PNC Bank 2011 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

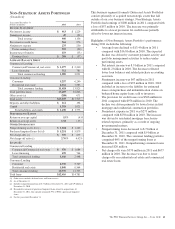

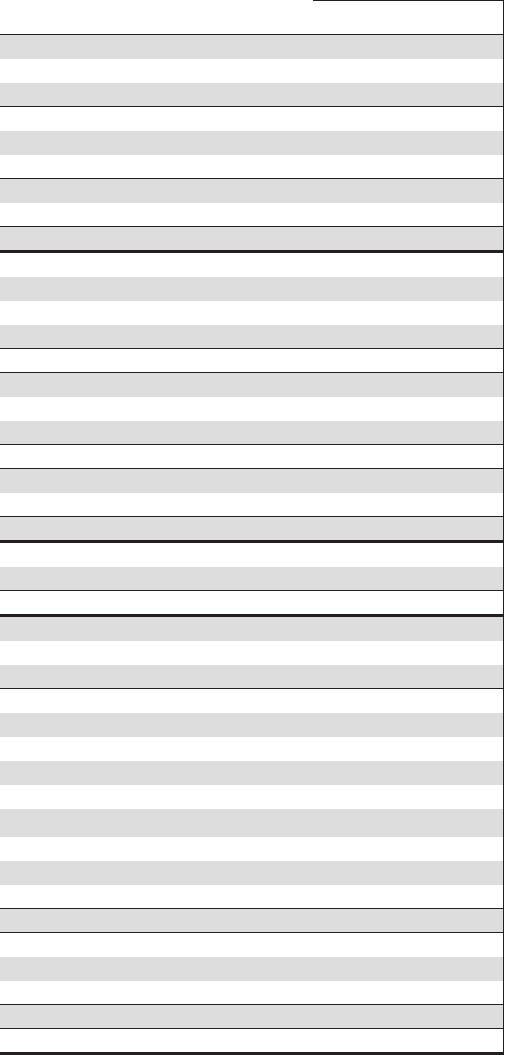

N

ON

-S

TRATEGIC

A

SSETS

P

ORTFOLIO

(Unaudited)

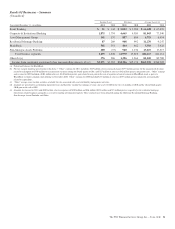

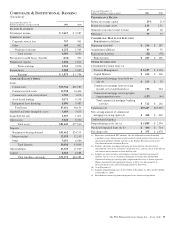

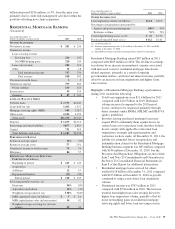

Year ended December 31

Dollars in millions 2011 2010

I

NCOME

S

TATEMENT

Net interest income $ 913 $ 1,229

Noninterest income 47 (93)

Total revenue 960 1,136

Provision for credit losses 366 976

Noninterest expense 275 250

Pretax earnings (loss) 319 (90)

Income taxes (benefit) 119 (33)

Earnings (loss) $ 200 $ (57)

A

VERAGE

B

ALANCE

S

HEET

Commercial Lending:

Commercial/Commercial real estate $ 1,277 $ 2,240

Lease financing 712 781

Total commercial lending 1,989 3,021

Consumer Lending:

Consumer 5,257 6,240

Residential real estate 6,161 7,585

Total consumer lending 11,418 13,825

Total portfolio loans 13,407 16,846

Other assets (a) (288) 671

Total assets $13,119 $17,517

Deposits and other liabilities $ 111 154

Capital 1,319 1,621

Total liabilities and equity $ 1,430 $ 1,775

P

ERFORMANCE

R

ATIOS

Return on average capital 15% (4)%

Return on average assets 1.52 (.33)

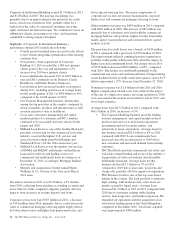

O

THER

I

NFORMATION

Nonperforming assets (b) (c) $ 1,024 $ 1,242

Purchased impaired loans (b) (d) $ 5,251 $ 5,879

Net charge-offs (e) $ 370 $ 677

Net charge-off ratio (e) 2.76% 4.02%

L

OANS

(b)

Commercial Lending

Commercial/Commercial real estate $ 976 $ 1,684

Lease financing 670 764

Total commercial lending 1,646 2,448

Consumer Lending

Consumer 4,930 5,769

Residential real estate 5,840 6,564

Total consumer lending 10,770 12,333

Total loans $12,416 $14,781

(a) Other assets includes deferred taxes and loan reserves.

(b) As of December 31.

(c) Includes nonperforming loans of $.7 billion at December 31, 2011 and $.9 billion at

December 31, 2010.

(d) Recorded investment of purchased impaired loans related to acquisitions. At

December 31, 2011, this segment contained 79% of PNC’s purchased impaired

loans.

(e) For the year ended December 31.

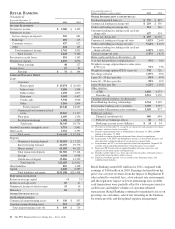

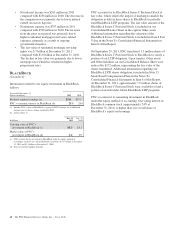

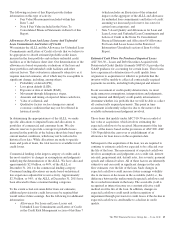

This business segment (formerly Distressed Assets Portfolio)

consists primarily of acquired non-strategic assets that fall

outside of our core business strategy. Non-Strategic Assets

Portfolio had earnings of $200 million in 2011 compared with

a loss of $57 million in 2010. The increase was primarily

attributable to a lower provision for credit losses partially

offset by lower net interest income.

Highlights of Non-Strategic Assets Portfolio’s performance

during 2011 include the following:

• Average loans declined to $13.4 billion in 2011

compared with $16.8 billion in 2010. The expected

decline was driven by customer payment activity and

portfolio management activities to reduce under-

performing assets.

• Net interest income was $.9 billion in 2011 compared

with $1.2 billion in 2010. The decrease reflected

lower loan balances and related purchase accounting

accretion.

• Noninterest income was $47 million in 2011

compared with a loss of $93 million in 2010. 2010

included an increase to the liability for estimated

losses on repurchase and indemnification claims on

brokered home equity loans sold to investors.

• The provision for credit losses was $366 million in

2011 compared with $976 million in 2010. The

decline was driven primarily by lower losses in first

mortgage and residential construction portfolios.

• Noninterest expense in 2011 was $275 million

compared with $250 million in 2010. The increase

was driven by residential mortgage foreclosure-

related expenses, primarily as a result of ongoing

governmental matters.

• Nonperforming loans decreased to $.7 billion at

December 31, 2011 compared with $.9 billion at

December 31, 2010. The consumer lending portfolio

comprised 66% of the nonperforming loans at

December 31, 2011. Nonperforming consumer loans

increased $20 million.

• Net charge-offs were $370 million in 2011 and $677

million in 2010. The decrease was due to lower

charge-offs on residential real estate and commercial

real estate loans.

The PNC Financial Services Group, Inc. – Form 10-K 61