Wells Fargo 2015 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Bank of Des Moines, and as of December 31, 2015, Wells Fargo

Bank, N.A. had outstanding advances of $37.1 billion across the

Federal Home Loan Bank System. In January 2016, Wells Fargo

Bank, N.A. executed an additional $12.5 billion in Federal Home

Loan Bank advances.

Credit Ratings Investors in the long-term capital markets, as

well as other market participants, generally will consider, among

other factors, a company’s debt rating in making investment

decisions. Rating agencies base their ratings on many

quantitative and qualitative factors, including capital adequacy,

liquidity, asset quality, business mix, the level and quality of

earnings, and rating agency assumptions regarding the

probability and extent of federal financial assistance or support

for certain large financial institutions. Adverse changes in these

factors could result in a reduction of our credit rating; however,

our debt securities do not contain credit rating covenants.

On October 5, 2015, Fitch Ratings, Inc. affirmed all the

ratings of Wells Fargo and its rated subsidiaries. On

December 2, 2015, Standard and Poor’s Ratings Services (S&P)

completed their assessment of whether to continue

incorporating the likelihood of extraordinary government

support into the ratings of eight bank holding companies,

including the Parent, in light of regulatory progress toward

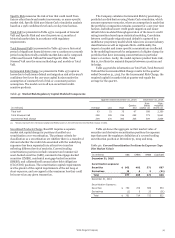

Table 54: Credit Ratings as of December 31, 2015

developing a resolution regime that reduces the likelihood of

government support. S&P concluded that it was appropriate to

remove from its ratings the uplift created by the likelihood of

government support and, as a result, the ratings of all eight bank

holding companies, including the Parent, were lowered by one

notch. S&P also concluded that nondeferrable subordinated debt

issued by a bank should be treated as hybrid capital. As a result,

the nondeferrable subordinated debt of Wells Fargo Bank, N.A.,

and several other banks, was lowered one notch. Both the Parent

and Wells Fargo Bank, N.A. remain among the top-rated

financial firms in the U.S.

See the “Risk Management – Asset/Liability Management”

and “Risk Factors” sections in this Report for additional

information regarding our credit ratings as of December 31,

2015, and the potential impact a credit rating downgrade would

have on our liquidity and operations, as well as Note 16

(Derivatives) to Financial Statements in this Report for

information regarding additional collateral and funding

obligations required for certain derivative instruments in the

event our credit ratings were to fall below investment grade.

The credit ratings of the Parent and Wells Fargo Bank, N.A.

as of December 31, 2015, are presented in Table 54.

Wells Fargo & Company Wells Fargo Bank, N.A.

Senior debt

Short-term

borrowings

Long-term

deposits

Short-term

borrowings

Moody's A2 P-1 Aa1 P-1

S&P A A-1 AA- A-1+

Fitch Ratings, Inc. AA- F1+ AA+ F1+

DBRS AA R-1* AA** R-1**

* middle **high

FEDERAL HOME LOAN BANK MEMBERSHIP The Federal

Home Loan Banks (the FHLBs) are a group of cooperatives that

lending institutions use to finance housing and economic

development in local communities. We are a member of the

FHLBs based in Dallas, Des Moines and San Francisco. Each

member of the FHLBs is required to maintain a minimum

investment in capital stock of the applicable FHLB. The board of

directors of each FHLB can increase the minimum investment

requirements in the event it has concluded that additional

capital is required to allow it to meet its own regulatory capital

requirements. Any increase in the minimum investment

requirements outside of specified ranges requires the approval of

the Federal Housing Finance Board. Because the extent of any

obligation to increase our investment in any of the FHLBs

depends entirely upon the occurrence of a future event, potential

future payments to the FHLBs are not determinable.

Wells Fargo & Company

101