Wells Fargo 2015 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

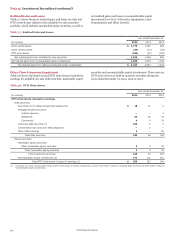

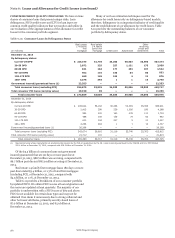

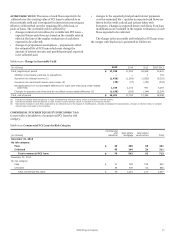

Note 6: Loans and Allowance for Credit Losses (continued)

CONSUMER CREDIT QUALITY INDICATORS We have various

classes of consumer loans that present unique risks. Loan

delinquency, FICO credit scores and LTV for loan types are

common credit quality indicators that we monitor and utilize in

our evaluation of the appropriateness of the allowance for credit

losses for the consumer portfolio segment.

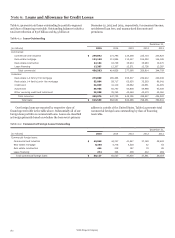

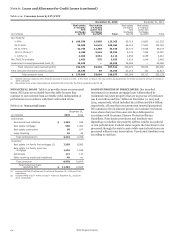

Table 6.10: Consumer Loans by Delinquency Status

Many of our loss estimation techniques used for the

allowance for credit losses rely on delinquency-based models;

therefore, delinquency is an important indicator of credit quality

and the establishment of our allowance for credit losses. Table

6.10 provides the outstanding balances of our consumer

portfolio by delinquency status.

Real estate Real estate Other

(in millions)

1-4 family

first

mortgage

1-4 family

junior lien

mortgage Credit card Automobile

revolving

credit and

installment Total

December 31, 2015

By delinquency status:

Current-29 DPD $ 225,195 51,778 33,208 58,503 38,690 407,374

30-59 DPD 2,072 325 257 1,121 175 3,950

60-89 DPD 821 184 177 253 107 1,542

90-119 DPD 402 110 150 84 86 832

120-179 DPD 460 145 246 4 21 876

180+ DPD 3,376 393 1 1 19 3,790

Government insured/guaranteed loans (1) 22,353 — — — — 22,353

Total consumer loans (excluding PCI) 254,679 52,935 34,039 59,966 39,098 440,717

Total consumer PCI loans (carrying value) 19,190 69 — — — 19,259

Total consumer loans $ 273,869 53,004 34,039 59,966 39,098 459,976

December 31, 2014

By delinquency status:

Current-29 DPD $ 208,642 58,182 30,356 54,365 35,356 386,901

30-59 DPD 2,415 398 239 1,056 180 4,288

60-89 DPD 993 220 160 235 111 1,719

90-119 DPD 488 158 136 78 82 942

120-179 DPD 610 194 227 5 21 1,057

180+ DPD 4,258 464 1 1 13 4,737

Government insured/guaranteed loans (1) 26,268 — — — — 26,268

Total consumer loans (excluding PCI) 243,674 59,616 31,119 55,740 35,763 425,912

Total consumer PCI loans (carrying value) 21,712 101 — — — 21,813

Total consumer loans $ 265,386 59,717 31,119 55,740 35,763 447,725

(1) Represents loans whose repayments are predominantly insured by the FHA or guaranteed by the VA. Loans insured/guaranteed by the FHA/VA and 90+ DPD totaled

$12.4 billion at December 31, 2015, compared with $16.2 billion at December 31, 2014.

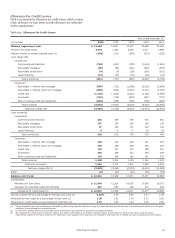

Of the $5.5 billion of consumer loans not government

insured/guaranteed that are 90 days or more past due at

December 31, 2015, $867 million was accruing, compared with

$6.7 billion past due and $873 million accruing at December 31,

2014.

Real estate 1-4 family first mortgage loans 180 days or more

past due totaled $3.4 billion, or 1.3% of total first mortgages

(excluding PCI), at December 31, 2015, compared with

$4.3 billion, or 1.7%, at December 31, 2014.

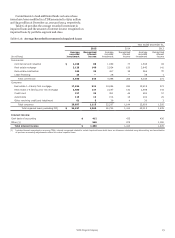

Table 6.11 provides a breakdown of our consumer portfolio

by updated FICO. We obtain FICO scores at loan origination and

the scores are updated at least quarterly. The majority of our

portfolio is underwritten with a FICO score of 680 and above.

FICO is not available for certain loan types and may not be

obtained if we deem it unnecessary due to strong collateral and

other borrower attributes, primarily security-based loans of

$7.0 billion at December 31, 2015, and $5.9 billion at

December 31, 2014.

Wells Fargo & Company

168