PNC Bank 2011 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

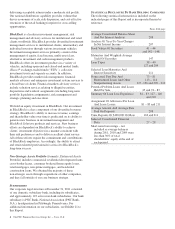

Total Loans

At Year End

Billions

Increasing Lending Our customer growth helped to drive increased lending in

2011. Loan growth accelerated toward the end of the year, with $4.5 billion of the $8.4 billion

annual increase occurring in the fourth quarter. Overall, we grew loans by 6 percent during

2011, with gains in commercial loans, indirect auto and education lending.

Tepid growth in the gross domestic product along with low interest rates had a dampening

effect on the banking industry in 2011, and we expect those factors to persist. In this

challenging environment, our balance sheet provides us with options to enhance our net

interest income through continued loan growth and repricing our deposit business.

We have significant opportunities to reduce funding costs through the repricing of certificates

of deposit and maturing debt as well as the potential to redeem relatively high-cost trust

preferred securities. In the fourth quarter of 2011 alone, we saw $6 billion of certificates of

deposit mature, and we called $750 million of trust preferred securities. We expect to see

additional opportunities to reduce funding costs in 2012.

Growing and Strengthening the Franchise During 2011 we

leveraged our financial performance and resulting capital strength to invest in our businesses.

We also announced several strategic acquisitions. These included purchases in greater Tampa,

Florida, of 19 branches from BankAtlantic, and 27 branches in the Atlanta area from Flagstar.

The acquisition of RBC Bank (USA), the U.S. retail banking operation of the Royal Bank of

Canada, closed and converted on March 2 of this year and is expected to be accretive to our

2012 earnings, excluding integration costs.

The RBC transaction added more than 400 Southeastern U.S. branches to PNC’s powerful retail

franchise. With RBC Bank (USA), PNC has approximately 2,900 branches in 17 states and the

District of Columbia. Since the beginning of 2008, this represents an increase of almost 1,800

branches and nine new states.

At PNC, acquisition was only one part of our growth story in 2011. Throughout the year, we

continued to add more customers and deepen our relationships with them across our existing

footprint, and all of our legacy markets exceeded their sales plans.

To support this growth, we developed innovative products and services focused on the needs of

tomorrow’s banking and investing clients. We applied an understanding of customer trends –

the roughly flat growth of branch and call center activity, the ongoing decline in check writing,

the expansion of online and mobile payments, and the increased use of multiple distribution

channels – to give customers a top-flight banking experience.

One example, the PNC Virtual Wallet® payments platform, has grown rapidly since its

introduction more than three years ago. At times in 2011, we added 14,000 new users every

$150.6

2010

$159.0

2011