Wells Fargo 2015 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

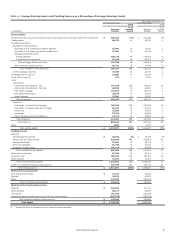

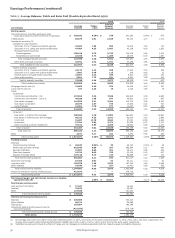

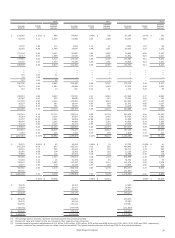

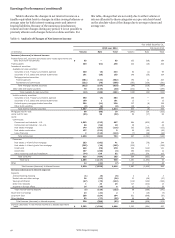

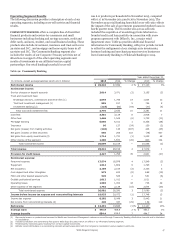

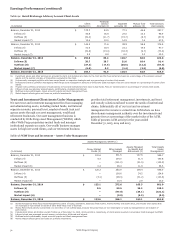

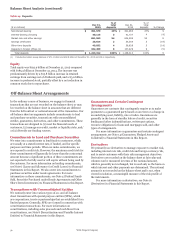

Earnings Performance (continued)

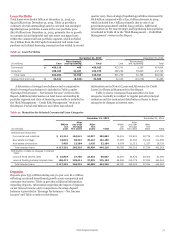

Cross-sell We aspire to create deep and enduring relationships

with our customers by providing them with an exceptional

experience and by discovering their needs and delivering the

most relevant products, services, advice, and guidance. An

outcome of offering customers the products and services they

need, want and value is that we earn more opportunities to serve

them, or what we call cross-sell. Cross-sell is the result of serving

our customers well, understanding their financial needs and

goals over their lifetimes, and ensuring we innovate our

products, services and channels so that we earn more of their

business and help them succeed financially. Our approach to

cross-sell is needs-based as some customers will benefit from

more products, and some may need fewer. We believe there is

continued opportunity to meet our customers' financial needs as

we build lifelong relationships with them. One way we track the

degree to which we are satisfying our customers' financial needs

is through our cross-sell metrics, which are based on whether the

customer is a retail banking household or has a wholesale

banking relationship. A retail banking household is a household

that uses at least one of the following retail products – a demand

deposit account, savings account, savings certificate, individual

retirement account (IRA) certificate of deposit, IRA savings

account, personal line of credit, personal loan, home equity line

of credit or home equity loan. A household is determined based

on aggregating all accounts with the same address. For our

wholesale banking relationships, we aggregate all related entities

under common ownership or control.

We report cross-sell metrics for Community Banking and

WIM based on the average number of retail products used per

retail banking household. For Community Banking the cross-sell

metric represents the relationship of all retail products used by

customers in retail banking households. For WIM the cross-sell

metric represents the relationship of all retail products used by

customers in retail banking households who are also WIM

customers.

Products included in our retail banking household cross-sell

metrics must be retail products and have the potential for

revenue generation and long-term viability. Products and

services that generally do not meet these criteria – such as ATM

cards, online banking and direct deposit – are not included. In

addition, multiple holdings by a WIM customer within an

investment category, such as common stock, mutual funds or

bonds, are counted as a single product. We may periodically

update the products included in our cross-sell metrics to

account for changes in our product offerings.

For Wholesale Banking, the cross-sell metric represents the

average number of Wholesale Banking (non-retail) products

used per Wholesale Banking customer relationship. What we

include as products in the cross-sell metric comes from a defined

set of revenue generating products within the following product

families: credit, treasury management, deposits, risk

management, foreign exchange, capital markets and advisory,

investments, insurance, trade financing, and trust and servicing.

The number of customer relationships is based on tax

identification numbers adjusted to combine those entities under

common ownership or another structure indicative of a single

relationship and includes only relationships that produced

revenue for the period of measurement.

Wells Fargo & Company

46