Wells Fargo 2015 Annual Report Download - page 193

Download and view the complete annual report

Please find page 193 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

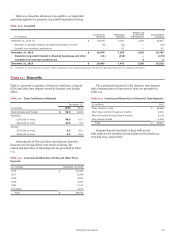

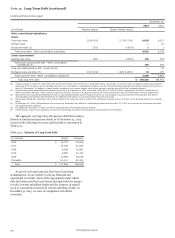

Transactions with Consolidated VIEs and Secured some instances will differ from “Total VIE assets.” For VIEs that

Borrowings obtain exposure synthetically through derivative instruments,

Table 8.7 presents a summary of financial assets and liabilities the remaining notional amount of the derivative is included in

for asset transfers accounted for as secured borrowings and “Total VIE assets.” On the consolidated balance sheet, we

involvements with consolidated VIEs. “Assets” are presented separately disclose the consolidated assets of certain VIEs that

using GAAP measurement methods, which may include fair can only be used to settle the liabilities of those VIEs.

value, credit impairment or other adjustments, and therefore in

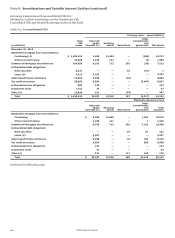

Table 8.7: Transactions with Consolidated VIEs and Secured Borrowings

Carrying value

(in millions)

Total VIE

assets Assets Liabilities

Noncontrolling

interests Net assets

December 31, 2015

Secured borrowings:

Municipal tender option bond securitizations $ 2,818 2,400 (1,800) — 600

Commercial real estate loans — — — — —

Residential mortgage securitizations 4,738 4,887 (4,844) — 43

Total secured borrowings 7,556 7,287 (6,644) — 643

Consolidated VIEs:

Nonconforming residential mortgage loan securitizations 4,134 3,654 (1,239) — 2,415

Commercial real estate loans 1,185 1,185 — — 1,185

Structured asset finance 54 20 (18) — 2

Investment funds 482 482 — — 482

Other 305 295 (101) (93) 101

Total consolidated VIEs 6,160 5,636 (1,358) (93) 4,185

Total secured borrowings and consolidated VIEs $ 13,716 12,923 (8,002) (93) 4,828

December 31, 2014

Secured borrowings:

Municipal tender option bond securitizations $ 5,422 4,837 (3,143) — 1,694

Commercial real estate loans 250 250 (63) — 187

Residential mortgage securitizations 4,804 5,045 (4,926) — 119

Total secured borrowings 10,476 10,132 (8,132) — 2,000

Consolidated VIEs:

Nonconforming residential mortgage loan securitizations 5,041 4,491 (1,509) — 2,982

Structured asset finance 47 47 (23) — 24

Investment funds 904 904 (2) — 902

Other 431 375 (143) (103) 129

Total consolidated VIEs 6,423 5,817 (1,677) (103) 4,037

Total secured borrowings and consolidated VIEs $ 16,899 $ 15,949 $ (9,809) $ (103) $ 6,037

In addition to the structure types included in the previous

table, at both December 31, 2015 and 2014, we had

approximately $6.0 billion of private placement debt financing

issued through a consolidated VIE. The issuance is classified as

long-term debt in our consolidated financial statements. At

December 31, 2015, we pledged approximately $529 million in

loans (principal and interest eligible to be capitalized), and

$5.9 billion in available-for-sale securities to collateralize the

VIE's borrowings, compared with $637 million and $5.7 billion,

respectively, at December 31, 2014. These assets were not

transferred to the VIE, and accordingly we have excluded the

VIE from the previous table.

We have raised financing through the securitization of

certain financial assets in transactions with VIEs accounted for

as secured borrowings. We also consolidate VIEs where we are

the primary beneficiary. In certain transactions we provide

contractual support in the form of limited recourse and liquidity

to facilitate the remarketing of short-term securities issued to

third party investors. Other than this limited contractual

support, the assets of the VIEs are the sole source of repayment

of the securities held by third parties.

MUNICIPAL TENDER OPTION BOND SECURITIZATIONS As

part of our normal investment portfolio activities, we consolidate

municipal bond trusts that hold highly rated, long-term, fixed-

rate municipal bonds, the majority of which are rated AA or

better. Our residual interests in these trusts generally allow us to

capture the economics of owning the securities outright, and

constructively make decisions that significantly impact the

economic performance of the municipal bond vehicle, primarily

by directing the sale of the municipal bonds owned by the

vehicle. In addition, the residual interest owners have the right

to receive benefits and bear losses that are proportional to

owning the underlying municipal bonds in the trusts. The trusts

obtain financing by issuing floating-rate trust certificates that

reprice on a weekly or other basis to third-party investors. Under

certain conditions, if we elect to terminate the trusts and

withdraw the underlying assets, the third party investors are

entitled to a small portion of any unrealized gain on the

Wells Fargo & Company

191