Wells Fargo 2015 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

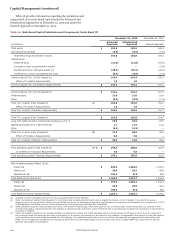

Capital Management

We have an active program for managing capital through a

comprehensive process for assessing the Company’s overall

capital adequacy. Our objective is to maintain capital at an

amount commensurate with our risk profile and risk tolerance

objectives, and to meet both regulatory and market expectations.

We primarily fund our capital needs through the retention of

earnings net of dividends as well as the issuance of preferred

stock and long and short-term debt. Retained earnings increased

$13.8 billion from December 31, 2014, predominantly from

Wells Fargo net income of $22.9 billion, less common and

preferred stock dividends of $9.1 billion. During 2015, we issued

85.2 million shares of common stock. In January 2015, we

issued 2 million Depositary Shares, each representing 1/25th

interest in a share of the Company’s newly issued 5.875% Fixed-

to-Floating Rate Non-Cumulative Perpetual Class A Preferred

Stock, Series U, for an aggregate public offering price of

$2.0 billion. In September 2015, we issued 40 million Depositary

Shares, each representing 1/1,000th interest in a share of the

Company’s newly issued Non-Cumulative Perpetual Class A

Preferred Stock, Series V, for an aggregate public offering price

of $1.0 billion. In addition, in January 2016, we issued

40 million Depositary Shares, each representing a 1/1,000th

interest in a share of the Company's newly issued Non-

Cumulative Perpetual Class A Preferred Stock, Series W, for an

aggregate public offering price of $1.0 billion. During 2015, we

repurchased 163.4 million shares of common stock in open

market transactions, private transactions and from employee

benefit plans, at a cost of $8.9 billion. We also entered into a

$500 million forward repurchase contract with an unrelated

third party in December 2015 that settled in January 2016 for

9.2 million shares. In addition, we entered into a $750 million

forward repurchase contract with an unrelated third party in

January 2016 that settled in first quarter 2016 for 15.9 million

shares. For additional information about our forward repurchase

agreements, see Note 1 (Summary of Significant Accounting

Policies) to Financial Statements in this Report.

Regulatory Capital Guidelines

The Company and each of our insured depository institutions are

subject to various regulatory capital adequacy requirements

administered by the FRB and the OCC. Risk-based capital (RBC)

guidelines establish a risk-adjusted ratio relating capital to

different categories of assets and off-balance sheet exposures.

See Note 26 (Regulatory and Agency Capital Requirements) to

Financial Statements in this Report for additional information.

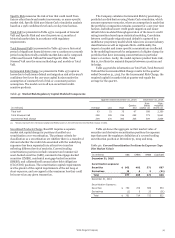

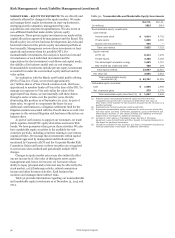

RISK-BASED CAPITAL AND RISK-WEIGHTED ASSETS The

Company is subject to final and interim final rules issued by

federal banking regulators to implement Basel III capital

requirements for U.S. banking organizations. These rules are

based on international guidelines for determining regulatory

capital issued by the Basel Committee on Banking Supervision

(BCBS). The federal banking regulators’ capital rules, among

other things, require on a fully phased-in basis:

• a minimum Common Equity Tier 1 (CET1) ratio of 4.5%;

• a minimum tier 1 capital ratio of 6.0%;

• a minimum total capital ratio of 8.0%;

• a capital conservation buffer of 2.5% to be added to the

minimum capital ratios, and a capital surcharge between

1.0-4.5% for global systemically important banks (G-SIBs)

that will be calculated annually (based on year-end 2014

data, the FRB estimated that our G-SIB surcharge would

be 2.0%) and also added to the minimum capital ratios

(for a minimum CET1 ratio of 9.0%, a minimum tier 1

capital ratio of 10.5%, and a minimum total capital ratio of

12.5%);

• a potential countercyclical buffer of up to 2.5%, which

would be imposed by regulators at their discretion if it is

determined that a period of excessive credit growth is

contributing to an increase in systemic risk;

• a minimum tier 1 leverage ratio of 4.0%; and

• a minimum supplementary leverage ratio (SLR) of 5.0%

(comprised of a 3.0% minimum requirement and a

supplementary leverage buffer of 2.0%) for large and

internationally active bank holding companies (BHCs).

We were required to comply with the final Basel III

capital rules beginning January 2014, with certain provisions

subject to phase-in periods. The Basel III capital rules are

scheduled to be fully phased in by the end of 2021. The Basel

III capital rules contain two frameworks for calculating capital

requirements, a Standardized Approach, which replaced Basel

I, and an Advanced Approach applicable to certain

institutions.

In March 2015, the FRB and OCC directed the Company

and its subsidiary national banks to exit the parallel run phase

and begin using the Basel III Advanced Approaches capital

framework, in addition to the Standardized Approach, to

determine our risk-based capital requirements starting in

second quarter 2015. Accordingly, in the assessment of our

capital adequacy, we must report the lower of our CET1, tier 1

and total capital ratios calculated under the Standardized

Approach and under the Advanced Approach.

Because the Company has been designated as a G-SIB, we

will also be subject to the FRB’s rule implementing the

additional capital surcharge on G-SIBs. Under the rule, we must

annually calculate our surcharge under two methods and use the

higher of the two surcharges. The first method (method one) will

consider our size, interconnectedness, cross-jurisdictional

activity, substitutability, and complexity, consistent with a

methodology developed by the BCBS and the Financial Stability

Board (FSB). The second (method two) will use similar inputs,

but will replace substitutability with use of short-term wholesale

funding and will generally result in higher surcharges than the

BCBS methodology. The G-SIB surcharge will be phased in

beginning on January 1, 2016 and become fully effective on

January 1, 2019. Based on year-end 2014 data, the FRB

estimated that the Company’s G-SIB surcharge would be 2.0% of

the Company’s RWAs. However, because the G-SIB surcharge is

calculated annually based on data that can differ over time, the

amount of the surcharge is subject to change in future periods.

Assuming a 2.0% G-SIB surcharge, our fully phased-in

minimum required CET1 ratio at December 31, 2015 would have

been 9.0%. Under the Standardized Approach (fully phased-in),

our CET1 ratio of 10.77% exceeded the minimum of 9.0% by

177 basis points at December 31, 2015.

The tables that follow provide information about our risk-

based capital and related ratios as calculated under Basel III

capital guidelines. For banking industry regulatory reporting

purposes, we report our capital in accordance with Transition

Requirements but are managing our capital based on a fully

phased-in calculation. For information about our capital

requirements calculated in accordance with Transition

Requirements, see Note 26 (Regulatory and Agency Capital

Wells Fargo & Company

102