Wells Fargo 2015 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

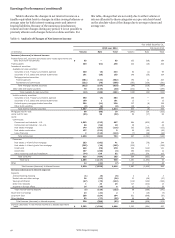

Earnings Performance (continued)

share of that income now being reported in all other income.

Other fees in 2014 were unchanged compared with 2013 as a

decline in charges and fees on loans was offset by an increase in

commercial real estate brokerage commissions. Commercial real

estate brokerage commissions increased to $618 million in 2015

compared with $469 million in 2014 and $338 million in 2013,

driven by increased sales and other property-related activities

including financing and advisory services.

Mortgage banking income, consisting of net servicing

income and net gains on loan origination/sales activities, totaled

$6.5 billion in 2015, compared with $6.4 billion in 2014 and

$8.8 billion in 2013.

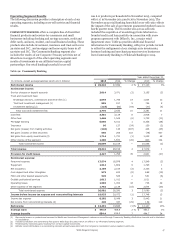

In addition to servicing fees, net mortgage loan servicing

income includes amortization of commercial mortgage servicing

rights (MSRs), changes in the fair value of residential MSRs

during the period, as well as changes in the value of derivatives

(economic hedges) used to hedge the residential MSRs. Net

servicing income of $2.4 billion for 2015 included a $885 million

net MSR valuation gain ($214 million increase in the fair value

of the MSRs and a $671 million hedge gain). Net servicing

income of $3.3 billion for 2014 included a $1.4 billion net MSR

valuation gain ($2.1 billion decrease in the fair value of the MSRs

offset by a $3.5 billion hedge gain), and net servicing income of

$1.9 billion for 2013 included a $489 million net MSR valuation

gain ($3.4 billion increase in the fair value of MSRs offset by a

$2.9 billion hedge loss). The decrease in net MSR valuation

gains in 2015, compared with 2014, was primarily attributable to

lower hedge gains. The lower net MSR valuation gain in 2013,

compared with 2014, was attributable to MSR valuation

adjustments associated with higher prepayments and increases

in servicing and foreclosure costs.

Our portfolio of loans serviced for others was $1.78 trillion

at December 31, 2015, $1.86 trillion at December 31, 2014, and

$1.90 trillion at December 31, 2013. At December 31, 2015, the

ratio of MSRs to related loans serviced for others was 0.77%,

compared with 0.75% at December 31, 2014 and 0.88% at

December 31, 2013. See the “Risk Management – Asset/Liability

Management – Mortgage Banking Interest Rate and Market

Risk” section in this Report for additional information regarding

our MSRs risks and hedging approach.

Net gains on mortgage loan origination/sale activities were

$4.1 billion in 2015, compared with $3.0 billion in 2014 and

$6.9 billion in 2013. The increase in 2015 compared to 2014 was

primarily driven by increased origination volumes and margins.

The decrease in 2014 from 2013 was primarily driven by lower

origination volume and margins. Mortgage loan originations

were $213 billion in 2015, compared with $175 billion for 2014

and $351 billion for 2013. The production margin on residential

held-for-sale mortgage originations, which represents net gains

on residential mortgage loan origination/sales activities divided

by total residential held-for-sale mortgage originations, provides

a measure of the profitability of our residential mortgage

origination activity. Table 7a presents the information used in

determining the production margin.

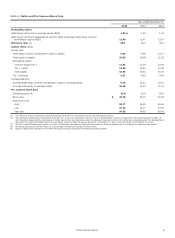

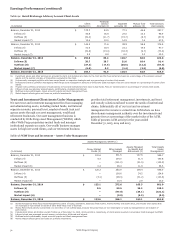

Table 7a: Selected Residential Mortgage Production Data

Year ended December 31,

2015 2014 2013

Net gains on mortgage

loan origination/sales

activities (in millions):

Residential (A) $ 2,861 2,217 6,227

Commercial 362 285 356

Residential pipeline

and unsold/

repurchased loan

management (1) 837 542 271

Total $ 4,060 3,044 6,854

Residential real estate

originations (in

billions):

Held-for-sale

Held-for-investment

(B) $ 155

58

129

46

300

51

Total $ 213 175 351

Production margin on

residential held-for-

sale mortgage

originations (A)/(B) 1.84% 1.72 2.08

(1) Primarily includes the results of GNMA loss mitigation activities, interest rate

management activities and changes in estimate to the liability for mortgage loan

repurchase losses.

The production margin was 1.84% for 2015, compared with

1.72% for 2014 and 2.08% for 2013. Mortgage applications were

$311 billion in 2015, compared with $262 billion in 2014 and

$438 billion in 2013. The 1-4 family first mortgage unclosed

pipeline was $29 billion at December 31, 2015, compared with

$26 billion at December 31, 2014 and $25 billion at

December 31, 2013. For additional information about our

mortgage banking activities and results, see the “Risk

Management – Asset/Liability Management – Mortgage

Banking Interest Rate and Market Risk” section and Note 9

(Mortgage Banking Activities) and Note 17 (Fair Values of Assets

and Liabilities) to Financial Statements in this Report.

Net gains on mortgage loan origination/sales activities

include adjustments to the mortgage repurchase liability.

Mortgage loans are repurchased from third parties based on

standard representations and warranties, and early payment

default clauses in mortgage sale contracts. For 2015, we released

a net $159 million from the repurchase liability, compared with

a net release of $140 million for 2014 and a provision of

$428 million for 2013. For additional information about

mortgage loan repurchases, see the “Risk Management – Credit

Risk Management – Liability for Mortgage Loan Repurchase

Losses” section and Note 9 (Mortgage Banking Activities) to

Financial Statements in this Report.

Wells Fargo & Company

42