Wells Fargo 2015 Annual Report Download - page 250

Download and view the complete annual report

Please find page 250 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Note 20: Employee Benefits and Other Expenses (continued)

Plan Assumptions Policies). Table 20.5 presents the weighted-average discount

For additional information on our pension accounting rates used to estimate the projected benefit obligation for

assumptions, see Note 1 (Summary of Significant Accounting pension benefits.

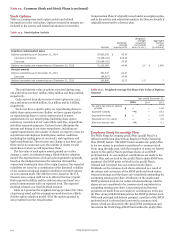

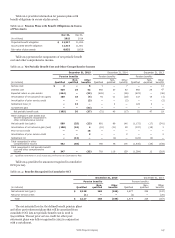

Table 20.5: Discount Rates Used to Estimate Projected Benefit Obligation

December 31, 2015

Pension benefits

December 31, 2014

Pension benefits

Discount rate

Qualified

4.25%

Non-

qualified

4.25

Other

benefits

4.25

Qualified

4.00

Non-

qualified

3.75

Other

benefits

4.00

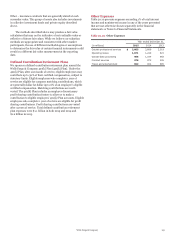

Table 20.6 presents the weighted-average assumptions used

to determine the net periodic benefit cost.

Table 20.6: Weighted-Average Assumptions Used to Determine Net Periodic Benefit Cost

December 31, 2015 December 31, 2014 December 31, 2013

Pension benefits Pension benefits Pension benefits

Non- Other Non- Other Non- Other

Qualified qualified benefits Qualified qualified benefits Qualified qualified benefits

Discount rate (1) 4.00% 3.60 4.00 4.75 4.16 4.50 4.38 4.08 3.75

Expected return on plan assets 7.00 N/A 6.00 7.00 N/A 6.00 7.50 N/A 6.00

(1) The discount rate for the 2013 qualified pension benefits and for the 2015, 2014, and 2013 nonqualified pension benefits includes the impact of quarter-end

remeasurements when settlement losses are recognized.

To account for postretirement health care plans we use

health care cost trend rates to recognize the effect of expected

changes in future health care costs due to medical inflation,

utilization changes, new technology, regulatory requirements

and Medicare cost shifting. In determining the end of year

benefit obligation we assume an average annual increase of

approximately 9.30%, for health care costs in 2016. This rate is

assumed to trend down 0.40%-0.60% per year until the trend

rate reaches an ultimate rate of 5.00% in 2024. The 2015

periodic benefit cost was determined using an initial annual

trend rate of 7.00%. This rate was assumed to decrease 0.25%

per year until the trend rate reached an ultimate rate of 5.00% in

2023. Increasing the assumed health care trend by one

percentage point in each year would increase the benefit

obligation as of December 31, 2015, by $34 million and the total

of the interest cost and service cost components of the net

periodic benefit cost for 2015 by $2 million. Decreasing the

assumed health care trend by one percentage point in each year

would decrease the benefit obligation as of December 31, 2015,

by $30 million and the total of the interest cost and service cost

components of the net periodic benefit cost for 2015 by

$2 million.

Investment Strategy and Asset Allocation

We seek to achieve the expected long-term rate of return with a

prudent level of risk given the benefit obligations of the pension

plans and their funded status. Our overall investment strategy is

designed to provide our Cash Balance Plan with long-term

growth opportunities while ensuring that risk is mitigated

through diversification across numerous asset classes and

various investment strategies. We target the asset allocation for

our Cash Balance Plan at a target mix range of 30%-50%

equities, 40%-60% fixed income, and approximately 10% in real

estate, venture capital, private equity and other investments. The

Employee Benefit Review Committee (EBRC), which includes

several members of senior management, formally reviews the

investment risk and performance of our Cash Balance Plan on a

quarterly basis. Annual Plan liability analysis and periodic asset/

liability evaluations are also conducted.

Other benefit plan assets include (1) assets held in a 401(h)

trust, which are invested with a target mix of 40%-60% for both

equities and fixed income, and (2) assets held in the Retiree

Medical Plan Voluntary Employees' Beneficiary Association

(VEBA) trust, which are invested with a general target asset mix

of 20%-40% equities and 60%-80% fixed income. In addition,

the strategy for the VEBA trust assets considers the effect of

income taxes by utilizing a combination of variable annuity and

low turnover investment strategies. Members of the EBRC

formally review the investment risk and performance of these

assets on a quarterly basis.

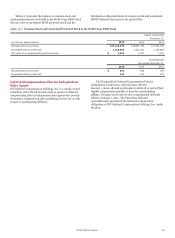

Projected Benefit Payments

Future benefits that we expect to pay under the pension and

other benefit plans are presented in Table 20.7. Other benefits

payments are expected to be reduced by prescription drug

subsidies from the federal government provided by the Medicare

Prescription Drug, Improvement and Modernization Act of

2003.

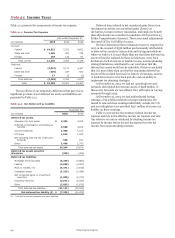

Table 20.7: Projected Benefit Payments

Pension benefits Other benefits

(in millions) Qualified

Non-

qualified

Future

benefits

Subsidy

receipts

Year ended

December 31,

2016 $ 762 61 86 11

2017 753 60 87 12

2018 737 56 87 12

2019 740 53 87 12

2020 745 52 87 12

2021-2025 3,578 224 410 61

Wells Fargo & Company

248