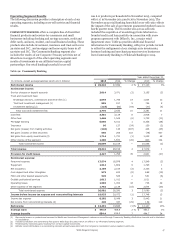

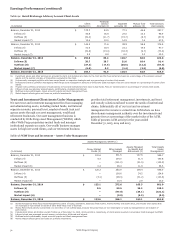

Wells Fargo 2015 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

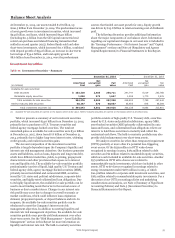

Balance Sheet Analysis

At December 31, 2015, our assets totaled $1.8 trillion, up

$100.5 billion from December 31, 2014. The predominant areas

of asset growth were in investment securities, which increased

$34.6 billion, and loans, which increased $54.0 billion

(including $11.5 billion from the GE Capital commercial real

estate loan purchase and related financing transaction that

settled in second quarter 2015). Federal funds sold and other

short-term investments, which increased $11.7 billion, combined

with deposit growth of $55.0 billion, an increase in short-term

borrowings of $34.0 billion, and total equity growth of

$8.6 billion from December 31, 2014, were the predominant

Investment Securities

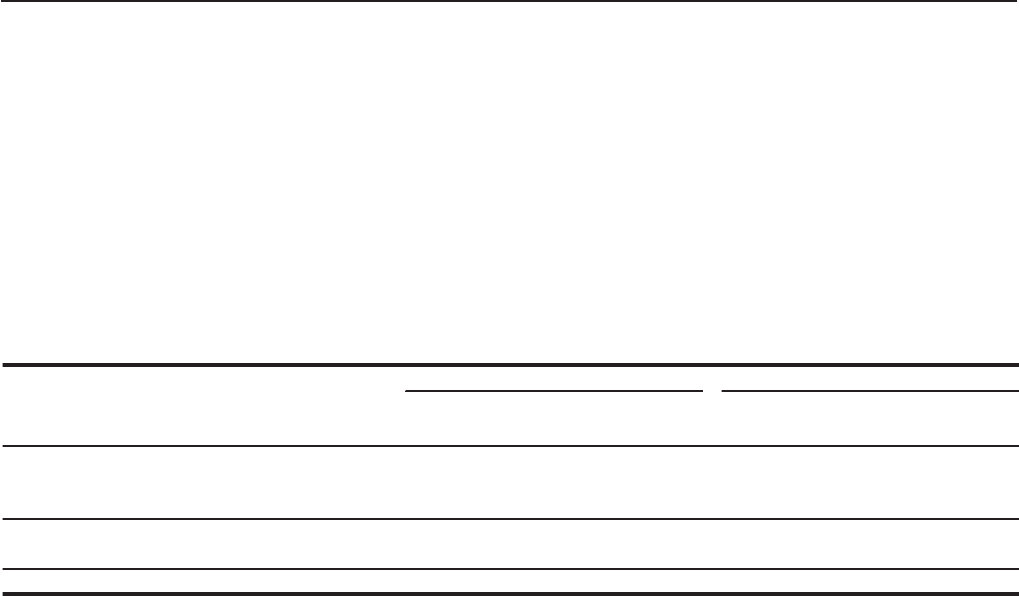

Table 10: Investment Securities – Summary

sources that funded our asset growth for 2015. Equity growth

was driven by $13.8 billion in retained earnings net of dividends

paid.

The following discussion provides additional information

about the major components of our balance sheet. Information

regarding our capital and changes in our asset mix is included in

the “Earnings Performance – Net Interest Income” and “Capital

Management” sections and Note 26 (Regulatory and Agency

Capital Requirements) to Financial Statements in this Report.

December 31, 2015 December 31, 2014

Net Net

Amortized unrealized Fair Amortized unrealized Fair

(in millions) Cost gain value Cost gain value

Available-for-sale securities:

Debt securities $ 263,318 2,403 265,721 247,747 6,019 253,766

Marketable equity securities 1,058 579 1,637 1,906 1,770 3,676

Total available-for-sale securities 264,376 2,982 267,358 249,653 7,789 257,442

Held-to-maturity debt securities 80,197 370 80,567 55,483 876 56,359

Total investment securities (1) $ 344,573 3,352 347,925 305,136 8,665 313,801

(1) Available-for-sale securities are carried on the balance sheet at fair value. Held-to-maturity securities are carried on the balance sheet at amortized cost.

Table 10 presents a summary of our investment securities

portfolio, which increased $34.6 billion from December 31, 2014,

primarily due to purchases of U.S. Treasury securities and

federal agency mortgage-backed securities. The total net

unrealized gains on available-for-sale securities were $3.0 billion

at December 31, 2015, down from $7.8 billion at December 31,

2014, primarily due to higher long-term interest rates, widening

credit spreads, and realized securities gains.

The size and composition of the investment securities

portfolio is largely dependent upon the Company’s liquidity and

interest rate risk management objectives. Our business generates

assets and liabilities, such as loans, deposits and long-term debt,

which have different maturities, yields, re-pricing, prepayment

characteristics and other provisions that expose us to interest

rate and liquidity risk. The available-for-sale securities portfolio

predominantly consists of liquid, high quality U.S. Treasury and

federal agency debt, agency mortgage-backed securities (MBS),

privately-issued residential and commercial MBS, securities

issued by U.S. states and political subdivisions, corporate debt

securities, and highly rated collateralized loan obligations. Due

to its highly liquid nature, the available-for-sale portfolio can be

used to meet funding needs that arise in the normal course of

business or due to market stress. Changes in our interest rate

risk profile may occur due to changes in overall economic or

market conditions, which could influence loan origination

demand, prepayment speeds, or deposit balances and mix. In

response, the available-for-sale securities portfolio can be

rebalanced to meet the Company’s interest rate risk

management objectives. In addition to meeting liquidity and

interest rate risk management objectives, the available-for-sale

securities portfolio may provide yield enhancement over other

short-term assets. See the “Risk Management – Asset/Liability

Management” section in this Report for more information on

liquidity and interest rate risk. The held-to-maturity securities

portfolio consists of high quality U.S. Treasury debt, securities

issued by U.S. states and political subdivisions, agency MBS,

asset-backed securities (ABS) primarily collateralized by auto

loans and leases, and collateralized loan obligations where our

intent is to hold these securities to maturity and collect the

contractual cash flows. The held-to-maturity portfolio may also

provide yield enhancement over short-term assets.

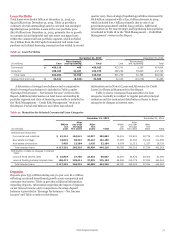

We analyze securities for other-than-temporary impairment

(OTTI) quarterly or more often if a potential loss-triggering

event occurs. Of the $559 million in OTTI write-downs

recognized in earnings in 2015, $183 million related to debt

securities and $2 million related to marketable equity securities,

which are each included in available-for-sale securities. Another

$374 million in OTTI write-downs were related to

nonmarketable equity investments, which are included in other

assets. OTTI write-downs recognized in earnings related to

energy investments totaled $287 million in 2015, of which

$104 million related to corporate debt investment securities, and

$183 million related to nonmarketable equity investments. For a

discussion of our OTTI accounting policies and underlying

considerations and analysis, see Note 1 (Summary of Significant

Accounting Policies) and Note 5 (Investment Securities) to

Financial Statements in this Report.

Wells Fargo & Company

53