Wells Fargo 2015 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Risk Management - Asset/Liability Management (continued)

resulting from a decline in interest rates because the potential

increase in origination/servicing fees in that scenario provides a

partial “natural business hedge.” An increase in interest rates

generally reduces the propensity for refinancing, extends the

expected duration of the servicing portfolio and, therefore,

increases the estimated fair value of the MSRs. However, an

increase in interest rates can also reduce mortgage loan demand

and, therefore, reduce origination income.

The price risk associated with our MSRs is economically

hedged with a combination of highly liquid interest rate forward

instruments including mortgage forward contracts, interest rate

swaps and interest rate options. All of the instruments included

in the hedge are marked to market daily. Because the hedging

instruments are traded in highly liquid markets, their prices are

readily observable and are fully reflected in each quarter’s mark

to market. Quarterly MSR hedging results include a combination

of directional gain or loss due to market changes as well as any

carry income generated. If the economic hedge is effective, its

overall directional hedge gain or loss will offset the change in the

valuation of the underlying MSR asset. Gains or losses

associated with these economic hedges are included in mortgage

banking noninterest income. Consistent with our longstanding

approach to hedging interest rate risk in the mortgage business,

the size of the hedge and the particular combination of forward

hedging instruments at any point in time is designed to reduce

the volatility of the mortgage business’s earnings over various

time frames within a range of mortgage interest rates. Because

market factors, the composition of the mortgage servicing

portfolio and the relationship between the origination and

servicing sides of our mortgage business change continually, the

types of instruments used in our hedging are reviewed daily and

rebalanced based on our evaluation of current market factors

and the interest rate risk inherent in our MSRs portfolio.

Throughout 2015, our economic hedging strategy generally used

forward mortgage purchase contracts that were effective at

offsetting the impact of interest rates on the value of the MSR

asset.

Mortgage forward contracts are designed to pass the full

economics of the underlying reference mortgage securities to the

holder of the contract, including both the directional gain and

loss from the forward delivery of the reference securities and the

corresponding carry income. Carry income represents the

contract’s price accretion from the forward delivery price to the

spot price including both the yield earned on the reference

securities and the market implied cost of financing during the

period. The actual amount of carry income earned on the hedge

each quarter will depend on the amount of the underlying asset

that is hedged and the particular instruments included in the

hedge. The level of carry income is driven by the slope of the

yield curve and other market driven supply and demand factors

affecting the specific reference securities. A steep yield curve

generally produces higher carry income while a flat or inverted

yield curve can result in lower or potentially negative carry

income. The level of carry income is also affected by the type of

instrument used. In general, mortgage forward contracts tend to

produce higher carry income than interest rate swap contracts.

Carry income is recognized over the life of the mortgage forward

as a component of the contract’s mark to market gain or loss.

Hedging the various sources of interest rate risk in mortgage

banking is a complex process that requires sophisticated

modeling and constant monitoring. While we attempt to balance

these various aspects of the mortgage business, there are several

potential risks to earnings:

• Valuation changes for MSRs associated with interest rate

changes are recorded in earnings immediately within the

accounting period in which those interest rate changes

occur, whereas the impact of those same changes in interest

rates on origination and servicing fees occur with a lag and

over time. Thus, the mortgage business could be protected

from adverse changes in interest rates over a period of time

on a cumulative basis but still display large variations in

income from one accounting period to the next.

• The degree to which our net gains on loan originations

offsets valuation changes for MSRs is imperfect, varies at

different points in the interest rate cycle, and depends not

just on the direction of interest rates but on the pattern of

quarterly interest rate changes.

• Origination volumes, the valuation of MSRs and hedging

results and associated costs are also affected by many

factors. Such factors include the mix of new business

between ARMs and fixed-rate mortgages, the relationship

between short-term and long-term interest rates, the degree

of volatility in interest rates, the relationship between

mortgage interest rates and other interest rate markets, and

other interest rate factors. Additional factors that can

impact the valuation of the MSRs include changes in

servicing and foreclosure costs due to changes in investor or

regulatory guidelines, as well as individual state foreclosure

legislation, and changes in discount rates due to market

participants requiring a higher return due to updated

market expectations on costs and risks associated with

investing in MSRs. Many of these factors are hard to predict

and we may not be able to directly or perfectly hedge their

effect.

• While our hedging activities are designed to balance our

mortgage banking interest rate risks, the financial

instruments we use may not perfectly correlate with the

values and income being hedged. For example, the change

in the value of ARM production held for sale from changes

in mortgage interest rates may or may not be fully offset by

Treasury and LIBOR index-based financial instruments

used as economic hedges for such ARMs. Additionally,

hedge-carry income we earn on our economic hedges for the

MSRs may not continue if the spread between short-term

and long-term rates decreases, or there are other changes in

the market for mortgage forwards that affect the implied

carry.

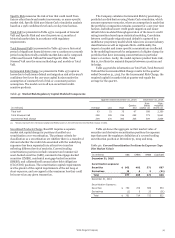

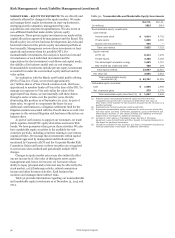

The total carrying value of our residential and commercial

MSRs was $13.7 billion and $14.0 billion at December 31, 2015

and 2014, respectively. The weighted-average note rate on our

portfolio of loans serviced for others was 4.37% and 4.45% at

December 31, 2015 and 2014, respectively. The carrying value of

our total MSRs represented 0.77% and 0.75% of mortgage loans

serviced for others at December 31, 2015 and 2014, respectively.

As part of our mortgage banking activities, we enter into

commitments to fund residential mortgage loans at specified

times in the future. A mortgage loan commitment is an interest

rate lock that binds us to lend funds to a potential borrower at a

specified interest rate and within a specified period of time,

generally up to 60 days after inception of the rate lock. These

loan commitments are derivative loan commitments if the loans

that will result from the exercise of the commitments will be held

for sale. These derivative loan commitments are recognized at

fair value on the balance sheet with changes in their fair values

recorded as part of mortgage banking noninterest income. The

fair value of these commitments include, at inception and during

the life of the loan commitment, the expected net future cash

flows related to the associated servicing of the loan as part of the

fair value measurement of derivative loan commitments.

Wells Fargo & Company

90