PNC Bank 2011 Annual Report Download - page 128

Download and view the complete annual report

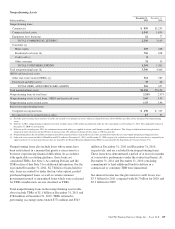

Please find page 128 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.years, beginning after December 15, 2011. We will adopt the

new disclosure requirements on January 1, 2012.

In May 2011, the FASB issued ASU 2011-04 - Fair Value

Measurement (Topic 820), Amendments to Achieve Common

Fair Value Measurement and Disclosure Requirements in U.S.

GAAP and IFRS. This ASU provides guidance to clarify the

concept of highest and best use valuation premise, how a

principal market is determined, and the application of the fair

value measurement for instruments with offsetting market or

counterparty credit risks. It also extends the prohibition on

blockage factors to all fair value hierarchy levels. This ASU

will require additional disclosures for the following:

(1) quantitative information about the significant unobservable

inputs used in all Level 3 financial instruments, (2) the

valuation processes used by the reporting entity as well as a

narrative description of the sensitivity of the fair value

measurement to changes in unobservable inputs, (3) a

reporting entity’s use of a nonfinancial asset in a way that

differs from the asset’s highest and best use if the fair value of

the asset is reported, (4) the categorization by level of the fair

value hierarchy for items that are not measured at fair value in

financial statements and (5) any transfers between Level 1 and

2 and the reason for those transfers. ASU 2011-04 is effective

for the first interim or annual period beginning after

December 15, 2011, and should be applied prospectively. The

adoption of this new guidance is not expected to have a

material effect on our results of operations or financial

position.

In April 2011, the FASB issued ASU 2011-03 – Transfers and

Servicing (Topic 860), Reconsideration of Effective Control

for Repurchase Agreements. This ASU removes from the

assessment of effective control (1) the criterion requiring the

transferor to have the ability to repurchase or redeem the

financial assets on substantially the agreed terms, even in the

event of default by the transferee, and (2) the collateral

maintenance implementation guidance related to that criterion.

Other criteria applicable to the assessment of effective control

have not been changed by this ASU. ASU 2011-03 is effective

for the first interim or annual period beginning on or after

December 15, 2011 and should be applied prospectively to

transactions or modifications of existing transactions that

occur on or after the effective date. The adoption of this new

guidance is not expected to have a material effect on our

results of operations or financial position.

In April 2011, the FASB issued ASU 2011-02 – Receivables

(Topic 310), A Creditor’s Determination of Whether a

Restructuring Is a Troubled Debt Restructuring. The ASU

clarifies when a loan restructuring constitutes a troubled debt

restructuring (TDR). This ASU (1) eliminates the sole use of

the borrowers’ effective interest rate test to determine if a

concession has occurred on the part of the creditor,

(2) requires a restructuring with below market terms to be

considered in determining classification as a TDR,

(3) specifies that a borrower not currently in default may still

be experiencing financial difficulty when payment default is

“probable in the foreseeable future,” and (4) specifies that a

delay in payment should be considered along with all other

factors in determining classification as a TDR. The ASU

guidance was effective for interim and annual periods

beginning after June 15, 2011 and was to be applied

retrospectively to the beginning of the annual period of

adoption.

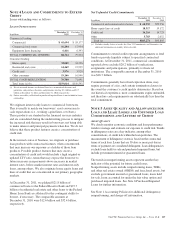

As a result of adopting the amendments in ASU 2011-02, we

reassessed all restructurings that occurred on or after the

beginning of the current fiscal year (January 1, 2011) for

identification as TDRs. We identified as TDRs certain loans

for which the allowance for credit losses had previously been

measured under a general allowance for credit losses

methodology. Upon identifying those loans as TDRs, we

accounted for them as impaired under the guidance in ASC

310-10-35. The amendments in ASU 2011-02 require

prospective application of the impairment measurement

guidance in ASC 310-10-35 for those loans newly identified

as TDRs. Accordingly, at the end of the first interim period of

adoption (September 30, 2011), the recorded investment in

receivables for which the allowance for credit losses was

previously measured under a general allowance for credit

losses methodology and are now measured under ASC

310-10-35 was approximately $69 million and the allowance

for credit losses associated with those receivables was

approximately $21 million.Additionally, we adopted ASU

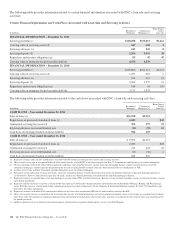

2010-20 – Receivables (Topic 310), Disclosures about the

Credit Quality of Financing Receivables and the Allowance

for Credit Losses for TDR disclosures. See Note 5 Asset

Quality and Allowances for Loan and Lease Losses and

Unfunded Loan Commitments and Letters of Credit for

additional information.

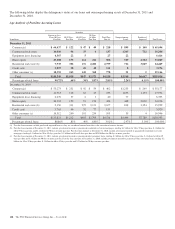

In January 2010, the FASB issued ASU 2010-06 – Fair Value

Measurements and Disclosures (Topic 820), Improving

Disclosures About Fair Value Measurements. This ASU

required purchases, sales, issuances and settlements to be

reported separately in the Level 3 fair value measurement

rollforward beginning with the first quarter 2011 reporting.

See Note 8 Fair Value for additional information.

The PNC Financial Services Group, Inc. – Form 10-K 119