Wells Fargo 2015 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

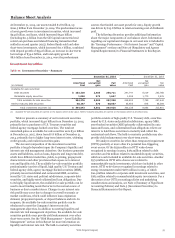

WIM reported net income of $2.3 billion in 2015, up

$256 million, or 12%, from 2014, which was up 17% from

$1.8 billion in 2013. Net income growth in 2015 and 2014 was

primarily driven by growth in net interest income, as well as

noninterest income. Revenue of $15.8 billion in 2015 increased

$508 million from 2014, which was up 7% from $14.3 billion in

2013. The increase in revenue for both 2015 and 2014 was due to

growth in both net interest income and noninterest income. Net

interest income increased 15% in 2015 and 8% in 2014 due to

growth in investment portfolios and loan balances. Average loan

balances of $60.1 billion in 2015 increased 15% from

$52.1 billion in 2014, which was up 13% from $46.2 billion in

2013. Average deposits in 2015 of $172.3 billion increased 5%

from $163.5 billion in 2014, which was up 3% from

$158.9 billion in 2013. Noninterest income increased 1% in 2015

from 2014, primarily due to growth in asset-based fees driven by

higher average client assets in 2015 than 2014, partially offset by

lower gains on deferred compensation plan investments (offset

in employee benefits expense). Noninterest income increased 6%

in 2014 from 2013, largely due to strong growth in asset-based

fees from higher client assets driven by net client asset inflows

and favorable market performance, partially offset by lower

brokerage transaction revenue. Noninterest expense of

$12.1 billion for 2015 was up 1% from $12.0 billion in 2014,

which was up 4% from $11.5 billion in 2013. The increase in 2015

was predominantly due to higher non-personnel expenses and

increased broker commissions, partially offset by lower deferred

compensation plan expense (offset in trading revenue). The

increase in 2014 was predominantly due to increased broker

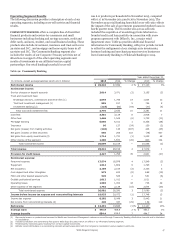

Table 9d: Retail Brokerage Client Assets

commissions and higher non-personnel expenses. The provision

for credit losses increased $25 million in 2015, driven primarily

by lower allowance releases. The provision for credit losses

decreased $34 million in 2014, driven by lower net charge-offs

and continued improvement in credit quality.

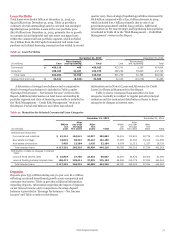

The following discussions provide additional information

for client assets we oversee in our retail brokerage advisory and

trust and investment management business lines.

Retail Brokerage Client Assets Brokerage advisory,

commissions and other fees are received for providing full-

service and discount brokerage services predominantly to retail

brokerage clients. Offering advisory account relationships to our

brokerage clients is an important component of our broader

strategy of meeting their financial needs. Although most of our

retail brokerage client assets are in accounts that earn brokerage

commissions, the fees from those accounts generally represent

transactional commissions based on the number and size of

transactions executed at the client’s direction. Fees earned from

advisory accounts are asset-based and depend on changes in the

value of the client’s assets as well as the level of assets resulting

from inflows and outflows. A major portion of our brokerage

advisory, commissions and other fee income is earned from

advisory accounts. Table 9d shows advisory account client assets

as a percentage of total retail brokerage client assets at

December 31, 2015, 2014 and 2013.

Year ended December 31,

(in billions) 2015 2014 2013

Retail brokerage client assets

Advisory account client assets

Advisory account client assets as a percentage of total client assets

$ 1,386.9

419.9

30%

1,421.8

422.8

30

1,363.6

374.8

27

Retail Brokerage advisory accounts include assets that are

financial advisor-directed and separately managed by third-

party managers, as well as certain client-directed brokerage

assets where we earn a fee for advisory and other services, but do

not have investment discretion. These advisory accounts

generate fees as a percentage of the market value of the assets,

which vary across the account types based on the distinct

services provided, and are affected by investment performance

as well as asset inflows and outflows. For the years ended

December 31, 2015, 2014 and 2013, the average fee rate by

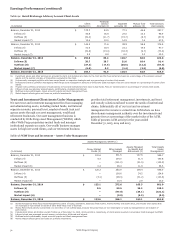

account type ranged from 80 to 120 basis points. Table 9e

presents retail brokerage advisory account client assets activity

by account type for the years ended December 31, 2015, 2014

and 2013.

Wells Fargo & Company

51