Wells Fargo 2015 Annual Report Download - page 50

Download and view the complete annual report

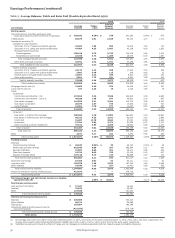

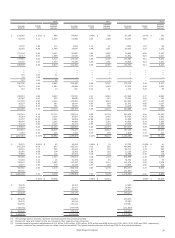

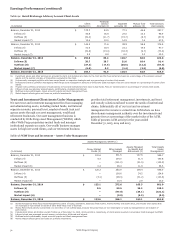

Please find page 50 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Earnings Performance (continued)

Community Banking reported net income of $13.5 billion in

2015, down $195 million, or 1%, from $13.7 billion in 2014,

which was up 13% from $12.1 billion in 2013. Revenue was

$49.3 billion in 2015, an increase of $1.2 billion, or 2%,

compared with $48.2 billion in 2014, which was up 1%

compared with $47.7 billion in 2013. The increase in revenue for

2015 was primarily driven by higher net interest income, gains

on sale of debt securities, debit and credit card fees, and trust

and investment fees, partially offset by lower gains from trading

activities, deferred compensation plan investment gains (offset

in employee benefits expense) and other income. Lower other

income in 2015, compared with 2014, reflected a gain on sale of

government guaranteed student loans in 2014 and lower

ineffectiveness gains in 2015 on derivatives that qualify for

hedge accounting. The increase in revenue for 2014, compared

with 2013, was primarily driven by higher net interest income,

gains on sale of equity investments and debt securities, higher

trust and investment fees, and higher card fees, partially offset

by lower mortgage banking revenue, the phase out of the direct

deposit advance product during the first half of 2014, and lower

deferred compensation plan investment gains (offset in

employee benefits expense). Higher other income for 2014

compared with 2013 reflected larger ineffectiveness gains on

derivatives that qualify for hedge accounting and a gain on sale

of government guaranteed student loans in fourth quarter 2014.

Average deposits increased $40.1 billion in 2015, or 7%, from

2014, which increased $119.6 billion, or 24%, from 2013.

Noninterest expense increased $691 million in 2015, or 3%, from

2014, which declined $800 million, or 3%, from 2013. The

increase in noninterest expense for 2015 largely reflected higher

personnel expense, operating losses, equipment expense, and a

$126 million donation to the Wells Fargo Foundation, partially

offset by lower deferred compensation expense (offset in

revenue), foreclosed assets, travel, data processing, occupancy

and various other expenses. The decrease in noninterest expense

for 2014 largely reflected lower mortgage volume-related

expenses and deferred compensation expense (offset in

revenue), partially offset by higher operating losses. The

provision for credit losses of $2.4 billion in 2015 was

$631 million, or 35%, higher than 2014, which was $1.0 billion,

or 37%, lower than 2013. The increase in provision in 2015 was

due to $1.1 billion lower allowance release, partially offset by

$403 million lower net charge-offs related to improvement in

the consumer real estate portfolio. The decrease in provision in

2014 was due to $1.5 billion lower net charge-offs related to the

consumer real estate portfoli0, partially offset by $454 million

lower allowance release.

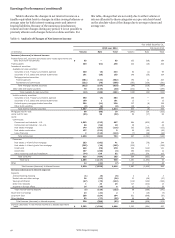

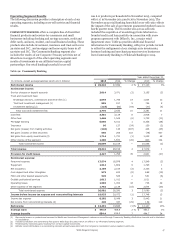

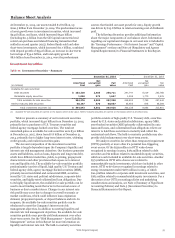

WHOLESALE BANKING provides financial solutions to

businesses across the United States and globally with annual

sales generally in excess of $5 million. Products and businesses

include Business Banking, Middle Market Commercial Banking,

Government and Institutional Banking, Corporate Banking,

Commercial Real Estate, Treasury Management, Wells Fargo

Capital Finance, Insurance, International, Real Estate Capital

Markets, Commercial Mortgage Servicing, Corporate Trust,

Equipment Finance, Wells Fargo Securities, Principal

Investments, and Asset Backed Finance. Wholesale Banking

cross-sell is reported on a one-quarter lag and for fourth quarter

2015 was 7.3 products per relationship, up from 7.2 for fourth

quarter 2014 and 7.1 for fourth quarter 2013. Wholesale Banking

cross-sell does not reflect Business Banking relationships, which

were realigned from Community Banking to Wholesale Banking

effective fourth quarter 2015. Table 9b provides additional

financial information for Wholesale Banking, with prior periods

revised to reflect the realignment of our asset management

business from Wholesale Banking to WIM; our reinsurance

business from WIM to Wholesale Banking; and our strategic

auto investments, business banking and merchant payment

services businesses from Community Banking to Wholesale

Banking in 2015.

Wells Fargo & Company

48