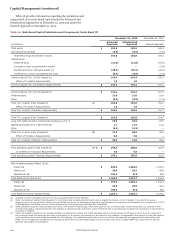

Wells Fargo 2015 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Risk Management - Asset/Liability Management (continued)

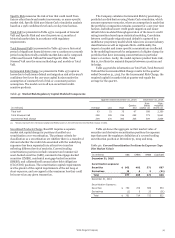

Table 52: Short-Term Borrowings

(in millions)

Dec 31,

2015

Sep 30,

2015

Jun 30,

2015

Quarter ended

Mar 31,

2015

Dec 31,

2014

Balance, period end

Federal funds purchased and securities sold under agreements to repurchase $ 82,948 74,652 71,439 64,400 51,052

Commercial paper 334 393 621 3,552 2,456

Other short-term borrowings 14,246 13,024 10,903 9,745 10,010

Total $ 97,528 88,069 82,963 77,697 63,518

Average daily balance for period

Federal funds purchased and securities sold under agreements to repurchase $ 88,949 79,445 72,429 58,881 51,509

Commercial paper 414 484 2,433 3,040 3,511

Other short-term borrowings 13,552 10,428 9,637 9,791 9,656

Total $ 102,915 90,357 84,499 71,712 64,676

Maximum month-end balance for period

Federal funds purchased and securities sold under agreements to repurchase (1)

Commercial paper (2)

Other short-term borrowings (3)

$ 89,800

461

14,246

80,961

510

13,024

71,811

2,713

10,903

66,943

3,552

10,068

51,052

3,740

10,010

(1)

(2)

(3)

Highest month-end balance in each of the last five quarters was in October, August, May and February 2015 and December 2014.

Highest month-end balance in each of the last five quarters was in November, July, April and March 2015 and November 2014.

Highest month-end balance in each of the last five quarters was in December, September, June and February 2015 and December 2014.

We access domestic and international capital markets for

long-term funding (generally greater than one year) through

issuances of registered debt securities, private placements and

asset-backed secured funding.

Parent Under SEC rules, our Parent is classified as a “well-

known seasoned issuer,” which allows it to file a registration

statement that does not have a limit on issuance capacity. In

May 2014, the Parent filed a registration statement with the SEC

for the issuance of senior and subordinated notes, preferred

stock and other securities. The Parent’s ability to issue debt and

other securities under this registration statement is limited by

the debt issuance authority granted by the Board. The Parent is

currently authorized by the Board to issue $60 billion in

outstanding short-term debt and $170 billion in outstanding

long-term debt. At December 31, 2015, the Parent had available

$39.4 billion in short-term debt issuance authority and

$46.0 billion in long-term debt issuance authority. The Parent’s

debt issuance authority granted by the Board includes short-

term and long-term debt issued to affiliates. In 2015, the Parent

issued $26.4 billion of senior notes, of which $17.0 billion were

registered with the SEC. In addition, in 2015, the Parent issued

$5.3 billion of subordinated notes, all of which were registered

with the SEC.

The Parent’s proceeds from securities issued were used for

general corporate purposes, and, unless otherwise specified in

the applicable prospectus or prospectus supplement, we expect

the proceeds from securities issued in the future will be used for

the same purposes. Depending on market conditions, we may

purchase our outstanding debt securities from time to time in

privately negotiated or open market transactions, by tender

offer, or otherwise.

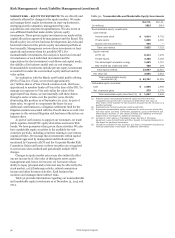

Table 53 provides information regarding the Parent’s

medium-term note (MTN) programs, which are covered by the

long-term debt issuance authority granted by the Board. The

Parent may issue senior and subordinated debt securities under

Series N & O, and the European and Australian programmes.

Under Series K, the Parent may issue senior debt securities

linked to one or more indices or bearing interest at a fixed or

floating rate.

Table 53: Medium-Term Note (MTN) Programs

December 31, 2015

(in billions)

Date

established

Debt

issuance

authority

Available

for

issuance

MTN program:

Series N & O (1)(2)

Series K (1)(3)

European (4)(5)

European (4)(6)

Australian (4)(7)

May 2014

April 2010

December 2009

August 2013

June 2005 AUD

$ —

25.0

25.0

10.0

10.0

—

20.7

3.9

7.9

7.8

(1) SEC registered.

(2) The Parent can issue an indeterminate amount of debt securities, subject to

the debt issuance authority granted by the Board.

(3) As amended in April 2012 and March 2015.

(4) Not registered with the SEC. May not be offered in the United States without

applicable exemptions from registration.

(5) As amended in April 2012, April 2013, April 2014 and March 2015. For

securities to be admitted to listing on the Official List of the United Kingdom

Financial Conduct Authority and to trade on the Regulated Market of the

London Stock Exchange.

(6) As amended in May 2014 and April 2015, for securities that will not be

admitted to listing, trading and/or quotation by any stock exchange or

quotation system, or will be admitted to listing, trading and/or quotation by a

stock exchange or quotation system that is not considered to be a regulated

market.

(7) As amended in October 2005, March 2010 and September 2013.

Wells Fargo Bank, N.A. Wells Fargo Bank, N.A. is authorized

by its board of directors to issue $100 billion in outstanding

short-term debt and $125 billion in outstanding long-term debt.

At December 31, 2015, Wells Fargo Bank, N.A. had available

$99.98 billion in short-term debt issuance authority and

$66.3 billion in long-term debt issuance authority. In April 2015,

Wells Fargo Bank, N.A. established a $100 billion bank note

program under which, subject to any other debt outstanding

under the limits described above, it may issue $50 billion in

outstanding short-term senior notes and $50 billion in

outstanding long-term senior or subordinated notes. At

December 31, 2015, Wells Fargo Bank, N.A. had remaining

issuance capacity under the bank note program of $50.0 billion

in short-term senior notes and $50.0 billion in long-term senior

or subordinated notes. In January 2016, Wells Fargo Bank, N.A.

issued $3.5 billion of unregistered senior notes under the bank

note program. In addition, during 2015, Wells Fargo Bank, N.A.

executed advances of $10.5 billion with the Federal Home Loan

Wells Fargo & Company

100