Wells Fargo 2015 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273

|

|

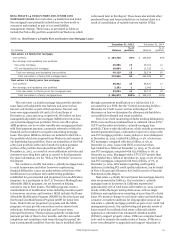

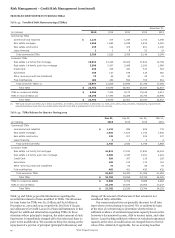

Risk Management – Credit Risk Management (continued)

large numbers of properties in a short period of time using

market comparables and price trends for local market areas. The

primary risk associated with the use of AVMs is that the value of

an individual property may vary significantly from the average

for the market area. We have processes to periodically validate

AVMs and specific risk management guidelines addressing the

circumstances when AVMs may be used. AVMs are generally

used in underwriting to support property values on loan

originations only where the loan amount is under $250,000. We

generally require property visitation appraisals by a qualified

independent appraiser for larger residential property loans.

Additional information about AVMs and our policy for their use

can be found in Note 6 (Loans and Allowance for Credit Losses)

to Financial Statements in this Report.

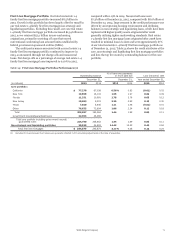

Table 23: Real Estate 1-4 Family First and Junior Lien

Mortgage Loans by State

December 31, 2015

Real

estate

Real 1-4 Total real

estate family estate

1-4 family junior 1-4 % of

first lien family total

(in millions) mortgage mortgage mortgage loans

Real estate 1-4 family

loans (excluding PCI):

California $ 88,367 14,554 102,921 11%

New York 20,962 2,416 23,378 3

Florida 14,068 4,823 18,891 2

New Jersey 11,825 4,462 16,287 2

Virginia 7,209 2,991 10,200 1

Texas 8,153 827 8,980 1

Pennsylvania 5,755 2,748 8,503 1

North Carolina 5,977 2,397 8,374 1

Washington 6,747 1,245 7,992 1

Other (1) 63,263 16,472 79,735 9

Government insured/

guaranteed loans (2) 22,353 — 22,353 2

Real estate 1-4 family

loans (excluding PCI) 254,679 52,935 307,614 34

Real estate 1-4 family

PCI loans (3) 19,190 69 19,259 2

Total $ 273,869 53,004 326,873 36%

(1) Consists of 41 states; no state had loans in excess of $7.2 billion.

(2) Represents loans whose repayments are predominantly insured by the Federal

Housing Administration (FHA) or guaranteed by the Department of Veterans

Affairs (VA).

(3) Includes $13.4 billion in real estate 1-4 family mortgage PCI loans in

California.

Wells Fargo & Company

70