Wells Fargo 2015 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Risk Management – Credit Risk Management (continued)

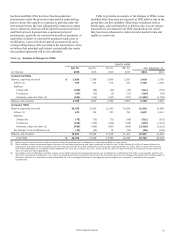

During 2014, we reported sufficient foreclosure prevention

actions to satisfy the $1.2 billion financial commitment.

In June 2015, we entered into an additional amendment to

the April 2011 Consent Order with the OCC to address 15 of the

98 actionable items contained in the April 2011 Consent Order

that were still considered open. This amendment requires that

we remediate certain activities associated with our mortgage

loan servicing practices and allows for the OCC to take additional

supervisory action, including possible civil money penalties, if

we do not comply with the terms of this amended Consent

Order. In addition, this amendment prohibits us from acquiring

new mortgage servicing rights or entering into new mortgage

servicing contracts, other than mortgage servicing associated

with originating mortgage loans or purchasing loans from

correspondent clients in our normal course of business.

Additionally, this amendment prohibits any new off-shoring of

new mortgage servicing activities and requires OCC approval to

outsource or sub-service any new mortgage servicing activities.

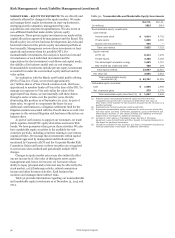

Asset/Liability Management

Asset/liability management involves evaluating, monitoring and

managing interest rate risk, market risk, liquidity and funding.

Primary oversight of interest rate risk and market risk resides

with the Finance Committee of our Board of Directors (Board),

which oversees the administration and effectiveness of financial

risk management policies and processes used to assess and

manage these risks. Primary oversight of liquidity and funding

resides with the Risk Committee of the Board. At the

management level we utilize a Corporate Asset/Liability

Management Committee (Corporate ALCO), which consists of

senior financial, risk, and business executives, to oversee these

risks and report on them periodically to the Board’s Finance

Committee and Risk Committee as appropriate. Each of our

principal lines of business has its own asset/liability

management committee and process linked to the Corporate

ALCO process. As discussed in more detail for trading activities

below, we employ separate management level oversight specific

to market risk. Market risk, in its broadest sense, refers to the

possibility that losses will result from the impact of adverse

changes in market rates and prices on our trading and non-

trading portfolios and financial instruments.

INTEREST RATE RISK Interest rate risk, which potentially can

have a significant earnings impact, is an integral part of being a

financial intermediary. We are subject to interest rate risk

because:

• assets and liabilities may mature or reprice at different

times (for example, if assets reprice faster than liabilities

and interest rates are generally falling, earnings will initially

decline);

• assets and liabilities may reprice at the same time but by

different amounts (for example, when the general level of

interest rates is falling, we may reduce rates paid on

checking and savings deposit accounts by an amount that is

less than the general decline in market interest rates);

• short-term and long-term market interest rates may change

by different amounts (for example, the shape of the yield

curve may affect new loan yields and funding costs

differently);

• the remaining maturity of various assets or liabilities may

shorten or lengthen as interest rates change (for example, if

long-term mortgage interest rates decline sharply, MBS held

in the investment securities portfolio may prepay

significantly earlier than anticipated, which could reduce

portfolio income); or

• interest rates may also have a direct or indirect effect on

loan demand, collateral values, credit losses, mortgage

origination volume, the fair value of MSRs and other

financial instruments, the value of the pension liability and

other items affecting earnings.

We assess interest rate risk by comparing outcomes under

various earnings simulations using many interest rate scenarios

that differ in the direction of interest rate changes, the degree of

change over time, the speed of change and the projected shape of

the yield curve. These simulations require assumptions

regarding how changes in interest rates and related market

conditions could influence drivers of earnings and balance sheet

composition such as loan origination demand, prepayment

speeds, deposit balances and mix, as well as pricing strategies.

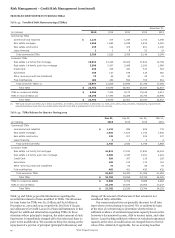

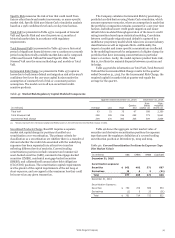

Our risk measures include both net interest income

sensitivity and interest rate sensitive noninterest income and

expense impacts. We refer to the combination of these exposures

as interest rate sensitive earnings. In general, the Company is

positioned to benefit from higher interest rates. Currently, our

profile is such that net interest income will benefit from higher

interest rates as our assets reprice faster and to a greater degree

than our liabilities, and, in response to lower market rates, our

assets will reprice downward and to a greater degree than our

liabilities. Our interest rate sensitive noninterest income and

expense is largely driven by mortgage activity, and tends to move

in the opposite direction of our net interest income. So, in

response to higher interest rates, mortgage activity, primarily

refinancing activity, generally declines. And in response to lower

rates, mortgage activity generally increases. Mortgage results in

our simulations are also impacted by the valuation of MSRs and

related hedge positions. See the “Risk Management – Mortgage

Banking Interest Rate and Market Risk” section in this Report

for more information.

The degree to which these sensitivities offset each other is

dependent upon the timing and magnitude of changes in interest

rates, and the slope of the yield curve. During a transition to a

higher or lower interest rate environment, a reduction or

increase in interest-sensitive earnings from the mortgage

banking business could occur quickly, while the benefit or

detriment from balance sheet repricing could take more time to

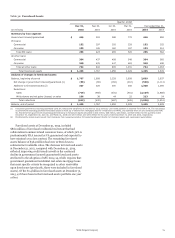

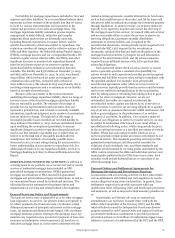

develop. For example, our lower rate scenarios (scenario 1 and

scenario 2) in the following table initially measure a decline in

interest rates versus our most likely scenario. Although the

performance in these rate scenarios contain initial benefit from

increased mortgage banking activity, the result is lower earnings

relative to the most likely scenario over time given pressure on

net interest income. The higher rate scenarios (scenario 3 and

scenario 4) measure the impact of varying degrees of rising

short-term and long-term interest rates over the course of the

forecast horizon relative to the most likely scenario, both

resulting in positive earnings sensitivity.

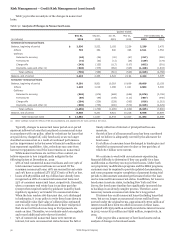

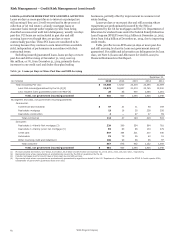

As of December 31, 2015, our most recent simulations

estimate earnings at risk over the next 24 months under a range

of both lower and higher interest rates. The results of the

simulations are summarized in Table 40, indicating cumulative

net income after tax earnings sensitivity relative to the most

likely earnings plan over the 24 month horizon (a positive range

indicates a beneficial earnings sensitivity measurement relative

to the most likely earnings plan and a negative range indicates a

detrimental earnings sensitivity relative to the most likely

earnings plan).

Wells Fargo & Company

88