PNC Bank 2011 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

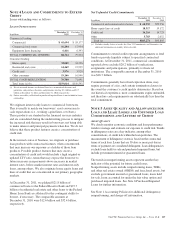

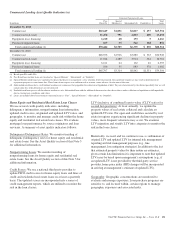

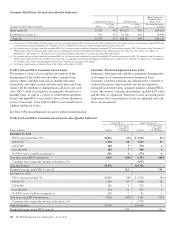

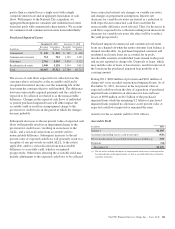

A combination of updated FICO scores, originated and

updated LTV ratios and geographic location assigned to home

equity loans and lines of credit and residential real estate loans

are used to monitor the risk in the loan classes. Loans with

higher FICO scores and lower LTVs tend to have a lower

level of risk. Conversely, loans with lower FICO scores,

higher LTVs, and in certain geographic locations tend to have

a higher level of risk.

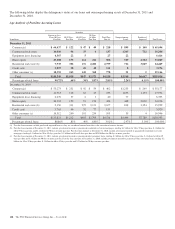

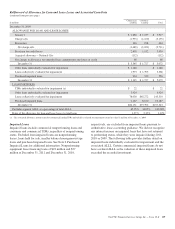

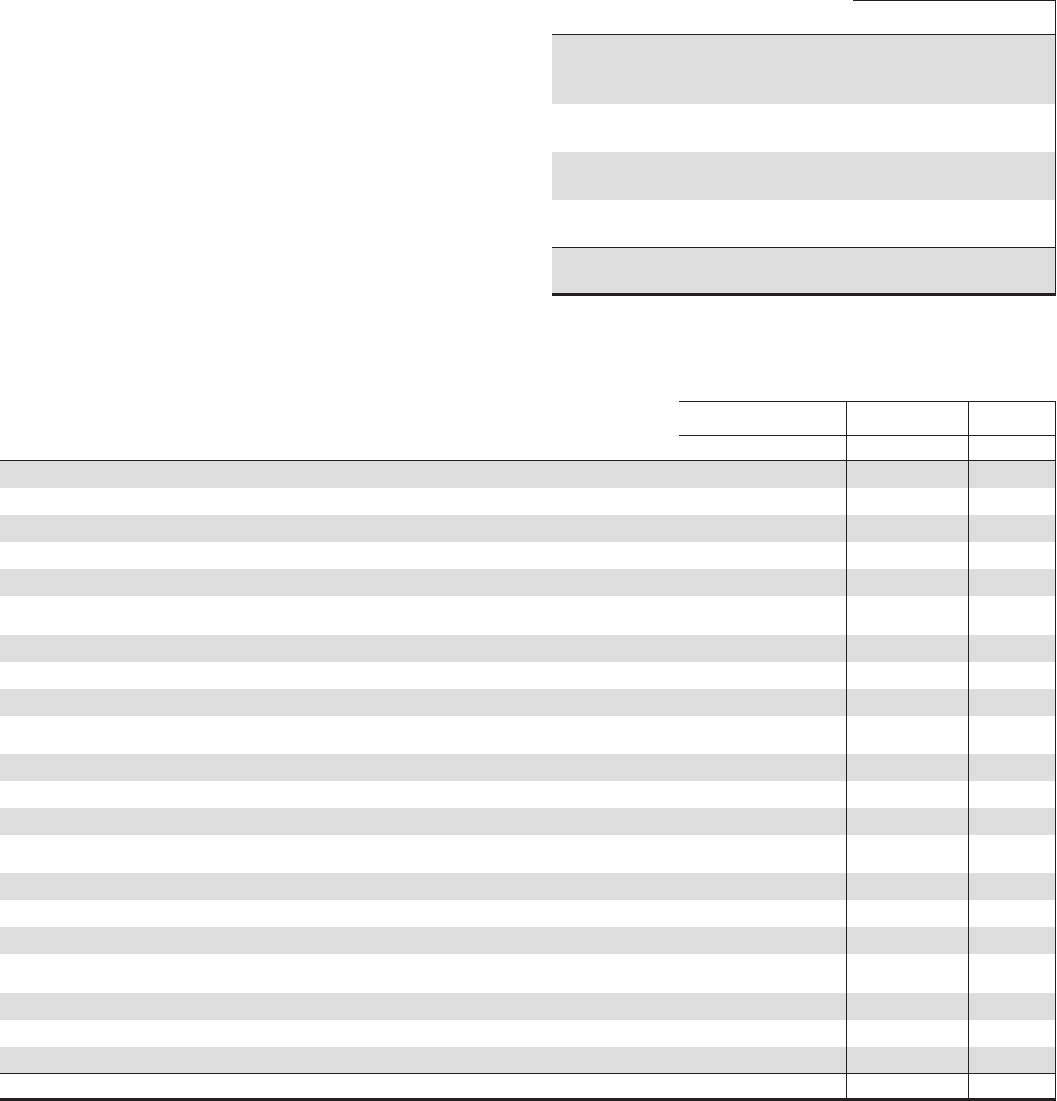

In the table below, we provide information on home equity

and residential real estate outstanding balances and recorded

investment. See Note 4 Loans and Commitments to Extend

Credit for additional information.

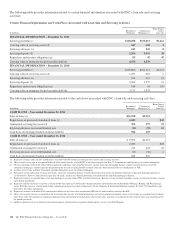

Home Equity and Residential Real Estate Balances

In millions

December 31

2011

December 31

2010

Home equity and residential real estate

loans - excluding purchased impaired

loans (a) $41,014 $42,298

Home equity and residential real estate

loans - purchased impaired loans (a) 6,533 7,924

Government insured or guaranteed

residential real estate mortgages (a) 2,884 2,488

Purchase accounting, deferred fees and

other accounting adjustments (2,873) (2,485)

Total home equity and residential real

estate loans (b) $47,558 $50,225

(a) Represents outstanding balance.

(b) Represents recorded investment.

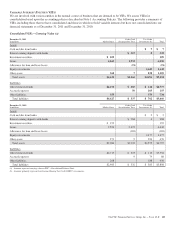

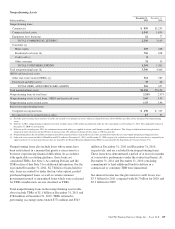

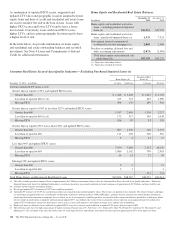

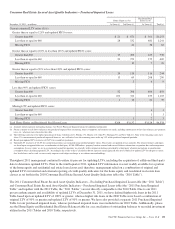

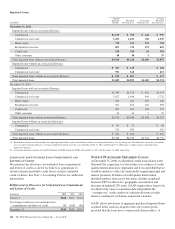

Consumer Real Estate Secured Asset Quality Indicators – Excluding Purchased Impaired Loans (a)

Home Equity (b)

Residential Real

Estate (b)

December 31, 2011 – in millions 1st Liens 2nd Liens 1st Liens Total (b)

Current estimated LTV ratios (c) (d)

Greater than or equal to 125% and updated FICO scores:

Greater than 660 $ 1,448 $ 3,488 $ 1,845 $ 6,781

Less than or equal to 660 (e) (f) 213 713 463 1,389

Missing FICO 494 135 289 918

Greater than or equal to 100% to less than 125% and updated FICO scores:

Greater than 660 1,017 2,864 1,336 5,217

Less than or equal to 660 (e) (f) 172 517 349 1,038

Missing FICO 186 87 53 326

Greater than or equal to 90% to less than 100% and updated FICO scores:

Greater than 660 687 1,350 760 2,797

Less than or equal to 660 111 205 200 516

Missing FICO 3 2 12 17

Less than 90% and updated FICO scores:

Greater than 660 7,190 7,888 3,152 18,230

Less than or equal to 660 1,080 1,102 799 2,981

Missing FICO 14 13 32 59

Missing LTV and updated FICO scores:

Greater than 660 92 11

Less than or equal to 660 2 1 3

Missing FICO 731 731

Total Home Equity and Residential Real Estate Loans $12,626 $18,367 $10,021 $41,014

(a) This table excludes purchased impaired loans of approximately $6.5 billion in outstanding balances (See the Consumer Real Estate Secured Asset Quality Indicators – Purchased

Impaired Loans table below for additional information), government insured or guaranteed residential real estate mortgages of approximately $2.9 billion, and loans held for sale.

(b) Amounts shown represent outstanding balance.

(c) Based upon updated LTV (inclusive of CLTV for second lien positions).

(d) Updated LTV (inclusive of CLTV for second lien positions) are estimated using modeled property values. These ratios are updated at least annually. The related estimates and inputs

are based upon an approach that uses a combination of third-party automated valuation models (AVMs), HPI indices, property location, internal and external balance information,

origination data and management assumptions. In cases where we are in an originated second lien position, we generally utilize origination balances provided by a third-party which

do not include an amortization assumption when calculating updated LTV. Accordingly, the results of these calculations do not represent actual appraised loan level collateral or

updated LTV based upon a current first lien balance, and as such, are necessarily imprecise and subject to change as we enhance our methodology.

(e) Higher risk loans are defined as loans with both an updated FICO score of less than or equal to 660 and an updated LTV greater than or equal to 100%.

(f) The following states have the highest percentage of higher risk loans: Pennsylvania 13%, New Jersey 13%, Illinois 10%, Ohio 9%, Florida 8%, California 8%, Maryland 5%, and

Michigan 5%. The remainder of the states have lower than 3% of the high risk loans individually, and collectively they represent approximately 29% of the higher risk loans.

132 The PNC Financial Services Group, Inc. – Form 10-K