Wells Fargo 2015 Annual Report Download - page 264

Download and view the complete annual report

Please find page 264 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

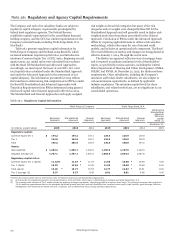

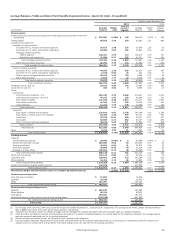

Note 26: Regulatory and Agency Capital Requirements

The Company and each of its subsidiary banks are subject to

regulatory capital adequacy requirements promulgated by

federal bank regulatory agencies. The Federal Reserve

establishes capital requirements for the consolidated financial

holding company, and the OCC has similar requirements for the

Company’s national banks, including Wells Fargo Bank, N.A.

(the Bank).

Table 26.1 presents regulatory capital information for

Wells Fargo & Company and the Bank using Basel III, which

increased minimum required capital ratios, and introduced a

minimum Common Equity Tier 1 (CET1) ratio. Beginning second

quarter 2015, our capital ratios were calculated in accordance

with the Basel III Standardized and Advanced Approaches.

Accordingly, we must report the lower of our CET1, tier 1 and

total capital ratios calculated under the Standardized Approach

and under the Advanced Approach in the assessment of our

capital adequacy. The information presented for 2015 reflects

the transition to determining risk-weighted assets (RWAs) under

the Basel III Standardized and Advanced Approaches with

Transition Requirements from RWAs determined using general

risk-based capital rules (General Approach) effective in 2014.

The Standardized and General Approaches each apply assigned

Table 26.1: Regulatory Capital Information

risk weights to broad risk categories but many of the risk

categories and/or weights were changed by Basel III for the

Standardized Approach and will generally result in higher risk-

weighted assets than from those prescribed for the General

Approach. Calculation of RWAs under the Advanced Approach

differs by requiring applicable banks to utilize a risk-sensitive

methodology, which relies upon the use of internal credit

models, and includes an operational risk component. The Basel

III revised definition of capital, and changes are being phased-in

effective January 1, 2014, through the end of 2021.

The Bank is an approved seller/servicer of mortgage loans

and is required to maintain minimum levels of shareholders’

equity, as specified by various agencies, including the United

States Department of Housing and Urban Development, GNMA,

FHLMC and FNMA. At December 31, 2015, the Bank met these

requirements. Other subsidiaries, including the Company’s

insurance and broker-dealer subsidiaries, are also subject to

various minimum capital levels, as defined by applicable

industry regulations. The minimum capital levels for these

subsidiaries, and related restrictions, are not significant to our

consolidated operations.

Advanced

Approach

Wells Fargo & Company

Standardized

Approach

General

Approach

Advanced

Approach

Wells Fargo Bank, N.A.

Standardized

Approach

General

Approach

Advanced &

Standardized

Approach

Minimum

capital

ratios (1)

December 31,

(in billions, except ratios) 2015 2015 2014 2015 2015 2014 2015

Regulatory capital:

Common equity tier 1

Tier 1

$ 144.2

164.6

144.2

164.6

137.1

154.7

126.9

126.9

126.9

126.9

119.9

119.9

Total 195.2 205.6 192.9 140.5 150.0 144.0

Assets:

Risk-weighted

Adjusted average (2)

$ 1,263.2

1,757.1

1,303.1

1,757.1

1,242.5

1,637.0

1,100.9

1,584.3

1,197.6

1,584.3

1,142.5

1,487.6

Regulatory capital ratios:

Common equity tier 1 capital

Tier 1 capital

Total capital

Tier 1 leverage (2)

11.42%

13.03

15.45 *

9.37

11.07

12.63

15.77

9.37

*

*

11.04

12.45

15.53

9.45

11.53

11.53

12.77

8.01

10.60

10.60

12.52

8.01

*

*

*

10.49

10.49

12.61

8.06

4.50

6.00

8.00

4.00

*Denotes the lowest capital ratio as determined under the Basel III Advanced and Standardized Approaches.

(1) As defined by the regulations issued by the Federal Reserve, OCC and FDIC, which apply to Wells Fargo & Company and Wells Fargo Bank, N.A.

(2) The leverage ratio consists of Tier 1 capital divided by quarterly average total assets, excluding goodwill and certain other items. The minimum leverage ratio guideline is

3% for banking organizations that do not anticipate significant growth and that have well-diversified risk, excellent asset quality, high liquidity, good earnings, effective

management and monitoring of market risk and, in general, are considered top-rated, strong banking organizations.

Wells Fargo & Company

262