Wells Fargo 2015 Annual Report Download - page 216

Download and view the complete annual report

Please find page 216 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273

|

|

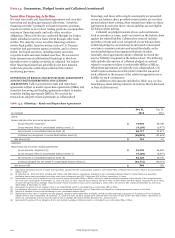

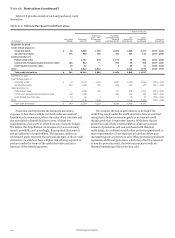

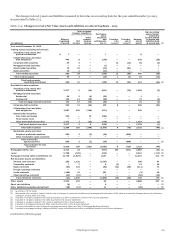

Note 16: Derivatives (continued)

Table 16.6 provides details of sold and purchased credit

derivatives.

Table 16.6: Sold and Purchased Credit Derivatives

Notional amount

Protection Protection

(in millions)

Fair value

liability

Protection

sold (A)

sold - non-

investment

grade

purchased with

identical

underlyings (B)

Net

protection

sold (A)-(B)

Other

protection

purchased

Range of

maturities

December 31, 2015

Credit default swaps on:

Corporate bonds $ 44 4,838 1,745 3,602 1,236 2,272 2016 - 2025

Structured products 275 598 463 395 203 142 2017 - 2047

Credit protection on:

Default swap index — 1,727 370 1,717 10 960 2016 - 2020

Commercial mortgage-backed securities index 203 822 — 766 56 316 2047 - 2057

Asset-backed securities index 18 47 — 1 46 71 2045 - 2046

Other 1 2,512 2,512 — 2,512 7,776 2016 - 2025

Total credit derivatives $ 541 10,544 5,090 6,481 4,063 11,537

December 31, 2014

Credit default swaps on:

Corporate bonds $ 23 6,344 2,904 4,894 1,450 2,831 2015 - 2021

Structured products 654 1,055 874 608 447 277 2017 - 2052

Credit protection on:

Default swap index — 1,659 292 777 882 1,042 2015 - 2019

Commercial mortgage-backed securities index 246 1,058 — 608 450 355 2047 - 2063

Asset-backed securities index 19 52 1 1 51 81 2045 - 2046

Other 1 2,136 2,136 — 2,136 5,185 2015 - 2025

Total credit derivatives $ 943 12,304 6,207 6,888 5,416 9,771

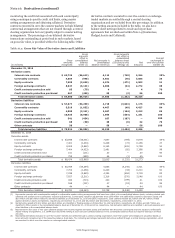

Protection sold represents the estimated maximum

exposure to loss that would be incurred under an assumed

hypothetical circumstance, where the value of our interests and

any associated collateral declines to zero, without any

consideration of recovery or offset from any economic hedges.

We believe this hypothetical circumstance to be an extremely

remote possibility and accordingly, this required disclosure is

not an indication of expected loss. The amounts under non-

investment grade represent the notional amounts of those credit

derivatives on which we have a higher risk of being required to

perform under the terms of the credit derivative and are a

function of the underlying assets.

We consider the risk of performance to be high if the

underlying assets under the credit derivative have an external

rating that is below investment grade or an internal credit

default grade that is equivalent thereto. We believe the net

protection sold, which is representative of the net notional

amount of protection sold and purchased with identical

underlyings, in combination with other protection purchased, is

more representative of our exposure to loss than either non-

investment grade or protection sold. Other protection purchased

represents additional protection, which may offset the exposure

to loss for protection sold, that was not purchased with an

identical underlying of the protection sold.

Wells Fargo & Company

214