PNC Bank 2011 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

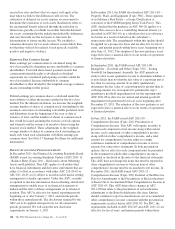

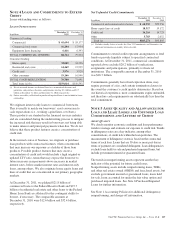

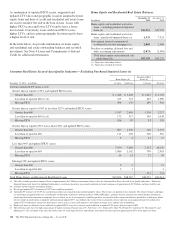

The following table provides information related to certain financial information associated with PNC’s loan sale and servicing

activities:

Certain Financial Information and Cash Flows Associated with Loan Sale and Servicing Activities

In millions

Residential

Mortgages

Commercial

Mortgages (a)

Home Equity

Loans/

Lines (b)

FINANCIAL INFORMATION – December 31, 2011

Servicing portfolio (c) $118,058 $155,813 $5,661

Carrying value of servicing assets (d) 647 468 1

Servicing advances (e) 563 510 8

Servicing deposits (f) 2,264 3,861 38

Repurchase and recourse obligations (g) 83 47 47

Carrying value of mortgage-backed securities held (h) 4,654 1,839

FINANCIAL INFORMATION – December 31, 2010

Servicing portfolio (c) $125,806 $162,514 $6,041

Carrying value of servicing assets (d) 1,033 665 2

Servicing advances (e) 533 415 21

Servicing deposits (f) 2,661 3,537 61

Repurchase and recourse obligations (g) 144 54 150

Carrying value of mortgage-backed securities held (h) 2,171 1,875

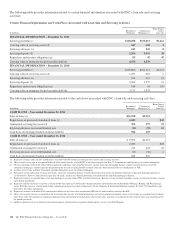

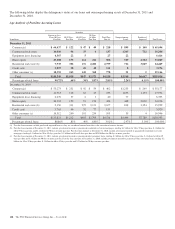

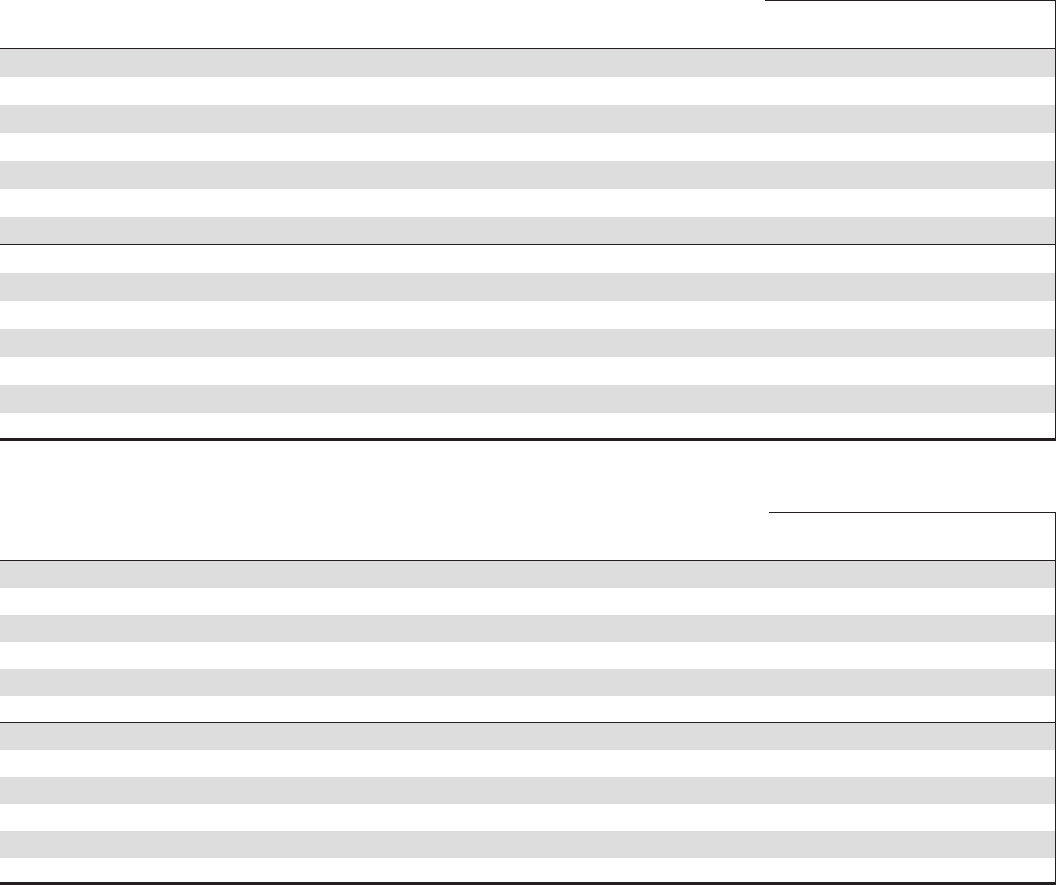

The following table provides information related to the cash flows associated with PNC’s loan sale and servicing activities:

In millions

Residential

Mortgages

Commercial

Mortgages (a)

Home Equity

Loans/

Lines (b)

CASH FLOWS – Year ended December 31, 2011

Sales of loans (i) $11,920 $2,351

Repurchases of previously transferred loans (j) 1,683 $42

Contractual servicing fees received 355 179 22

Servicing advances recovered/(funded), net (30) (95) 12

Cash flows on mortgage-backed securities held (h) 586 419

CASH FLOWS – Year ended December 31, 2010

Sales of loans (i) $ 9,951 $2,413

Repurchases of previously transferred loans (j) 2,283 $28

Contractual servicing fees received 413 224 26

Servicing advances recovered/(funded), net 66 (32) 2

Cash flows on mortgage-backed securities held (h) 588 510

(a) Represents financial and cash flow information associated with both commercial mortgage loan transfer and servicing activities.

(b) These activities were part of an acquired brokered home equity business in which PNC is no longer engaged. See Note 23 Commitments and Guarantees for further information.

(c) For our continuing involvement with residential mortgages and home equity loan/line transfers, amount represents outstanding balance of loans transferred and serviced. For

commercial mortgages, amount represents the portion of the overall servicing portfolio in which loans have been transferred by us or third parties to VIEs.

(d) See Note 8 Fair Value and Note 9 Goodwill and Other Intangible Assets for further information.

(e) Pursuant to certain contractual servicing agreements, represents outstanding balance of funds advanced (i) to investors for monthly collections of borrower principal and interest,

(ii) for borrower draws on unused home equity lines of credit, and (iii) for collateral protection associated with the underlying mortgage collateral.

(f) Represents balances in custodial and escrow demand deposit accounts held at PNC on behalf of investors. Borrower’s loan payments including escrows are deposited in these accounts

prior to their distribution.

(g) Represents liability for our loss exposure associated with loan repurchases for breaches of representations and warranties for our Residential Mortgage Banking and Non-Strategic

Assets Portfolio segments, and our multi-family commercial mortgage loss share arrangements for our Corporate & Institutional Banking segment. See Note 23 Commitments and

Guarantees for further information.

(h) Represents securities held where PNC transferred to and/or services loans for a securitization SPE and we hold securities issued by that SPE.

(i) There were no gains or losses recognized on the transaction date for sales of residential mortgage and certain commercial mortgage loans as these loans are recognized on the balance

sheet at fair value. For transfers of commercial mortgage loans not recognized on the balance sheet at fair value, gains/losses recognized on sales of these loans were insignificant for

the periods presented.

(j) Includes repurchases of government insured and government guaranteed loans repurchased through the exercise of our ROAP option.

122 The PNC Financial Services Group, Inc. – Form 10-K