Wells Fargo 2015 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

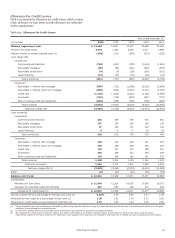

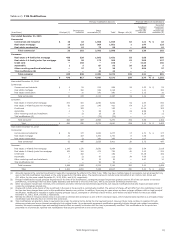

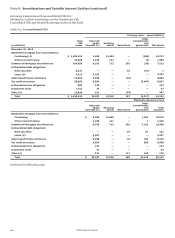

Table 6.17: TDR Modifications

Primary modification type (1) Financial effects of modifications

Recorded

Weighted investment

average related to

Interest rate Other interest rate interest rate

(in millions) Principal (2) reduction concessions (3) Total Charge- offs (4) reduction reduction (5)

Year ended December 31, 2015

Commercial:

Commercial and industrial $ 10 33 1,806 1,849 62 1.11 % $ 33

Real estate mortgage 14 133 904 1,051 1 1.47 133

Real estate construction 11 15 72 98 — 0.95 15

Total commercial 35 181 2,782 2,998 63 1.36 181

Consumer:

Real estate 1-4 family first mortgage 400 339 1,892 2,631 53 2.50 656

Real estate 1-4 family junior lien mortgage 34 99 172 305 43 3.09 127

Credit card — 166 — 166 — 11.44 166

Automobile 1 5 87 93 38 8.28 5

Other revolving credit and installment — 27 8 35 1 5.94 27

Trial modifications (6) — — 44 44 — — —

Total consumer 435 636 2,203 3,274 135 4.21 981

Total $ 470 817 4,985 6,272 198 3.77 % $ 1,162

Year ended December 31, 2014

Commercial:

Commercial and industrial $ 4 51 914 969 36 1.53 % $ 51

Real estate mortgage 7 182 929 1,118 — 1.21 182

Real estate construction — 10 270 280 — 2.12 10

Total commercial 11 243 2,113 2,367 36 1.32 243

Consumer:

Real estate 1-4 family first mortgage 571 401 2,690 3,662 92 2.50 833

Real estate 1-4 family junior lien mortgage 50 114 246 410 64 3.27 157

Credit card — 155 — 155 — 11.40 155

Automobile 2 5 85 92 36 8.56 5

Other revolving credit and installment — 12 16 28 — 5.26 12

Trial modifications (6) — — (74) (74) — — —

Total consumer 623 687 2,963 4,273 192 3.84 1,162

Total $ 634 930 5,076 6,640 228 3.41 % $ 1,405

Year ended December 31, 2013

Commercial:

Commercial and industrial $ 19 177 1,081 1,277 17 4.71 % $ 177

Real estate mortgage 33 307 1,391 1,731 8 1.66 308

Real estate construction — 12 381 393 4 1.07 12

Total commercial 52 496 2,853 3,401 29 2.72 497

Consumer:

Real estate 1-4 family first mortgage 1,143 1,170 3,681 5,994 233 2.64 2,019

Real estate 1-4 family junior lien mortgage 103 181 472 756 42 3.33 276

Credit card — 182 — 182 — 10.38 182

Automobile 3 12 97 112 34 7.66 12

Other revolving credit and installment — 10 12 22 — 4.87 10

Trial modifications (6) — — 50 50 — — —

Total consumer 1,249 1,555 4,312 7,116 309 3.31 2,499

Total $ 1,301 2,051 7,165 10,517 338 3.21 % $ 2,996

(1) Amounts represent the recorded investment in loans after recognizing the effects of the TDR, if any. TDRs may have multiple types of concessions, but are presented only

once in the first modification type based on the order presented in the table above. The reported amounts include loans remodified of $2.1 billion, $2.1 billion and

$3.1 billion, for the years ended December 31, 2015, 2014, and 2013, respectively.

(2) Principal modifications include principal forgiveness at the time of the modification, contingent principal forgiveness granted over the life of the loan based on borrower

performance, and principal that has been legally separated and deferred to the end of the loan, with a zero percent contractual interest rate.

(3) Other concessions include loan renewals, term extensions and other interest and noninterest adjustments, but exclude modifications that also forgive principal and/or

reduce the contractual interest rate.

(4) Charge-offs include write-downs of the investment in the loan in the period it is contractually modified. The amount of charge-off will differ from the modification terms if

the loan has been charged down prior to the modification based on our policies. In addition, there may be cases where we have a charge-off/down with no legal principal

modification. Modifications resulted in legally forgiving principal (actual, contingent or deferred) of $100 million, $149 million and $393 million for the years ended

December 31, 2015, 2014, and 2013, respectively.

(5) Reflects the effect of reduced interest rates on loans with an interest rate concession as one of their concession types, which includes loans reported as a principal primary

modification type that also have an interest rate concession.

(6) Trial modifications are granted a delay in payments due under the original terms during the trial payment period. However, these loans continue to advance through

delinquency status and accrue interest according to their original terms. Any subsequent permanent modification generally includes interest rate related concessions;

however, the exact concession type and resulting financial effect are usually not known until the loan is permanently modified. Trial modifications for the period are

presented net of previously reported trial modifications that became permanent in the current period.

Wells Fargo & Company

175