Wells Fargo 2015 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273

|

|

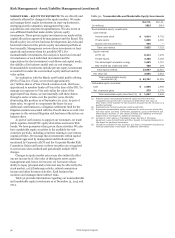

Risk Management - Asset/Liability Management (continued)

Economic hedges and other Economic hedges in trading are not

designated in a hedge accounting relationship and exclude

economic hedging related to our asset/liability risk management

and substantially all mortgage banking risk management

activities. Economic hedging activities include the use of trading

securities to economically hedge risk exposures related to non-

trading activities or derivatives to hedge risk exposures related

to trading assets or trading liabilities. Economic hedges are

unrelated to our customer accommodation activities. Other

activities include financial assets held for investment purposes

that we elected to carry at fair value with changes in fair value

recorded to earnings in order to mitigate accounting

measurement mismatches or avoid embedded derivative

accounting complexities.

Proprietary trading Proprietary trading consists of security or

derivative positions executed for our own account based upon

market expectations or to benefit from price differences between

financial instruments and markets. Proprietary trading activity

has been substantially restricted by the Dodd-Frank Act

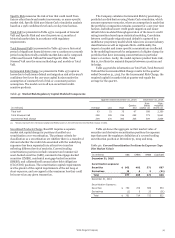

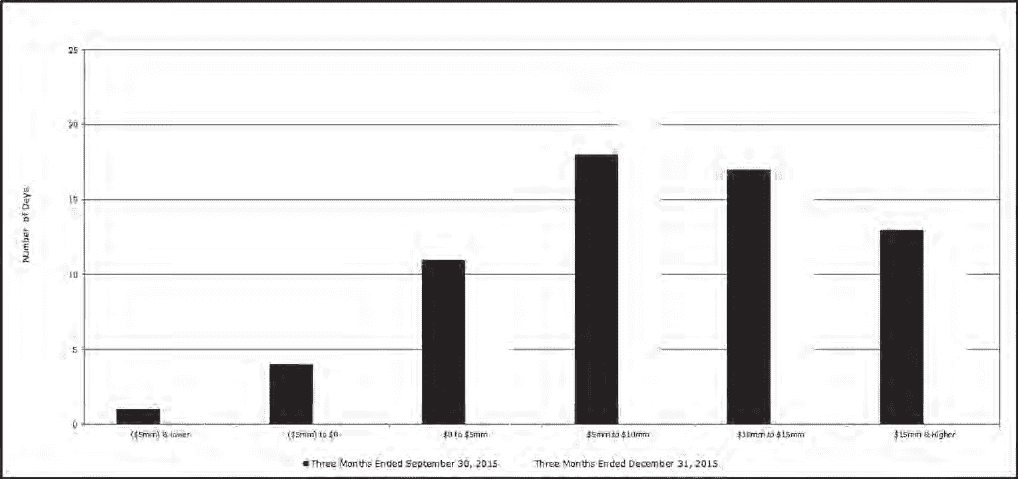

Table 42: Distribution of Daily Trading-Related Revenues

provisions known as the “Volcker Rule.” Accordingly, we

reduced and have exited certain business activities as a result of

the rule. As discussed within this section and the noninterest

income section of our financial results, proprietary trading

activity is insignificant to our business and financial results. For

more details on the Volcker Rule, see the “Regulatory Reform”

section in this Report.

Daily Trading-Related Revenue Table 42 provides information

on the distribution of daily trading-related revenues for the

Company’s trading portfolio. This trading-related revenue is

defined as the change in value of the trading assets and trading

liabilities, trading-related net interest income, and trading-

related intra-day gains and losses. Net trading-related revenue

does not include activity related to long-term positions held for

economic hedging purposes, period-end adjustments, and other

activity not representative of daily price changes driven by

market factors.

Market risk is the risk of possible economic loss from adverse

changes in market risk factors such as interest rates, credit

spreads, foreign exchange rates, equity prices, commodity prices,

mortgage rates and mortgage liquidity. Market risk is intrinsic to

the Company’s sales and trading, market making, investing, and

risk management activities.

The Company uses Value-at-Risk (VaR) metrics

complemented with sensitivity analysis and stress testing in

measuring and monitoring market risk. These market risk

measures are monitored at both the business unit level and at

aggregated levels on a daily basis. Our corporate market risk

management function aggregates and monitors all exposures to

ensure risk measures are within our established risk appetite.

Changes to the market risk profile are analyzed and reported on

a daily basis. The Company monitors various market risk

exposure measures from a variety of perspectives, including line

of business, product, risk type, and legal entity.

Wells Fargo & Company

92