Wells Fargo 2015 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

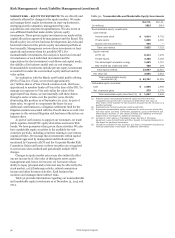

LIQUIDITY AND FUNDING The objective of effective liquidity

management is to ensure that we can meet customer loan

requests, customer deposit maturities/withdrawals and other

cash commitments efficiently under both normal operating

conditions and under periods of Wells Fargo-specific and/or

market stress. To achieve this objective, the Board of Directors

establishes liquidity guidelines that require sufficient asset-

based liquidity to cover potential funding requirements and to

avoid over-dependence on volatile, less reliable funding markets.

These guidelines are monitored on a monthly basis by the

Corporate ALCO and on a quarterly basis by the Board of

Directors. These guidelines are established and monitored for

both the consolidated company and for the Parent on a stand-

alone basis to ensure that the Parent is a source of strength for

its regulated, deposit-taking banking subsidiaries.

Liquidity Standards On September 3, 2014, the FRB, OCC

and FDIC issued a final rule that implements a quantitative

liquidity requirement consistent with the liquidity coverage ratio

(LCR) established by the Basel Committee on Banking

Supervision (BCBS). The rule requires banking institutions, such

as Wells Fargo, to hold high-quality liquid assets, such as central

bank reserves and government and corporate debt that can be

converted easily and quickly into cash, in an amount equal to or

greater than its projected net cash outflows during a 30-day

stress period. The final LCR rule began its phase-in period on

January 1, 2015, and requires full compliance with a minimum

100% LCR by January 1, 2017. The FRB also finalized rules

imposing enhanced liquidity management standards on large

bank holding companies (BHC) such as Wells Fargo. In addition,

the FRB recently proposed a rule that would require large bank

holding companies, such as Wells Fargo, to publicly disclose on a

quarterly basis certain quantitative and qualitative information

regarding their LCR calculations. We continue to analyze these

rules and other regulatory proposals that may affect liquidity

risk management to determine the level of operational or

compliance impact to Wells Fargo. For additional information

see the “Capital Management” and “Regulatory Reform” sections

in this Report.

Liquidity Sources We maintain liquidity in the form of cash,

cash equivalents and unencumbered high-quality, liquid

securities. These assets make up our primary sources of liquidity

which are presented in Table 51. Our cash is primarily on deposit

with the Federal Reserve. Securities included as part of our

primary sources of liquidity are comprised of U.S. Treasury and

federal agency debt, and mortgage-backed securities issued by

federal agencies within our investment securities portfolio. We

believe these securities provide quick sources of liquidity

through sales or by pledging to obtain financing, regardless of

market conditions. Some of these securities are within the held-

to-maturity portion of our investment securities portfolio and as

such are not intended for sale but may be pledged to obtain

financing. Some of the legal entities within our consolidated

group of companies are subject to various regulatory, tax, legal

and other restrictions that can limit the transferability of their

funds. We believe we maintain adequate liquidity for these

entities in consideration of such funds transfer restrictions.

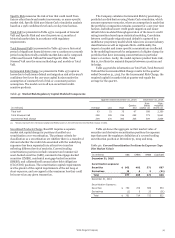

Table 51: Primary Sources of Liquidity

December 31, 2015 December 31, 2014

(in millions) Total Encumbered Unencumbered Total Encumbered Unencumbered

Interest-earning deposits $ 220,409 — 220,409 219,220 — 219,220

Securities of U.S. Treasury and federal agencies (1) 81,417 6,462 74,955 67,352 856 66,496

Mortgage-backed securities of federal agencies (2) 132,967 74,778 58,189 115,730 80,324 35,406

Total $ 434,793 81,240 353,553 402,302 81,180 321,122

(1) Included in encumbered securities at December 31, 2014, were securities with a fair value of $152 million which were purchased in December 2014, but settled in

January 2015.

(2) Included in encumbered securities at December 31, 2014, were securities with a fair value of $5 million which were purchased in December 2014, but settled in

January 2015.

In addition to our primary sources of liquidity shown in Deposits have historically provided a sizeable source of

Table 51, liquidity is also available through the sale or financing relatively low-cost funds. At December 31, 2015, deposits were

of other securities including trading and/or available-for-sale 133% of total loans compared with 135% at December 31, 2014.

securities, as well as through the sale, securitization or financing Additional funding is provided by long-term debt and short-term

of loans, to the extent such securities and loans are not borrowings.

encumbered. In addition, other securities in our held-to- Table 52 shows selected information for short-term

maturity portfolio, to the extent not encumbered, may be borrowings, which generally mature in less than 30 days.

pledged to obtain financing.

Wells Fargo & Company

99