Wells Fargo 2015 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

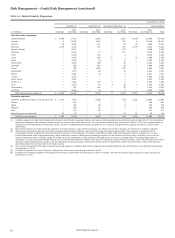

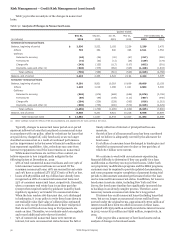

Risk Management – Credit Risk Management (continued)

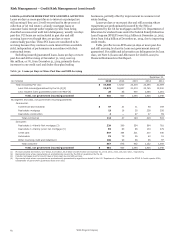

Table 31 provides an analysis of the changes in nonaccrual

loans.

Table 31: Analysis of Changes in Nonaccrual Loans

Quarter ended

Dec 31, Sep 30, Jun 30, Mar 31, Year ended Dec 31,

(in millions) 2015 2015 2015 2015 2015 2014

Commercial nonaccrual loans

Balance, beginning of period $ 2,336 2,522 2,192 2,239 2,239 3,475

Inflows 793 382 840 496 2,511 1,552

Outflows:

Returned to accruing (44) (26) (20) (67) (157) (280)

Foreclosures (72) (32) (11) (24) (139) (174)

Charge-offs (243) (135) (117) (107) (602) (501)

Payments, sales and other (1) (346) (375) (362) (345) (1,428) (1,833)

Total outflows (705) (568) (510) (543) (2,326) (2,788)

Balance, end of period 2,424 2,336 2,522 2,192 2,424 2,239

Consumer nonaccrual loans

Balance, beginning of period 9,201 9,921 10,318 10,609 10,609 12,193

Inflows 1,226 1,019 1,098 1,341 4,684 6,306

Outflows:

Returned to accruing (646) (676) (668) (686) (2,676) (3,706)

Foreclosures (89) (99) (108) (111) (407) (540)

Charge-offs (204) (228) (229) (265) (926) (1,315)

Payments, sales and other (1) (530) (736) (490) (570) (2,326) (2,329)

Total outflows (1,469) (1,739) (1,495) (1,632) (6,335) (7,890)

Balance, end of period 8,958 9,201 9,921 10,318 8,958 10,609

Total nonaccrual loans $ 11,382 11,537 12,443 12,510 11,382 12,848

(1) Other outflows include the effects of VIE deconsolidations and adjustments for loans carried at fair value.

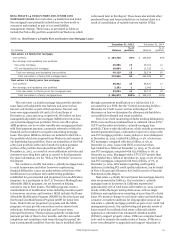

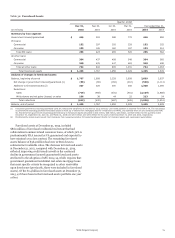

Typically, changes to nonaccrual loans period-over-period

represent inflows for loans that are placed on nonaccrual status

in accordance with our policy, offset by reductions for loans that

are paid down, charged off, sold, foreclosed, or are no longer

classified as nonaccrual as a result of continued performance

and an improvement in the borrower’s financial condition and

loan repayment capabilities. Also, reductions can come from

borrower repayments even if the loan remains on nonaccrual.

While nonaccrual loans are not free of loss content, we

believe exposure to loss is significantly mitigated by the

following factors at December 31, 2015:

• 98% of total commercial nonaccrual loans and over 99% of

total consumer nonaccrual loans are secured. Of the

consumer nonaccrual loans, 98% are secured by real estate

and 75% have a combined LTV (CLTV) ratio of 80% or less.

• losses of $483 million and $3.1 billion have already been

recognized on 28% of commercial nonaccrual loans and

52% of consumer nonaccrual loans, respectively. Generally,

when a consumer real estate loan is 120 days past due

(except when required earlier by guidance issued by bank

regulatory agencies), we transfer it to nonaccrual status.

When the loan reaches 180 days past due, or is discharged

in bankruptcy, it is our policy to write these loans down to

net realizable value (fair value of collateral less estimated

costs to sell), except for modifications in their trial period

that are not written down as long as trial payments are

made on time. Thereafter, we reevaluate each loan regularly

and record additional write-downs if needed.

• 79% of commercial nonaccrual loans were current on

interest, but were on nonaccrual status because the full or

timely collection of interest or principal had become

uncertain.

• the risk of loss of all nonaccrual loans has been considered

and we believe is adequately covered by the allowance for

loan losses.

• $1.9 billion of consumer loans discharged in bankruptcy and

classified as nonaccrual were 60 days or less past due, of

which $1.7 billion were current.

We continue to work with our customers experiencing

financial difficulty to determine if they can qualify for a loan

modification so that they can stay in their homes. Under both

our proprietary modification programs and the MHA programs,

customers may be required to provide updated documentation,

and some programs require completion of payment during trial

periods to demonstrate sustained performance before the loan

can be removed from nonaccrual status. In addition, for loans in

foreclosure in certain states, including New York and New

Jersey, the foreclosure timeline has significantly increased due

to backlogs in an already complex process. Therefore, some

loans may remain on nonaccrual status for a long period.

If interest due on all nonaccrual loans (including loans that

were, but are no longer on nonaccrual at year end) had been

accrued under the original terms, approximately $700 million of

interest would have been recorded as income on these loans,

compared with $569 million actually recorded as interest income

in 2015, versus $741 million and $598 million, respectively, in

2014.

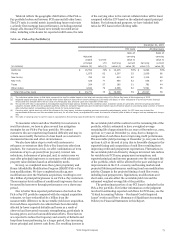

Table 32 provides a summary of foreclosed assets and an

analysis of changes in foreclosed assets.

Wells Fargo & Company

78