PNC Bank 2011 Annual Report Download - page 197

Download and view the complete annual report

Please find page 197 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

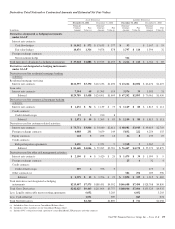

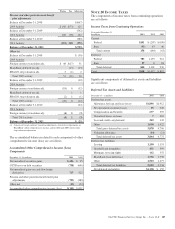

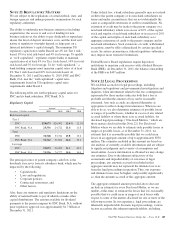

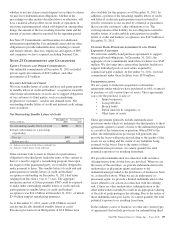

A reconciliation between the statutory and effective tax rates

follows:

Reconciliation of Statutory and Effective Tax Rates

Year ended December 31 2011 2010 2009

Statutory tax rate 35.0% 35.0% 35.0%

Increases (decreases) resulting from

State taxes net of federal benefit .4 .8 1.2

Tax-exempt interest (1.7) (1.3) (1.2)

Life insurance (2.0) (1.8) (1.9)

Dividend received deduction (1.6) (1.4) (1.2)

Tax credits (5.1) (4.3) (5.4)

IRS letter ruling and settlements (2.5)

Other (.5) 1.0 .4

Effective tax rate 24.5% 25.5% 26.9%

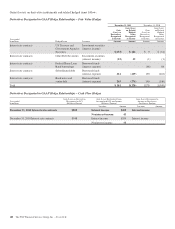

The net operating loss carryforwards at December 31, 2011

and 2010 follow:

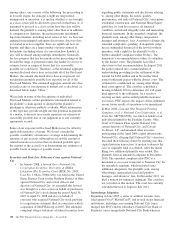

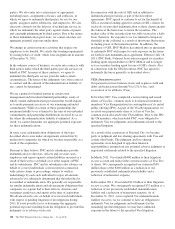

Net Operating Loss Carryforwards and Tax Credit

Carryforwards

In millions

December 31

2011

December 31

2010

Net Operating Loss Carryforwards:

Federal $30 $54

State 1,460 1,600

Valuation allowance – State 14 21

Tax Credit Carryforwards:

Federal $ 112

State 3

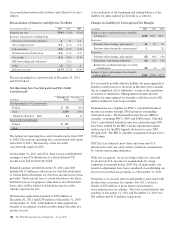

The federal net operating loss carryforwards expire from 2027

to 2028. The state net operating loss carryforwards will expire

from 2012 to 2031. The majority of the tax credit

carryforwards expire in 2031.

At December 31, 2011 and 2010, there were no undistributed

earnings of non-US subsidiaries for which deferred US

income taxes had not been provided.

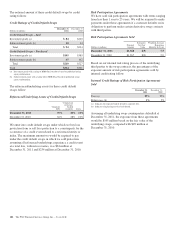

Retained earnings at both December 31, 2011 and 2010

included $117 million in allocations for bad debt deductions

of former thrift subsidiaries for which no income tax has been

provided. Under current law, if certain subsidiaries use these

bad debt reserves for purposes other than to absorb bad debt

losses, they will be subject to Federal income tax at the

current corporate tax rate.

We had unrecognized tax benefits of $209 million at

December 31, 2011 and $238 million at December 31, 2010.

At December 31, 2011, $100 million of unrecognized tax

benefits, if recognized, would favorably impact the effective

income tax rate.

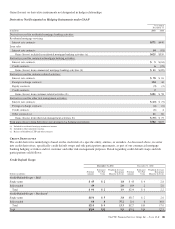

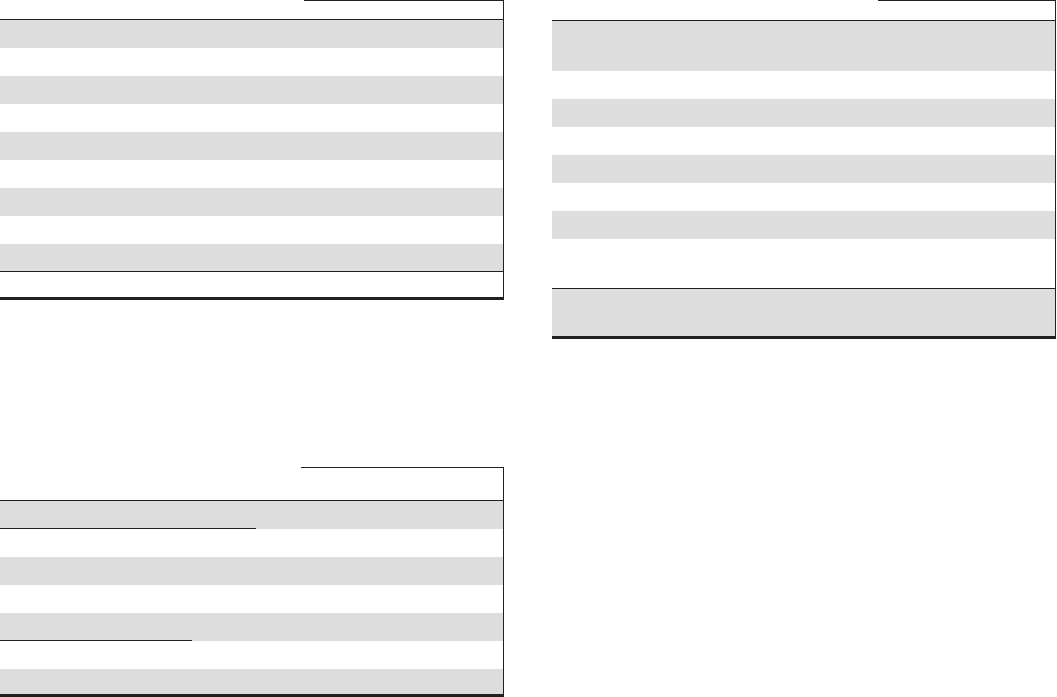

A reconciliation of the beginning and ending balance of the

liability for unrecognized tax benefits is as follows:

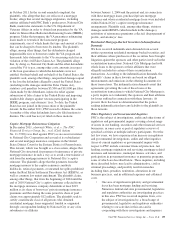

Changes in Liability for Unrecognized Tax Benefits

In millions 2011 2010 2009

Balance of gross unrecognized tax benefits

at January 1 $238 $227 $257

Increases:

Positions taken during a prior period 65 76 22

Positions taken during the current period 126

Decreases:

Positions taken during a prior period (62) (49) (39)

Settlements with taxing authorities (10) (13) (34)

Reductions resulting from lapse of statute

of limitations (23) (3) (5)

Balance of gross unrecognized tax benefits

at December 31 $209 $238 $227

It is reasonably possible that the liability for unrecognized tax

benefits could increase or decrease in the next twelve months

due to completion of tax authorities’ exams or the expiration

of statutes of limitations. Management estimates that the

liability for unrecognized tax benefits could decrease by $81

million within the next twelve months.

Examinations are complete for PNC’s consolidated federal

income tax returns through 2006 having no outstanding

unresolved issues. The Internal Revenue Service (IRS) is

currently examining PNC’s 2007 and 2008 returns. National

City’s consolidated federal income tax returns through 2007

have been audited by the IRS. Certain adjustments remain

under review by the IRS Appeals division for years 2003

through 2007. The IRS is currently examining National City’s

2008 return.

PNC files tax returns in most states and some non-U.S.

jurisdictions each year and is under continuous examination

by various state taxing authorities.

With few exceptions, we are no longer subject to state and

local and non-U.S. income tax examinations by taxing

authorities for periods before 2003. For all open audits, any

potential adjustments have been considered in establishing our

reserve for uncertain tax positions as of December 31, 2011.

Our policy is to classify interest and penalties associated with

income taxes as income tax expense. For 2011, we had a

benefit of $33 million of gross interest and penalties

decreasing income tax expense. The total accrued interest and

penalties at December 31, 2011 and December 31, 2010 was

$81 million and $113 million, respectively.

188 The PNC Financial Services Group, Inc. – Form 10-K