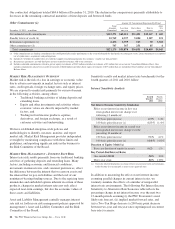

Please find page 95 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.FHLB borrowings increased to $7.0 billion at December 31,

2011 from $6.0 billion at December 31, 2010 due to $2.0

billion in new borrowings partially offset by maturities.

PNC Bank, N.A. has the ability to offer up to $3.0 billion of

its commercial paper to provide additional liquidity. As of

December 31, 2011, there were no issuances outstanding

under this program. Other borrowed funds on our

Consolidated Balance Sheet includes $4.3 billion of

commercial paper issued by Market Street Funding LLC, a

consolidated VIE.

PNC Bank, N.A. can also borrow from the Federal Reserve

Bank of Cleveland’s (Federal Reserve Bank) discount window

to meet short-term liquidity requirements. The Federal

Reserve Bank, however, is not viewed as the primary means

of funding our routine business activities, but rather as a

potential source of liquidity in a stressed environment or

during a market disruption. These potential borrowings are

secured by securities and commercial loans. At December 31,

2011, our unused secured borrowing capacity was $26.9

billion with the Federal Reserve Bank.

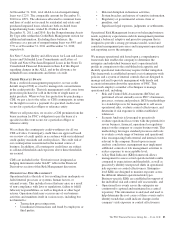

Parent Company Liquidity – Uses

Obligations requiring the use of liquidity can generally be

characterized as either contractual or discretionary. The parent

company’s contractual obligations consist primarily of debt

service related to parent company borrowings and funding

non-bank affiliates. Additionally, the parent company

maintains adequate liquidity to fund discretionary activities

such as paying dividends to PNC shareholders, share

repurchases, and acquisitions. As of December 31, 2011, there

were approximately $4.0 billion of parent company

borrowings with contractual maturities of less than one year.

In addition, we will use approximately $3.5 billion of parent

company cash and short-term investments to acquire RBC

Bank (USA) in March 2012.

See “Supervision and Regulation” in Item 1 of this Report for

information regarding the Federal Reserve’s current

supervisory assessment of capital adequacy program (the 2012

CCAR), including its impact on our ability to take certain

capital actions, including plans to pay or increase common

stock dividends or to reinstate or increase common stock

repurchase programs.

See Capital and Liquidity Actions in the Executive Summary

section of this Item 7 for additional information regarding our

December 2011 announcement that the Federal Reserve

approved the acquisition of RBC Bank (USA) and that the

OCC approved the merger of RBC Bank (USA) with and into

PNC Bank, N.A. with these transactions scheduled to close

March 2012, our November 2011 redemption of trust

preferred securities, our September 2011 issuance of senior

notes, our July 2011 issuance of preferred stock, and our April

2011 increase to PNC’s quarterly common stock dividend. We

did not repurchase any shares under PNC’s existing common

stock repurchase program in 2011.

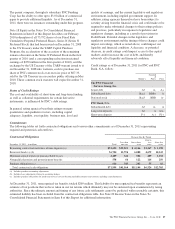

Parent Company Liquidity – Sources

The principal source of parent company liquidity is the

dividends it receives from its subsidiary bank, which may be

impacted by the following:

• Bank-level capital needs,

• Laws and regulations,

• Corporate policies,

• Contractual restrictions, and

• Other factors.

The amount available for dividend payments by PNC Bank,

N.A. to the parent company without prior regulatory approval

was approximately $1.7 billion at December 31, 2011. There

are statutory and regulatory limitations on the ability of

national banks to pay dividends or make other capital

distributions or to extend credit to the parent company or its

non-bank subsidiaries. See Note 21 Regulatory Matters in the

Notes To Consolidated Financial Statements in Item 8 of this

Report for a further discussion of these limitations. Dividends

may also be impacted by the bank’s capital needs and by

contractual restrictions. We provide additional information on

certain contractual restrictions under the “Trust Preferred

Securities” section of the Off-Balance Sheet Arrangements

And Variable Interest Entities section of this Item 7 and in

Note 13 Capital Securities of Subsidiary Trusts and Perpetual

Trust Securities in the Notes To Consolidated Financial

Statements in Item 8 of this Report.

In addition to dividends from PNC Bank, N.A., other sources

of parent company liquidity include cash and short-term

investments, as well as dividends and loan repayments from

other subsidiaries and dividends or distributions from equity

investments. As of December 31, 2011, the parent company

had approximately $7.8 billion in funds available from its cash

and short-term investments.

We can also generate liquidity for the parent company and

PNC’s non-bank subsidiaries through the issuance of debt

securities and equity securities, including certain capital

securities, in public or private markets and commercial paper.

We have effective shelf registration statements pursuant to

which we can issue additional debt and equity securities,

including certain hybrid capital instruments. Total senior and

subordinated debt and hybrid capital instruments declined to

$16.0 billion at December 31, 2011 from $17.3 billion at

December 31, 2010 due to maturities.

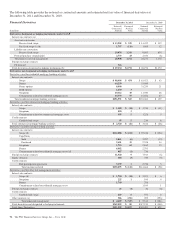

During 2011 we issued the following securities under our

shelf registration statement:

• $1.25 billion of senior notes issued September 19,

2011 and due September 2016. Interest is paid semi-

annually at a fixed rate of 2.70%,

• One million depositary shares, each representing a

1/100th interest in a share of our Fixed-to-Floating

Rate Non-Cumulative Perpetual Preferred Stock,

Series O, issued July 27, 2011, resulting in gross

proceeds to us before commissions and expenses of

$1 billion.

86 The PNC Financial Services Group, Inc. – Form 10-K