Wells Fargo 2015 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Risk Management - Asset/Liability Management (continued)

SECURITIZATION DUE DILIGENCE AND RISK MONITORING The

market risk capital rule requires that the Company conduct due

diligence on the risk of each position within three days of the

purchase of a securitization position. The Company's due

diligence seeks to provide an understanding of the features that

would materially affect the performance of a securitization or re-

securitization. The due diligence analysis is re-performed on a

quarterly basis for each securitization and re-securitization

position. The Company uses an automated solution to track the

due diligence associated with securitization activity. The

Company aims to manage the risks associated with securitization

and re-securitization positions through the use of offsetting

positions and portfolio diversification.

Standardized Specific Risk Charge For debt and equity positions

that are not evaluated by the approved internal specific risk

models, a regulatory prescribed standard specific risk charge is

applied. The standard specific risk add-on for sovereign entities,

public sector entities, and depository institutions is based on the

Organization for Economic Co-operation and Development

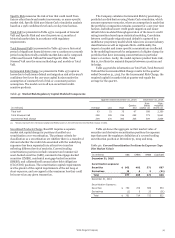

Table 47: Market Risk Regulatory Capital and RWAs

(OECD) country risk classifications (CRC) and the remaining

contractual maturity of the position. These risk add-ons for debt

positions range from 0.25% to 12%. The add-on for corporate

debt is based on creditworthiness and the remaining contractual

maturity of the position. All other types of debt positions are

subject to an 8% add-on. The standard specific risk add-on for

equity positions is generally 8%.

Comprehensive Risk Charge/Correlation Trading The market

risk capital rule requires capital for correlation trading positions.

The Company's remaining correlation trading exposure covered

under the market risk capital rule matured in fourth quarter

2014.

Table 47 summarizes the market risk-based capital

requirements charge and market RWAs in accordance with the

Basel III market risk capital rule as of December 31, 2015 and

2014. The market RWAs are calculated as the sum of the

components in the table below.

December 31, 2015 December 31, 2014

(in millions)

Risk-

based

capital

Risk-

weighted

assets

Risk-

based

capital

Risk-

weighted

assets

Total VaR $ 188 2,350 146 1,822

Total Stressed VaR 773 9,661 1,469 18,359

Incremental Risk Charge

Securitized Products Charge

Standardized Specific Risk Charge

De minimis Charges (positions not included in models)

309

616

1,048

19

3,864

7,695

13,097

243

345

766

1,177

66

4,317

9,577

14,709

829

Total $ 2,953 36,910 3,969 49,613

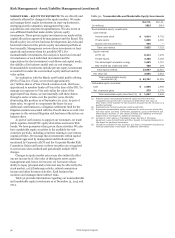

RWA Rollforward Table 48 depicts the changes in market risk

regulatory capital and RWAs under Basel III for the full year and

fourth quarter of 2015.

Table 48: Analysis of Changes in Market Risk Regulatory

Capital and RWAs

(in millions)

Balance, December 31, 2014

Total VaR

Total Stressed VaR

Incremental Risk Charge

Securitized Products Charge

Standardized Specific Risk Charge

De minimis Charges

Balance, December 31, 2015

$

$

Risk-

based

capital

3,969

42

(696)

(36)

(151)

(129)

(46)

2,953

Risk-

weighted

assets

49,613

528

(8,698)

(453)

(1,882)

(1,612)

(586)

36,910

Balance, September 30, 2015

Total VaR

Total Stressed VaR

Incremental Risk Charge

Securitized Products Charge

Standardized Specific Risk Charge

De minimis Charges

Balance, December 31, 2015

$

$

3,275

5

(73)

(69)

(79)

(99)

(7)

2,953

40,934

58

(910)

(857)

(984)

(1,243)

(88)

36,910

All changes to market risk regulatory capital and RWAs for the

full year and fourth quarter of 2015 were associated with

changes in positions due to normal trading activity in addition to

market volatility over the last year.

VaR Backtesting The market risk capital rule requires

backtesting as one form of validation of the VaR model.

Backtesting is a comparison of the daily VaR estimate with the

actual clean profit and loss (clean P&L) as defined by the market

risk capital rule. Clean P&L is the change in the value of the

Company’s covered trading positions that would have occurred

had previous end-of-day covered trading positions remained

unchanged (therefore, excluding fees, commissions, net interest

income, and intraday trading gains and losses). The backtesting

analysis compares the daily Total VaR for each of the trading

days in the preceding 12 months with the net clean P&L. Clean

P&L does not include credit adjustments and other activity not

representative of daily price changes driven by market risk

factors. The clean P&L measure of revenue is used to evaluate

the performance of the Total VaR and is not comparable to our

actual daily trading net revenues, as reported elsewhere in this

Report.

Any observed clean P&L loss in excess of the Total VaR is

considered a market risk regulatory capital backtesting

exception. The actual number of exceptions (that is, the number

of business days for which the clean P&L losses exceed the

corresponding 1-day, 99% Total VaR measure) over the

preceding 12 months is used to determine the capital multiplier

for the market risk capital calculation. The number of actual

backtesting exceptions is dependent on current market

Wells Fargo & Company

96