Wells Fargo 2015 Annual Report Download - page 223

Download and view the complete annual report

Please find page 223 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(continued from previous page)

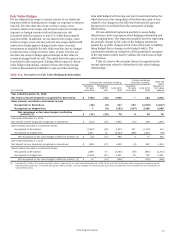

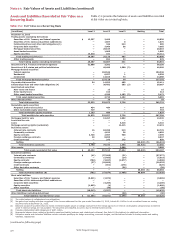

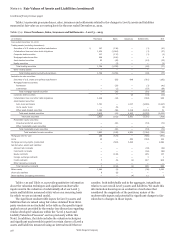

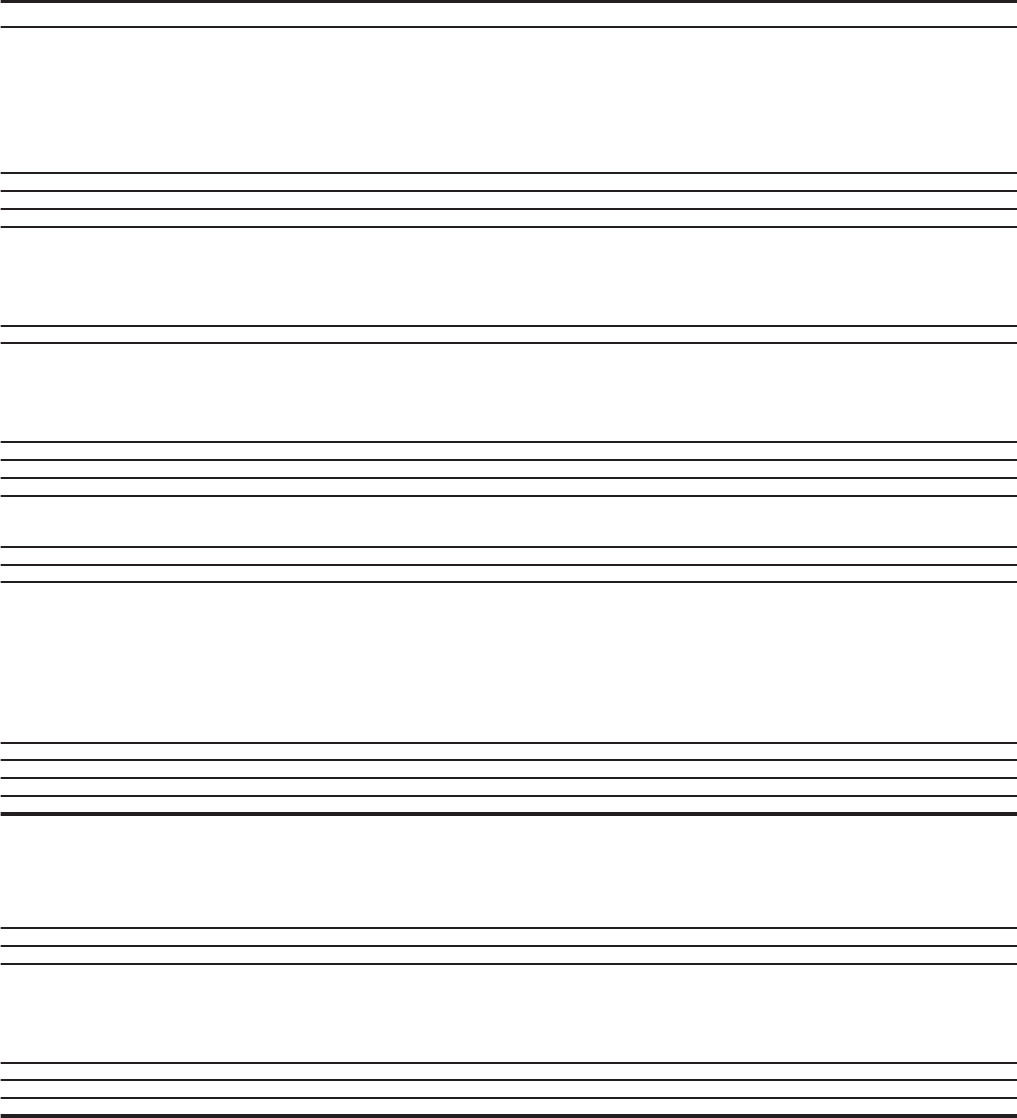

(in millions) Level 1 Level 2 Level 3 Netting Total

December 31, 2014

Trading assets (excluding derivatives)

Securities of U.S. Treasury and federal agencies $ 10,506 3,886 — — 14,392

Securities of U.S. states and political subdivisions — 1,537 7 — 1,544

Collateralized loan and other debt obligations (1) — 274 445 — 719

Corporate debt securities — 7,517 54 — 7,571

Mortgage-backed securities — 16,273 — — 16,273

Asset-backed securities — 776 79 — 855

Equity securities 18,512 38 10 — 18,560

Total trading securities (2) 29,018 30,301 595 — 59,914

Other trading assets — 1,398 55 — 1,453

Total trading assets (excluding derivatives) 29,018 31,699 650 — 61,367

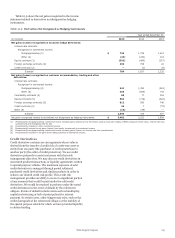

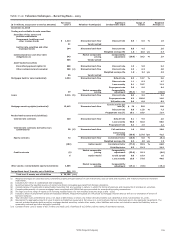

Securities of U.S. Treasury and federal agencies 19,899 5,905 — — 25,804

Securities of U.S. states and political subdivisions — 42,667 2,277 (3) — 44,944

Mortgage-backed securities:

Federal agencies — 110,089 — — 110,089

Residential — 9,245 24 — 9,269

Commercial — 16,885 109 — 16,994

Total mortgage-backed securities — 136,219 133 — 136,352

Corporate debt securities 83 14,451 252 — 14,786

Collateralized loan and other debt obligations (4) — 24,274 1,087 (3) — 25,361

Asset-backed securities:

Auto loans and leases — 31 245 (3) — 276

Home equity loans — 662 — — 662

Other asset-backed securities — 4,189 1,372 (3) — 5,561

Total asset-backed securities — 4,882 1,617 — 6,499

Other debt securities — 20 — — 20

Total debt securities 19,982 228,418 5,366 — 253,766

Marketable equity securities:

Perpetual preferred securities (5) 468 569 663 (3) — 1,700

Other marketable equity securities 1,952 24 — — 1,976

Total marketable equity securities 2,420 593 663 — 3,676

Total available-for-sale securities 22,402 229,011 6,029 — 257,442

Mortgages held for sale — 13,252 2,313 — 15,565

Loans held for sale — 1 — — 1

Loans — — 5,788 — 5,788

Mortgage servicing rights (residential) — — 12,738 — 12,738

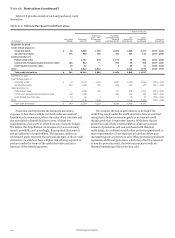

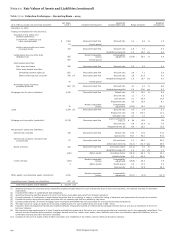

Derivative assets:

Interest rate contracts 27 63,306 365 — 63,698

Commodity contracts — 7,438 23 — 7,461

Equity contracts 4,102 3,544 1,359 — 9,005

Foreign exchange contracts 65 7,339 — — 7,404

Credit contracts — 440 466 — 906

Netting — — — (65,869) (6) (65,869)

Total derivative assets (7) 4,194 82,067 2,213 (65,869) 22,605

Other assets — — 2,593 — 2,593

Total assets recorded at fair value $ 55,614 356,030 32,324 (65,869) 378,099

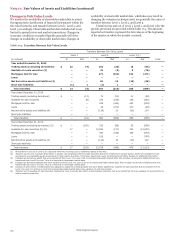

Derivative liabilities:

Interest rate contracts (29) (59,958) (72) — (60,059)

Commodity contracts — (7,680) (22) — (7,702)

Equity contracts (1,290) (4,305) (1,443) — (7,038)

Foreign exchange contracts (60) (7,767) — — (7,827)

Credit contracts — (456) (655) — (1,111)

Other derivative contracts — — (44) — (44)

Netting — — — 65,043 (6) 65,043

Total derivative liabilities (7) (1,379) (80,166) (2,236) 65,043 (18,738)

Short sale liabilities:

Securities of U.S. Treasury and federal agencies (7,043) (1,636) — — (8,679)

Securities of U.S. states and political subdivisions — (26) — — (26)

Corporate debt securities — (5,055) — — (5,055)

Equity securities (2,259) (2) — — (2,261)

Other securities — (73) (6) — (79)

Total short sale liabilities (9,302) (6,792) (6) — (16,100)

Other liabilities (excluding derivatives) — — (28) — (28)

Total liabilities recorded at fair value $ (10,681) (86,958) (2,270) 65,043 (34,866)

(1) The entire balance is collateralized loan obligations.

(2) Net gains from trading activities recognized in the income statement for the year ended December 31, 2014, include $211 million in net unrealized gains on trading

securities held at December 31, 2014.

(3) Balances consist of securities that are mostly investment grade based on ratings received from the ratings agencies or internal credit grades categorized as investment

grade if external ratings are not available. The securities are classified as Level 3 due to limited market activity.

(4) Includes collateralized debt obligations of $500 million.

(5) Perpetual preferred securities include ARS and corporate preferred securities. See Note 8 (Securitizations and Variable Interest Entities) for additional information.

(6) Represents balance sheet netting of derivative asset and liability balances and related cash collateral. See Note 16 (Derivatives) for additional information.

(7) Derivative assets and derivative liabilities include contracts qualifying for hedge accounting, economic hedges, and derivatives included in trading assets and trading

liabilities, respectively.

Wells Fargo & Company

221