Wells Fargo 2015 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

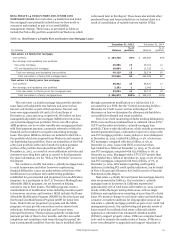

REAL ESTATE 1-4 FAMILY FIRST AND JUNIOR LIEN is discussed later in this Report. These loans also include other

MORTGAGE LOANS Our real estate 1-4 family first and junior purchased loans and loans included on our balance sheet as a

lien mortgage loans primarily include loans we have made to result of consolidation of variable interest entities (VIEs).

customers and retained as part of our asset/liability

management strategy. These loans, as presented in Table 22,

include the Pick-a-Pay portfolio acquired from Wachovia, which

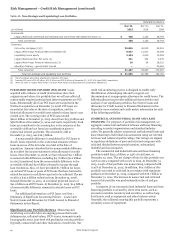

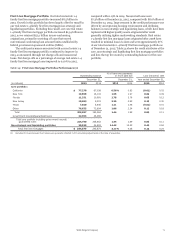

Table 22: Real Estate 1-4 Family First and Junior Lien Mortgage Loans

December 31, 2015 December 31, 2014

(in millions) Balance

% of

portfolio Balance

% of

portfolio

Real estate 1-4 family first mortgage

Core portfolio

Non-strategic and liquidating loan portfolios:

Pick-a-Pay mortgage

PCI and liquidating first mortgage

$ 224,750

39,065

10,054

69%

12

3

$ 208,852

45,002

11,532

64%

14

4

Total non-strategic and liquidating loan portfolios 49,119 15 56,534 18

Total real estate 1-4 family first mortgage loans 273,869 84 265,386 82

Real estate 1-4 family junior lien mortgage

Core portfolio

Non-strategic and liquidating loan portfolios

50,652

2,352

15

1

56,631

3,086

17

1

Total real estate 1-4 family junior lien mortgage loans 53,004 16 59,717 18

Total real estate 1-4 family mortgage loans $ 326,873 100% $ 325,103 100%

The real estate 1-4 family mortgage loan portfolio includes

some loans with adjustable-rate features and some with an

interest-only feature as part of the loan terms. Interest-only

loans were approximately 9% and 12% of total loans at

December 31, 2015 and 2014, respectively. We believe we have

manageable adjustable-rate mortgage (ARM) reset risk across

our owned mortgage loan portfolios. We do not offer option

ARM products, nor do we offer variable-rate mortgage products

with fixed payment amounts, commonly referred to within the

financial services industry as negative amortizing mortgage

loans. The option ARMs we do have are included in the Pick-a-

Pay portfolio which was acquired from Wachovia and are part of

our liquidating loan portfolios. Since our acquisition of the Pick-

a-Pay loan portfolio at the end of 2008, the option payment

portion of the portfolio has reduced from 86% to 38% at

December 31, 2015, as a result of our modification activities and

customers exercising their option to convert to fixed payments.

For more information, see the “Pick-a-Pay Portfolio” section in

this Report.

We continue to modify real estate 1-4 family mortgage loans

to assist homeowners and other borrowers experiencing

financial difficulties. Loans are underwritten at the time of the

modification in accordance with underwriting guidelines

established for governmental and proprietary loan modification

programs. As a participant in the U.S. Treasury’s Making Home

Affordable (MHA) programs, we are focused on helping

customers stay in their homes. The MHA programs create a

standardization of modification terms including incentives paid

to borrowers, servicers, and investors. MHA includes the Home

Affordable Modification Program (HAMP) for first lien loans and

the Second Lien Modification Program (2MP) for junior lien

loans. Under both our proprietary programs and the MHA

programs, we may provide concessions such as interest rate

reductions, forbearance of principal, and in some cases,

principal forgiveness. These programs generally include trial

payment periods of three to four months, and after successful

completion and compliance with terms during this period, the

loan is permanently modified. Once the loan is modified either

through a permanent modification or a trial period, it is

accounted for as a TDR. See the “Critical Accounting Policies –

Allowance for Credit Losses” section in this Report for

discussion on how we determine the allowance attributable to

our modified residential real estate portfolios.

Part of our credit monitoring includes tracking delinquency,

FICO scores and loan/combined loan to collateral values (LTV/

CLTV) on the entire real estate 1-4 family mortgage loan

portfolio. These credit risk indicators, which exclude government

insured/guaranteed loans, continued to improve in 2015 on the

non-PCI mortgage portfolio. Loans 30 days or more delinquent

at December 31, 2015, totaled $8.3 billion, or 3%, of total non-

PCI mortgages, compared with $10.2 billion, or 3%, at

December 31, 2014. Loans with FICO scores lower than

640 totaled $21.1 billion at December 31, 2015, or 7% of total

non-PCI mortgages, compared with $25.8 billion, or 9%, at

December 31, 2014. Mortgages with a LTV/CLTV greater than

100% totaled $15.1 billion at December 31, 2015, or 5% of total

non-PCI mortgages, compared with $20.3 billion, or 7%, at

December 31, 2014. Information regarding credit quality

indicators, including PCI credit quality indicators, can be found

in Note 6 (Loans and Allowance for Credit Losses) to Financial

Statements in this Report.

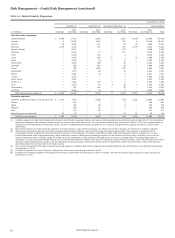

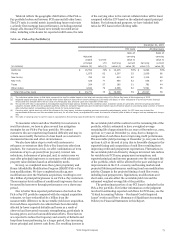

Real estate 1-4 family first and junior lien mortgage loans by

state are presented in Table 23. Our real estate 1-4 family

mortgage loans to borrowers in California represented

approximately 13% of total loans at December 31, 2015, located

mostly within the larger metropolitan areas, with no single

California metropolitan area consisting of more than 5% of total

loans. We monitor changes in real estate values and underlying

economic or market conditions for all geographic areas of our

real estate 1-4 family mortgage portfolio as part of our credit risk

management process. Our underwriting and periodic review of

loans secured by residential real estate collateral includes

appraisals or estimates from automated valuation models

(AVMs) to support property values. AVMs are computer-based

tools used to estimate the market value of homes. AVMs are a

lower-cost alternative to appraisals and support valuations of

Wells Fargo & Company

69