Wells Fargo 2015 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

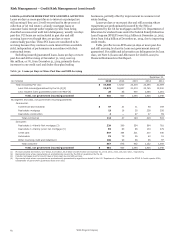

Risk Management – Credit Risk Management (continued)

LOANS 90 DAYS OR MORE PAST DUE AND STILL ACCRUING

Loans 90 days or more past due as to interest or principal are

still accruing if they are (1) well-secured and in the process of

collection or (2) real estate 1-4 family mortgage loans or

consumer loans exempt under regulatory rules from being

classified as nonaccrual until later delinquency, usually 120 days

past due. PCI loans are not included in past due and still

accruing loans even though they are 90 days or more

contractually past due. These PCI loans are considered to be

accruing because they continue to earn interest from accretable

yield, independent of performance in accordance with their

contractual terms.

Excluding insured/guaranteed loans, loans 90 days or more

past due and still accruing at December 31, 2015, were up

$61 million, or 7%, from December 31, 2014, primarily due to

increases in our credit card and dealer floorplan lending

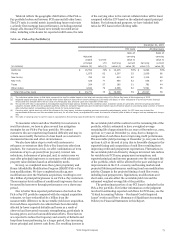

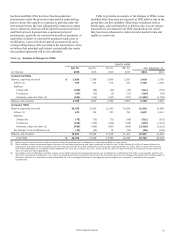

Table 36: Loans 90 Days or More Past Due and Still Accruing

businesses, partially offset by improvement in consumer real

estate lending.

Loans 90 days or more past due and still accruing whose

repayments are predominantly insured by the FHA or

guaranteed by the VA for mortgages and the U.S. Department of

Education for student loans under the Federal Family Education

Loan Program (FFELP) were $13.4 billion at December 31, 2015,

down from $16.9 billion at December 31, 2014, due to improving

credit trends.

Table 36 reflects non-PCI loans 90 days or more past due

and still accruing by class for loans not government insured/

guaranteed. For additional information on delinquencies by loan

class, see Note 6 (Loans and Allowance for Credit Losses) to

Financial Statements in this Report.

December 31,

(in millions) 2015 2014 2013 2012 2011

Total (excluding PCI (1)): $ 14,380 17,810 23,219 23,245 22,569

Less: FHA insured/guaranteed by the VA (2)(3) 13,373 16,827 21,274 20,745 19,240

Less: Student loans guaranteed under the FFELP (4) 26 63 900 1,065 1,281

Total, not government insured/guaranteed $ 981 920 1,045 1,435 2,048

By segment and class, not government insured/guaranteed:

Commercial:

Commercial and industrial $ 97 31 11 48 159

Real estate mortgage 13 16 35 228 256

Real estate construction 4 — 97 27 89

Total commercial 114 47 143 303 504

Consumer:

Real estate 1-4 family first mortgage (3) 224 260 354 564 781

Real estate 1-4 family junior lien mortgage (3) 65 83 86 133 279

Credit card 397 364 321 310 346

Automobile 79 73 55 40 51

Other revolving credit and installment 102 93 86 85 87

Total consumer 867 873 902 1,132 1,544

Total, not government insured/guaranteed $ 981 920 1,045 1,435 2,048

(1) PCI loans totaled $2.9 billion, $3.7 billion, $4.5 billion, $6.0 billion and $8.7 billion at December 31, 2015, 2014, 2013, 2012 and 2011, respectively.

(2) Represents loans whose repayments are predominantly insured by the FHA or guaranteed by the VA.

(3) Includes mortgages held for sale 90 days or more past due and still accruing.

(4) Represents loans whose repayments are predominantly guaranteed by agencies on behalf of the U.S. Department of Education under the FFELP. In fourth quarter 2014,

substantially all government guaranteed loans were sold.

Wells Fargo & Company

82