Wells Fargo 2015 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

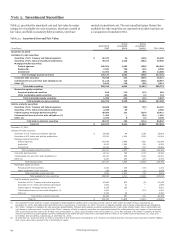

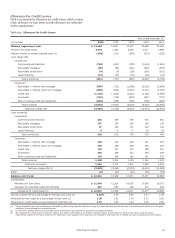

Gross Unrealized Losses and Fair Value

Table 5.2 shows the gross unrealized losses and fair value of

securities in the investment securities portfolio by length of time

that individual securities in each category have been in a

continuous loss position. Debt securities on which we have taken

Table 5.2: Gross Unrealized Losses and Fair Value

credit-related OTTI write-downs are categorized as being "less

than 12 months" or "12 months or more" in a continuous loss

position based on the point in time that the fair value declined to

below the cost basis and not the period of time since the credit-

related OTTI write-down.

Less than 12 months 12 months or more Total

Gross Gross Gross

unrealized unrealized unrealized

(in millions) losses Fair value losses Fair value losses Fair value

December 31, 2015

Available-for-sale securities:

Securities of U.S. Treasury and federal agencies $ (148) 24,795 — — (148) 24,795

Securities of U.S. states and political subdivisions (26) 3,453 (476) 12,377 (502) 15,830

Mortgage-backed securities:

Federal agencies (522) 36,329 (306) 9,888 (828) 46,217

Residential (20) 1,276 (5) 285 (25) 1,561

Commercial (32) 4,476 (53) 2,363 (85) 6,839

Total mortgage-backed securities (574) 42,081 (364) 12,536 (938) 54,617

Corporate debt securities (244) 4,941 (205) 1,057 (449) 5,998

Collateralized loan and other debt obligations (276) 22,214 (92) 4,844 (368) 27,058

Other (33) 2,768 (13) 425 (46) 3,193

Total debt securities (1,301) 100,252 (1,150) 31,239 (2,451) 131,491

Marketable equity securities:

Perpetual preferred securities (1) 24 (12) 109 (13) 133

Other marketable equity securities (2) 40 — — (2) 40

Total marketable equity securities (3) 64 (12) 109 (15) 173

Total available-for-sale securities (1,304) 100,316 (1,162) 31,348 (2,466) 131,664

Held-to-maturity securities:

Securities of U.S. Treasury and federal agencies (73) 5,264 — — (73) 5,264

Federal agency mortgage-backed securities (314) 23,115 — — (314) 23,115

Collateralized loan and other debt obligations (20) 1,148 (4) 233 (24) 1,381

Other (3) 1,096 — — (3) 1,096

Total held-to-maturity securities (410) 30,623 (4) 233 (414) 30,856

Total $ (1,714) 130,939 (1,166) 31,581 (2,880) 162,520

December 31, 2014

Available-for-sale securities:

Securities of U.S. Treasury and federal agencies $ (16) 7,138 (122) 5,719 (138) 12,857

Securities of U.S. states and political subdivisions (198) 10,228 (301) 3,725 (499) 13,953

Mortgage-backed securities:

Federal agencies (16) 1,706 (735) 37,854 (751) 39,560

Residential (18) 946 (6) 144 (24) 1,090

Commercial (9) 2,202 (48) 1,532 (57) 3,734

Total mortgage-backed securities (43) 4,854 (789) 39,530 (832) 44,384

Corporate debt securities (102) 1,674 (68) 1,265 (170) 2,939

Collateralized loan and other debt obligations (99) 12,755 (85) 3,958 (184) 16,713

Other (23) 708 (4) 277 (27) 985

Total debt securities (481) 37,357 (1,369) 54,474 (1,850) 91,831

Marketable equity securities:

Perpetual preferred securities (2) 92 (68) 633 (70) 725

Other marketable equity securities (2) 41 — — (2) 41

Total marketable equity securities (4) 133 (68) 633 (72) 766

Total available-for-sale securities (485) 37,490 (1,437) 55,107 (1,922) 92,597

Held-to-maturity securities:

Securities of U.S. Treasury and federal agencies (8) 1,889 — — (8) 1,889

Collateralized loan and other debt obligations (13) 1,391 — — (13) 1,391

Total held-to-maturity securities (21) 3,280 — — (21) 3,280

Total $ (506) 40,770 (1,437) 55,107 (1,943) 95,877

Wells Fargo & Company

155