Wells Fargo 2015 Annual Report Download - page 236

Download and view the complete annual report

Please find page 236 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273

|

|

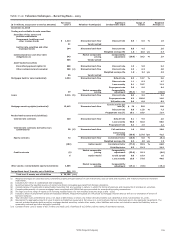

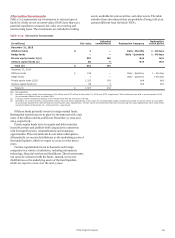

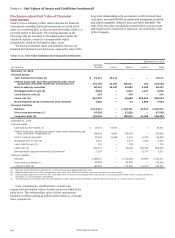

Note 17: Fair Values of Assets and Liabilities (continued)

Table 17.14 provides quantitative information about the

valuation techniques and significant unobservable inputs used in

the valuation of substantially all of our Level 3 assets and

liabilities measured at fair value on a nonrecurring basis for

which we use an internal model. The table is limited to financial

instruments that had nonrecurring fair value adjustments during

the periods presented.

We have excluded from the table classes of Level 3 assets

and liabilities measured using an internal model that we

Table 17.14: Valuation Techniques – Nonrecurring Basis

consider, both individually and in the aggregate, insignificant

relative to our overall Level 3 nonrecurring measurements. We

made this determination based upon an evaluation of each class,

which considered the magnitude of the positions, nature of the

unobservable inputs and potential for significant changes in fair

value due to changes in those inputs.

Fair Value Significant Unobservable Weighted

($ in millions) Level 3 Valuation Technique(s) (1) Inputs (1) Range of inputs Average (2)

December 31, 2015

Residential mortgages held

for sale (LOCOM) $ 1,047 (3) Discounted cash flow Default rate (4) 0.5 - 5.0% 4.2%

Discount rate 1.5 - 8.5 3.5

Loss severity 0.0 - 26.1 2.9

Prepayment rate (5) 2.6 - 100.0 65.4

Other assets: nonmarketable

equity investments 286 Net asset value Net asset value (6)

Market comparable Comparability

228 pricing adjustment 5.0 - 9.2 8.5

Insignificant level 3 assets 147

Total $ 1,708

December 31, 2014

Residential mortgages held for

sale (LOCOM) $ 1,098 (3) Discounted cash flow Default rate (4) 0.9 - 3.8 % 2.1

%

Discount rate 1.5 - 8.5 3.6

Loss severity 0.0 - 29.8 3.8

Prepayment rate (5) 2.0 - 100.0 65.5

Other assets: nonmarketable Comparability

equity investments 171 Market comparable pricing adjustment 6.0 - 6.0 6.0

Insignificant level 3 assets 294

Total $ 1,563

(1) Refer to the narrative following Table 17.11 for a definition of the valuation technique(s) and significant unobservable inputs.

(2) For residential MHFS, weighted averages are calculated using outstanding unpaid principal balance of the loans.

(3) Consists of $1.0 billion government insured/guaranteed loans purchased from GNMA-guaranteed mortgage securitization at both December 31, 2015 and 2014, and

$41 million and $78 million of other mortgage loans that are not government insured/guaranteed at December 31, 2015 and 2014, respectively.

(4) Applies only to non-government insured/guaranteed loans.

(5) Includes the impact on prepayment rate of expected defaults for the government insured/guaranteed loans, which impacts the frequency and timing of early resolution of

loans.

(6) The range and weighted average have not been provided since the investments have been recorded at their net asset redemption values.

Wells Fargo & Company

234