Wells Fargo 2015 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

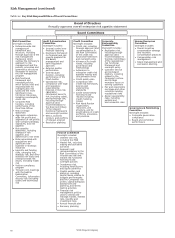

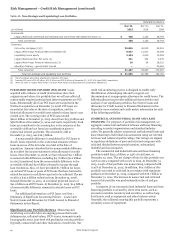

Risk Management – Credit Risk Management (continued)

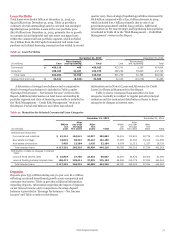

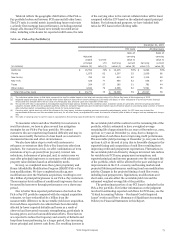

Table 18: Non-Strategic and Liquidating Loan Portfolios

Outstanding balance

Dec 31, Dec 31, Dec 31,

(in millions) 2015 2014 2008

Commercial:

Legacy Wachovia commercial and industrial and commercial real estate PCI loans (1) $ 468 1,125 18,704

Total commercial 468 1,125 18,704

Consumer:

Pick-a-Pay mortgage (1)(2) 39,065 45,002 95,315

Legacy Wells Fargo Financial debt consolidation (3) 9,957 11,417 25,299

Liquidating home equity 2,234 2,910 10,309

Legacy Wachovia other PCI loans (1) 221 300 2,478

Legacy Wells Fargo Financial indirect auto (3) 10 34 18,221

Education Finance – government insured — — 20,465

Total consumer 51,487 59,663 172,087

Total non-strategic and liquidating loan portfolios $ 51,955 60,788 190,791

(1) Net of purchase accounting adjustments related to PCI loans.

(2) Includes PCI loans of $19.0 billion, $21.5 billion and $37.6 billion at December 31, 2015, 2014 and 2008, respectively.

(3) When we refer to “legacy Wells Fargo”, we mean Wells Fargo excluding Wachovia Corporation (Wachovia).

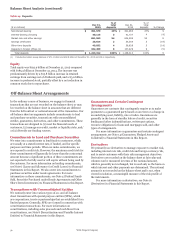

PURCHASED CREDIT-IMPAIRED (PCI) LOANS Loans

acquired with evidence of credit deterioration since their

origination and where it is probable that we will not collect all

contractually required principal and interest payments are PCI

loans. Substantially all of our PCI loans were acquired in the

Wachovia acquisition on December 31, 2008. PCI loans are

recorded at fair value at the date of acquisition, and the

historical allowance for credit losses related to these loans is not

carried over. The carrying value of PCI loans totaled

$20.0 billion at December 31, 2015, down from $23.3 billion and

$58.8 billion at December 31, 2014 and 2008, respectively. Such

loans are considered to be accruing due to the existence of the

accretable yield and not based on consideration given to

contractual interest payments. The accretable yield at

December 31, 2015, was $16.3 billion.

A nonaccretable difference is established for PCI loans to

absorb losses expected on the contractual amounts of those

loans in excess of the fair value recorded at the date of

acquisition. Amounts absorbed by the nonaccretable difference

do not affect the income statement or the allowance for credit

losses. Since December 31, 2008, we have released $11.7 billion

in nonaccretable difference, including $9.7 billion ($1.2 billion

in 2015) transferred from the nonaccretable difference to the

accretable yield and $2.0 billion released to income through

loan resolutions. Also, we have provided $1.7 billion for losses

on certain PCI loans or pools of PCI loans that have had credit-

related decreases to cash flows expected to be collected. The net

result is a $10.0 billion reduction from December 31, 2008,

through December 31, 2015, in our initial projected losses of

$41.0 billion on all PCI loans. At December 31, 2015, $1.9 billion

of nonaccretable difference remained to absorb losses on PCI

loans.

For additional information on PCI loans, see Note 1

(Summary of Significant Accounting Policies – Loans) and

Note 6 (Loans and Allowance for Credit Losses) to Financial

Statements in this Report.

Significant Loan Portfolio Reviews Measuring and

monitoring our credit risk is an ongoing process that tracks

delinquencies, collateral values, FICO scores, economic trends

by geographic areas, loan-level risk grading for certain portfolios

(typically commercial) and other indications of credit risk. Our

credit risk monitoring process is designed to enable early

identification of developing risk and to support our

determination of an appropriate allowance for credit losses. The

following discussion provides additional characteristics and

analysis of our significant portfolios. See Note 6 (Loans and

Allowance for Credit Losses) to Financial Statements in this

Report for more analysis and credit metric information for each

of the following portfolios.

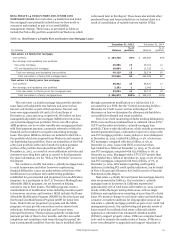

COMMERCIAL AND INDUSTRIAL LOANS AND LEASE

FINANCING For purposes of portfolio risk management, we

aggregate commercial and industrial loans and lease financing

according to market segmentation and standard industry

codes. We generally subject commercial and industrial loans and

lease financing to individual risk assessment using our internal

borrower and collateral quality ratings. Our ratings are aligned

to regulatory definitions of pass and criticized categories with

criticized divided between special mention, substandard,

doubtful and loss categories.

The commercial and industrial loans and lease financing

portfolio totaled $312.3 billion, or 34% of total loans, at

December 31, 2015. The net charge-off rate for this portfolio was

0.16% in 2015 compared with 0.10% in 2014. At December 31,

2015, 0.44% of this portfolio was nonaccruing, compared with

0.20% at December 31, 2014. In addition, $19.1 billion of this

portfolio was rated as criticized in accordance with regulatory

guidance at December 31, 2015, compared with $16.7 billion at

December 31, 2014. The increase in nonaccrual and criticized

loans in this portfolio was predominantly in the oil and gas

portfolio.

A majority of our commercial and industrial loans and lease

financing portfolio is secured by short-term assets, such as

accounts receivable, inventory and securities, as well as long-

lived assets, such as equipment and other business assets.

Generally, the collateral securing this portfolio represents a

secondary source of repayment.

Wells Fargo & Company

64