Wells Fargo 2015 Annual Report Download - page 222

Download and view the complete annual report

Please find page 222 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

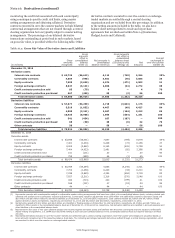

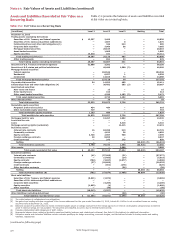

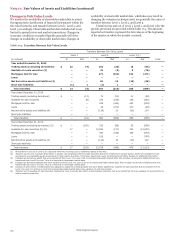

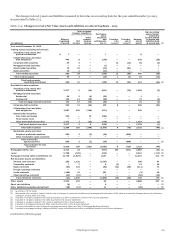

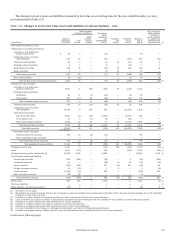

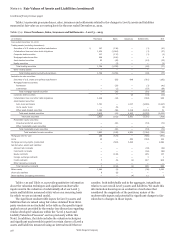

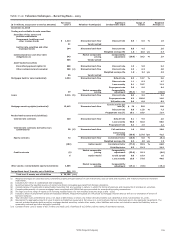

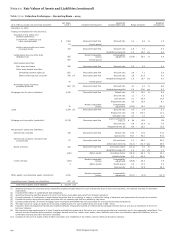

Note 17: Fair Values of Assets and Liabilities (continued)

Assets and Liabilities Recorded at Fair Value on a Table 17.2 presents the balances of assets and liabilities recorded

Recurring Basis at fair value on a recurring basis.

Table 17.2: Fair Value on a Recurring Basis

(in millions) Level 1 Level 2 Level 3 Netting Total

December 31, 2015

Trading assets (excluding derivatives)

Securities of U.S. Treasury and federal agencies $ 13,357 3,469 — — 16,826

Securities of U.S. states and political subdivisions — 1,667 8 — 1,675

Collateralized loan and other debt obligations (1) — 346 343 — 689

Corporate debt securities — 7,909 56 — 7,965

Mortgage-backed securities — 20,619 — — 20,619

Asset-backed securities — 1,005 — — 1,005

Equity securities 15,010 101 — — 15,111

Total trading securities (2) 28,367 35,116 407 — 63,890

Other trading assets — 891 34 — 925

Total trading assets (excluding derivatives) 28,367 36,007 441 — 64,815

Securities of U.S. Treasury and federal agencies 32,868 3,382 — — 36,250

Securities of U.S. states and political subdivisions — 48,490 1,500 (3) — 49,990

Mortgage-backed securities:

Federal agencies — 104,546 — — 104,546

Residential — 8,557 1 — 8,558

Commercial — 14,015 73 — 14,088

Total mortgage-backed securities — 127,118 74 — 127,192

Corporate debt securities 54 14,952 405 — 15,411

Collateralized loan and other debt obligations (4) — 30,402 565 (3) — 30,967

Asset-backed securities:

Auto loans and leases — 15 — — 15

Home equity loans — 414 — — 414

Other asset-backed securities — 4,290 1,182 (3) — 5,472

Total asset-backed securities — 4,719 1,182 — 5,901

Other debt securities — 10 — — 10

Total debt securities 32,922 229,073 3,726 — 265,721

Marketable equity securities:

Perpetual preferred securities 434 484 — — 918

Other marketable equity securities 719 — — — 719

Total marketable equity securities 1,153 484 — — 1,637

Total available-for-sale securities 34,075 229,557 3,726 — 267,358

Mortgages held for sale — 12,457 1,082 — 13,539

Loans held for sale — — — — —

Loans — — 5,316 — 5,316

Mortgage servicing rights (residential) — — 12,415 — 12,415

Derivative assets:

Interest rate contracts 16 62,390 319 — 62,725

Commodity contracts — 4,623 36 — 4,659

Equity contracts 3,726 2,907 966 — 7,599

Foreign exchange contracts 48 8,899 — — 8,947

Credit contracts — 375 275 — 650

Netting — — — (66,924) (5) (66,924)

Total derivative assets (6) 3,790 79,194 1,596 (66,924) 17,656

Other assets — — 3,088 — 3,088

Total assets recorded at fair value $ 66,232 357,215 27,664 (66,924) 384,187

Derivative liabilities:

Interest rate contracts $ (41) (57,905) (31) — (57,977)

Commodity contracts — (5,495) (24) — (5,519)

Equity contracts (704) (3,027) (1,077) — (4,808)

Foreign exchange contracts (37) (10,896) — — (10,933)

Credit contracts — (351) (278) — (629)

Other derivative contracts — — (58) — (58)

Netting — — — 66,004 (5) 66,004

Total derivative liabilities (6) (782) (77,674) (1,468) 66,004 (13,920)

Short sale liabilities:

Securities of U.S. Treasury and federal agencies (8,621) (1,074) — — (9,695)

Securities of U.S. states and political subdivisions — — — — —

Corporate debt securities — (4,209) — — (4,209)

Equity securities (1,692) (4) — — (1,696)

Other securities — (70) — — (70)

Total short sale liabilities (10,313) (5,357) — — (15,670)

Other liabilities (excluding derivatives) — — (30) — (30)

Total liabilities recorded at fair value $ (11,095) (83,031) (1,498) 66,004 (29,620)

(1) The entire balance is collateralized loan obligations.

(2) Net gains from trading activities recognized in the income statement for the year ended December 31, 2015, include $1.0 billion in net unrealized losses on trading

securities held at December 31, 2015.

(3) Balances consist of securities that are mostly investment grade based on ratings received from the ratings agencies or internal credit grades categorized as investment

grade if external ratings are not available. The securities are classified as Level 3 due to limited market activity.

(4) Includes collateralized debt obligations of $257 million.

(5) Represents balance sheet netting of derivative asset and liability balances and related cash collateral. See Note 16 (Derivatives) for additional information.

(6) Derivative assets and derivative liabilities include contracts qualifying for hedge accounting, economic hedges, and derivatives included in trading assets and trading

liabilities, respectively.

(continued on following page)

Wells Fargo & Company

220