Wells Fargo 2015 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

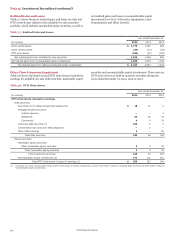

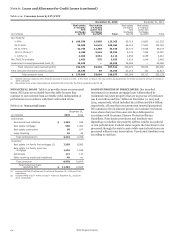

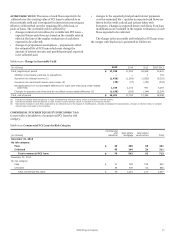

Table 6.11: Consumer Loans by FICO

Real estate Real estate Other

(in millions)

1-4 family

first

mortgage

1-4 family

junior lien

mortgage Credit card Automobile

revolving

credit and

installment Total

December 31, 2015

By updated FICO:

< 600 $ 8,716 3,025 2,927 9,260 965 24,893

600-639 6,961 2,367 2,875 6,619 1,086 19,908

640-679 13,006 4,613 5,354 10,014 2,416 35,403

680-719 24,460 7,863 6,857 10,947 4,388 54,515

720-759 38,309 10,966 7,017 8,279 6,010 70,581

760-799 92,975 16,369 5,693 7,761 8,351 131,149

800+ 44,452 6,895 3,090 6,654 6,510 67,601

No FICO available 3,447 837 226 432 2,395 7,337

FICO not required — — — — 6,977 6,977

Government insured/guaranteed loans (1) 22,353 — — — — 22,353

Total consumer loans (excluding PCI) 254,679 52,935 34,039 59,966 39,098 440,717

Total consumer PCI loans (carrying value) 19,190 69 — — — 19,259

Total consumer loans $ 273,869 53,004 34,039 59,966 39,098 459,976

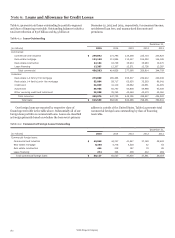

December 31, 2014

By updated FICO:

< 600 $ 11,166 4,001 2,639 8,825 894 27,525

600-639 7,866 2,794 2,588 6,236 1,058 20,542

640-679 13,894 5,324 4,931 9,352 2,366 35,867

680-719 24,412 8,970 6,285 9,994 4,389 54,050

720-759 35,490 12,171 6,407 7,475 5,896 67,439

760-799 82,123 17,897 5,234 7,315 7,673 120,242

800+ 39,219 7,581 2,758 6,184 5,819 61,561

No FICO available 3,236 878 277 359 1,814 6,564

FICO not required — — — — 5,854 5,854

Government insured/guaranteed loans (1) 26,268 — — — — 26,268

Total consumer loans (excluding PCI) 243,674 59,616 31,119 55,740 35,763 425,912

Total consumer PCI loans (carrying value) 21,712 101 — — — 21,813

Total consumer loans $ 265,386 59,717 31,119 55,740 35,763 447,725

(1) Represents loans whose repayments are predominantly insured by the FHA or guaranteed by the VA.

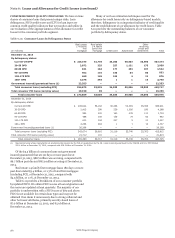

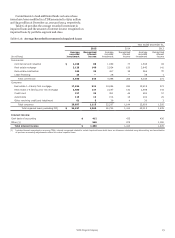

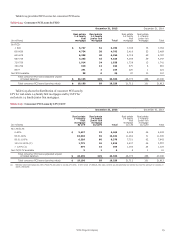

LTV refers to the ratio comparing the loan’s unpaid

principal balance to the property’s collateral value. CLTV refers

to the combination of first mortgage and junior lien mortgage

(including unused line amounts for credit line products) ratios.

LTVs and CLTVs are updated quarterly using a cascade approach

which first uses values provided by automated valuation models

(AVMs) for the property. If an AVM is not available, then the

value is estimated using the original appraised value adjusted by

the change in Home Price Index (HPI) for the property location.

If an HPI is not available, the original appraised value is used.

The HPI value is normally the only method considered for high

value properties, generally with an original value of $1 million or

more, as the AVM values have proven less accurate for these

properties.

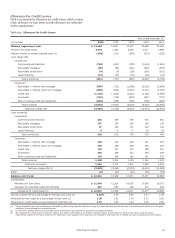

Table 6.12 shows the most updated LTV and CLTV

distribution of the real estate 1-4 family first and junior lien

mortgage loan portfolios. We consider the trends in residential

real estate markets as we monitor credit risk and establish our

allowance for credit losses. In the event of a default, any loss

should be limited to the portion of the loan amount in excess of

the net realizable value of the underlying real estate collateral

value. Certain loans do not have an LTV or CLTV primarily due

to industry data availability and portfolios acquired from or

serviced by other institutions.

Wells Fargo & Company

169