PNC Bank 2011 Annual Report Download - page 194

Download and view the complete annual report

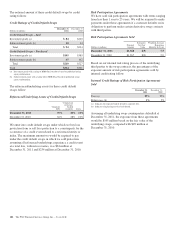

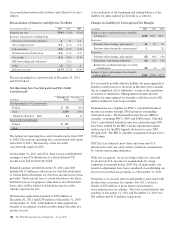

Please find page 194 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.pledged the $500,100,000 principal amount of National City

8.729% Junior Subordinated Notes due 2043 held by the Trust

and their proceeds to secure this purchase obligation.

If Series M shares are issued prior to December 10, 2012, any

dividends on such shares will be calculated at a rate per

annum equal to 12.000% until December 10, 2012, and

thereafter, at a rate per annum that will be reset quarterly and

will equal three-month LIBOR for the related dividend period

plus 8.610%. Dividends will be payable if and when declared

by the Board at the dividend rate so indicated applied to the

liquidation preference per share of the Series M Preferred

Stock. The Series M is redeemable at PNC’s option, subject to

Federal Reserve approval, if then applicable, on or after

December 10, 2012 at a redemption price per share equal to

the liquidation preference plus any declared but unpaid

dividends.

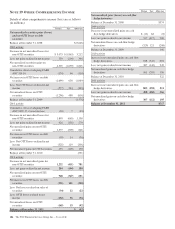

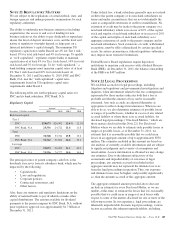

The replacement capital covenants with respect to the Normal

APEX Securities, our Series M shares and our 6,000,000 of

Depositary Shares (each representing 1/4000th of an interest

in a share of our 9.875% Fixed-to-Floating Rate

Non-Cumulative Preferred Stock, Series L) were terminated

on November 5, 2010 as a result of a successful consent

solicitation.

After receiving all required approvals, on February 10, 2010,

we redeemed all 75,792 shares of our Fixed Rate Cumulative

Perpetual Preferred Stock, Series N that had been issued on

December 31, 2008 to the US Treasury under the US

Treasury’s Troubled Asset Relief Program (TARP) Capital

Purchase Program.

In connection with the redemption of the Series N Preferred

Stock, we accelerated the accretion of the remaining issuance

discount on the Series N Preferred Stock, recorded a

corresponding reduction in retained earnings of $250 million

during the first quarter of 2010 and paid dividends of $89

million to the US Treasury. This resulted in a noncash

reduction in net income attributable to common shareholders

and related basic and diluted earnings per share.

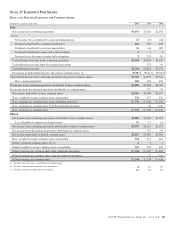

During 2010, PNC called its Series A, C and D cumulative

convertible preferred stock for redemption in accordance with

the terms of that stock. Effective September 10, 2010, PNC

redeemed 1,777 outstanding shares of Series A at a

redemption price of $40.00 per share. Effective October 1,

2010, PNC redeemed 18,118 outstanding shares of Series C

and 26,010 shares of Series D at a redemption price of $20.00

per share.

W

ARRANTS

We have outstanding 16,885,192 warrants, each to purchase

one share of PNC common stock at an exercise price of

$67.33 per share. These warrants were sold by the US

Treasury in a secondary public offering that closed on May 5,

2010 after the US Treasury exchanged its TARP Warrant

(issued on December 31, 2008 under the TARP Capital

Purchase Program in relation to the Series N preferred stock

referred to above) for 16,885,192 warrants. These warrants

expire December 31, 2018.

F

ORMER

N

ATIONAL

C

ITY

W

ARRANTS

28,022 warrants issued by National City that converted into

warrants to purchase PNC common stock expired over the

period June 15, 2011 through July 15, 2011, and 28,023 of

such warrants expired over the period July 18, 2011 through

October 20, 2011. The strike price of these warrants was $750

per share. PNC reserved 5.0 million shares for issuance

pursuant to the warrants and has cancelled this reserve in

February 2012.

O

THER

S

HAREHOLDERS

’E

QUITY

M

ATTERS

We have a dividend reinvestment and stock purchase plan.

Holders of preferred stock and PNC common stock may

participate in the plan, which provides that additional shares

of common stock may be purchased at market value with

reinvested dividends and voluntary cash payments. Common

shares issued pursuant to this plan were: 379,459 shares in

2011, 149,088 shares in 2010 and 534,515 shares in 2009.

At December 31, 2011, we had reserved approximately

118.3 million common shares to be issued in connection with

certain stock plans and the conversion of certain debt and

equity securities.

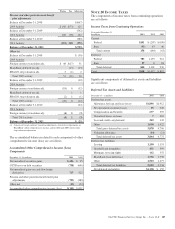

Effective October 4, 2007, our Board of Directors approved a

stock repurchase program to purchase up to 25 million shares

of PNC common stock on the open market or in privately

negotiated transactions. A maximum of 24.710 million shares

remained available for repurchase under this program at

December 31, 2011. This program will remain in effect until

fully utilized or until modified, superseded or terminated. We

did not repurchase any shares during 2011, 2010 or 2009

under this program.

The PNC Financial Services Group, Inc. – Form 10-K 185