Wells Fargo 2015 Annual Report Download - page 211

Download and view the complete annual report

Please find page 211 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

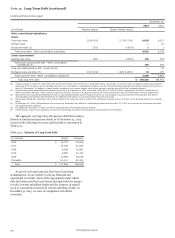

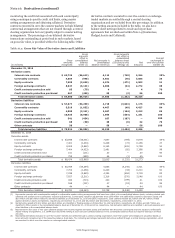

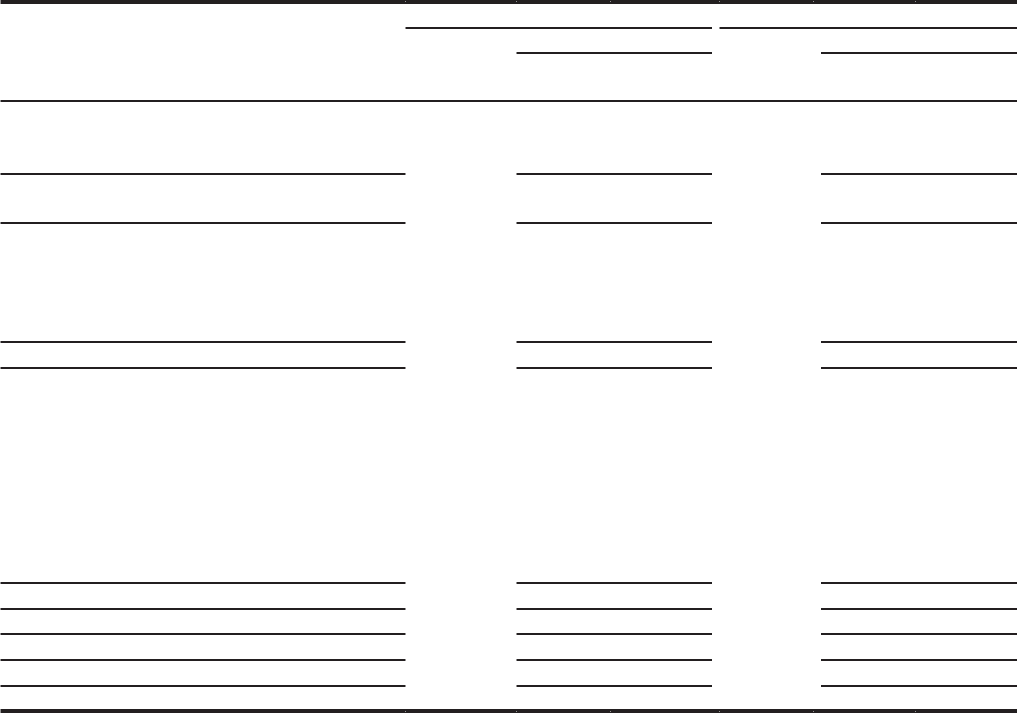

Table 16.1: Notional or Contractual Amounts and Fair Values of Derivatives

December 31, 2015 December 31, 2014

Notional or Fair value Notional or Fair value

contractual Asset Liability contractual Asset Liability

(in millions) amount derivatives derivatives amount derivatives derivatives

Derivatives designated as hedging instruments

Interest rate contracts (1) $ 191,684 7,477 2,253 148,967 6,536 2,435

Foreign exchange contracts (1) 25,115 378 2,494 26,778 752 1,347

Total derivatives designated as

qualifying hedging instruments 7,855 4,747 7,288 3,782

Derivatives not designated as hedging instruments

Economic hedges:

Interest rate contracts (2) 211,375 195 315 221,527 697 487

Equity contracts 7,427 531 47 5,219 367 96

Foreign exchange contracts 16,407 321 100 14,405 275 28

Subtotal (3) 1,047 462 1,339 611

Customer accommodation, trading and

other derivatives:

Interest rate contracts 4,685,898 55,053 55,409 4,378,767 56,465 57,137

Commodity contracts 47,571 4,659 5,519 88,640 7,461 7,702

Equity contracts 139,956 7,068 4,761 138,422 8,638 6,942

Foreign exchange contracts 295,962 8,248 8,339 253,742 6,377 6,452

Credit contracts - protection sold 10,544 83 541 12,304 151 943

Credit contracts - protection purchased 18,018 567 88 16,659 755 168

Other contracts 1,041 — 58 1,994 — 44

Subtotal 75,678 74,715 79,847 79,388

Total derivatives not designated as hedging instruments 76,725 75,177 81,186 79,999

Total derivatives before netting 84,580 79,924 88,474 83,781

Netting (3) (66,924) (66,004) (65,869) (65,043)

Total $ 17,656 13,920 22,605 18,738

(1) Notional amounts presented exclude $1.9 billion of interest rate contracts at both December 31, 2015 and 2014, for certain derivatives that are combined for designation

as a hedge on a single instrument. The notional amount for foreign exchange contracts at December 31, 2015 and 2014, excludes $7.8 billion and $2.7 billion, respectively

for certain derivatives that are combined for designation as a hedge on a single instrument.

(2) Includes economic hedge derivatives used to hedge the risk of changes in the fair value of residential MSRs, MHFS, loans, derivative loan commitments and other interests

held.

(3) Represents balance sheet netting of derivative asset and liability balances, related cash collateral and portfolio level counterparty valuation adjustments. See the next table

in this Note for further information.

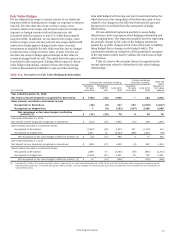

Table 16.2 provides information on the gross fair values of

derivative assets and liabilities, the balance sheet netting

adjustments and the resulting net fair value amount recorded on

our balance sheet, as well as the non-cash collateral associated

with such arrangements. We execute substantially all of our

derivative transactions under master netting arrangements. We

reflect all derivative balances and related cash collateral subject

to enforceable master netting arrangements on a net basis within

the balance sheet. The “Gross amounts recognized” column in

the following table include $69.9 billion and $74.0 billion of

gross derivative assets and liabilities, respectively, at

December 31, 2015, and $69.6 billion and $75.0 billion,

respectively, at December 31, 2014, with counterparties subject

to enforceable master netting arrangements that are carried on

the balance sheet net of offsetting amounts. The remaining gross

derivative assets and liabilities of $14.6 billion and $5.9 billion,

respectively, at December 31, 2015 and $18.9 billion and

$8.8 billion, respectively, at December 31, 2014, include those

with counterparties subject to master netting arrangements for

which we have not assessed the enforceability because they are

with counterparties where we do not currently have positions to

offset, those subject to master netting arrangements where we

have not been able to confirm the enforceability and those not

subject to master netting arrangements. As such, we do not net

derivative balances or collateral within the balance sheet for

these counterparties.

We determine the balance sheet netting adjustments based

on the terms specified within each master netting arrangement.

We disclose the balance sheet netting amounts within the

column titled “Gross amounts offset in consolidated balance

sheet.” Balance sheet netting adjustments are determined at the

counterparty level for which there may be multiple contract

types. For disclosure purposes, we allocate these adjustments to

the contract type for each counterparty proportionally based

upon the “Gross amounts recognized” by counterparty. As a

result, the net amounts disclosed by contract type may not

represent the actual exposure upon settlement of the contracts.

Balance sheet netting does not include non-cash collateral

that we receive and pledge. For disclosure purposes, we present

the fair value of this non-cash collateral in the column titled

“Gross amounts not offset in consolidated balance sheet

(Disclosure-only netting)” within the table. We determine and

allocate the Disclosure-only netting amounts in the same

manner as balance sheet netting amounts.

The “Net amounts” column within the following table

represents the aggregate of our net exposure to each

counterparty after considering the balance sheet and Disclosure-

only netting adjustments. We manage derivative exposure by

Wells Fargo & Company

209