Wells Fargo 2015 Annual Report Download - page 230

Download and view the complete annual report

Please find page 230 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

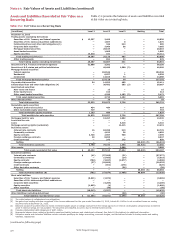

Note 17: Fair Values of Assets and Liabilities (continued)

(continued from previous page)

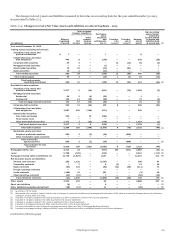

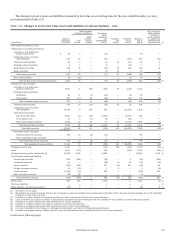

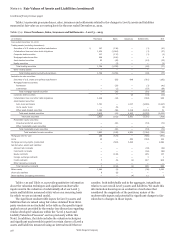

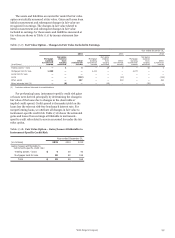

Table 17.9 presents gross purchases, sales, issuances and settlements related to the changes in Level 3 assets and liabilities

measured at fair value on a recurring basis for the year ended December 31, 2013.

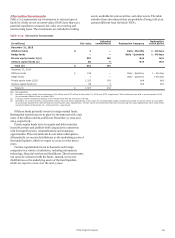

Table 17.9: Gross Purchases, Sales, Issuances and Settlements – Level 3 – 2013

(in millions) Purchases Sales Issuances Settlements Net

Year ended December 31, 2013

Trading assets (excluding derivatives):

Securities of U.S. states and political subdivisions $ 127 (136) — (1) (10)

Collateralized loan and other debt obligations 1,030 (1,064) — (3) (37)

Corporate debt securities 117 (117) — (1) (1)

Mortgage-backed securities 429 (420) — — 9

Asset-backed securities 53 (45) — (43) (35)

Equity securities — (3) — — (3)

Total trading securities 1,756 (1,785) — (48) (77)

Other trading assets — — — — —

Total trading assets (excluding derivatives) 1,756 (1,785) — (48) (77)

Available-for-sale securities:

Securities of U.S. states and political subdivisions — (69) 648 (761) (182)

Mortgage-backed securities:

Residential — (37) — (3) (40)

Commercial — (1) — (57) (58)

Total mortgage-backed securities — (38) — (60) (98)

Corporate debt securities — — 20 (33) (13)

Collateralized loan and other debt obligations 1,008 (14) — (369) 625

Asset-backed securities:

Auto loans and leases 1,751 — 1,047 (3,865) (1,067)

Home equity loans — (5) — — (5)

Other asset-backed securities 1,164 (36) 1,116 (2,213) 31

Total asset-backed securities 2,915 (41) 2,163 (6,078) (1,041)

Total debt securities 3,923 (162) 2,831 (7,301) (709)

Marketable equity securities:

Perpetual preferred securities — (20) — (53) (73)

Other marketable equity securities — — — — —

Total marketable equity securities — (20) — (53) (73)

Total available-for-sale securities 3,923 (182) 2,831 (7,354) (782)

Mortgages held for sale 286 (574) — (586) (874)

Loans 23 — 452 (369) 106

Mortgage servicing rights (residential) — (583) 3,469 — 2,886

Net derivative assets and liabilities:

Interest rate contracts — — — (39) (39)

Commodity contracts — — — (66) (66)

Equity contracts — (148) — 285 137

Foreign exchange contracts — — — 1 1

Credit contracts 7 (5) (4) 807 805

Other derivative contracts — — — — —

Total derivative contracts 7 (153) (4) 988 838

Other assets 1,064 (2) — (36) 1,026

Short sale liabilities 8 (8) — — —

Other liabilities (excluding derivatives) — — (4) 11 7

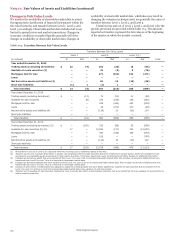

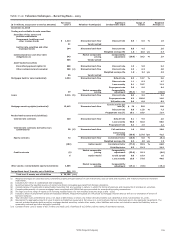

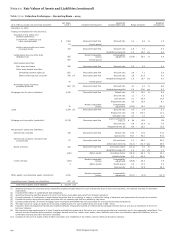

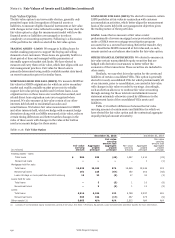

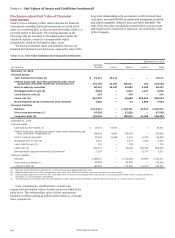

Table 17.10 and Table 17.11 provide quantitative information

about the valuation techniques and significant unobservable

inputs used in the valuation of substantially all of our Level 3

assets and liabilities measured at fair value on a recurring basis

for which we use an internal model.

The significant unobservable inputs for Level 3 assets and

liabilities that are valued using fair values obtained from third-

party vendors are not included in the table as the specific inputs

applied are not provided by the vendor (see discussion regarding

vendor-developed valuations within the “Level 3 Asset and

Liability Valuation Processes” section previously within this

Note). In addition, the table excludes the valuation techniques

and significant unobservable inputs for certain classes of Level 3

assets and liabilities measured using an internal model that we

consider, both individually and in the aggregate, insignificant

relative to our overall Level 3 assets and liabilities. We made this

determination based upon an evaluation of each class that

considered the magnitude of the positions, nature of the

unobservable inputs and potential for significant changes in fair

value due to changes in those inputs.

Wells Fargo & Company

228