Wells Fargo 2015 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Changes subsequent to inception are based on changes in fair

value of the underlying loan resulting from the exercise of the

commitment and changes in the probability that the loan will not

fund within the terms of the commitment, referred to as a fall-

out factor. The value of the underlying loan commitment is

affected primarily by changes in interest rates and the passage of

time.

Outstanding derivative loan commitments expose us to the

risk that the price of the mortgage loans underlying the

commitments might decline due to increases in mortgage

interest rates from inception of the rate lock to the funding of the

loan. To minimize this risk, we employ mortgage forwards and

options, Eurodollar futures and options, and Treasury futures,

forwards and options contracts as economic hedges against the

potential decreases in the values of the loans. We expect that

these derivative financial instruments will experience changes in

fair value that will either fully or partially offset the changes in

fair value of the derivative loan commitments. However, changes

in investor demand, such as concerns about credit risk, can also

cause changes in the spread relationships between underlying

loan value and the derivative financial instruments that cannot

be hedged.

MARKET RISK – TRADING ACTIVITIES The Finance

Committee of our Board of Directors reviews the acceptable

market risk appetite for our trading activities. We engage in

trading activities primarily to accommodate the investment and

risk management activities of our customers (which involves

transactions that are recorded as trading assets and liabilities on

our balance sheet), to execute economic hedging to manage

certain balance sheet risks and, to a very limited degree, for

proprietary trading for our own account. These activities

primarily occur within our Wholesale Banking businesses and to

a lesser extent other divisions of the Company. All of our trading

assets and liabilities, including securities, foreign exchange

transactions, commodity transactions, and derivatives are

carried at fair value. Income earned related to these trading

activities include net interest income and changes in fair value

related to trading assets and liabilities. Net interest income

earned on trading assets and liabilities is reflected in the interest

income and interest expense components of our income

statement. Changes in fair value of trading assets and liabilities

are reflected in net gains on trading activities, a component of

noninterest income in our income statement.

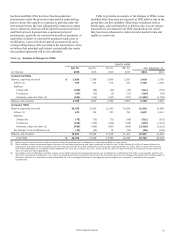

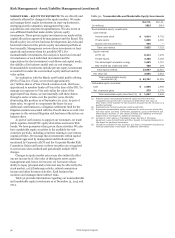

Table 41 presents total revenue from trading activities.

Table 41: Net gains (losses) from Trading Activities

Year ended December 31,

(in millions) 2015 2014 2013

Interest income (1) 1,971 1,685 1,376

Less: Interest expense (2) 357 382 307

Net interest income 1,614 1,303 1,069

Noninterest income:

Net gains (losses) from

trading activities (3):

Customer

accommodation 806 924 1,278

Economic hedges

and other (4) (192) 233 332

Proprietary trading — 4 13

Total net gains

from trading

activities 614 1,161 1,623

Total trading-related net

interest and noninterest

income 2,228 2,464 2,692

(1) Represents interest and dividend income earned on trading securities.

(2) Represents interest and dividend expense incurred on trading securities we

have sold but have not yet purchased.

(3) Represents realized gains (losses) from our trading activity and unrealized

gains (losses) due to changes in fair value of our trading positions, attributable

to the type of business activity.

(4) Excludes economic hedging of mortgage banking and asset/liability

management activities, for which hedge results (realized and unrealized) are

reported with the respective hedged activities.

Customer accommodation Customer accommodation activities

are conducted to help customers manage their investment and

risk management needs. We engage in market-making activities

or act as an intermediary to purchase or sell financial

instruments in anticipation of or in response to customer needs.

This category also includes positions we use to manage our

exposure to customer transactions.

For the majority of our customer accommodation trading,

we serve as intermediary between buyer and seller. For example,

we may purchase or sell a derivative to a customer who wants to

manage interest rate risk exposure. We typically enter into

offsetting derivative or security positions with a separate

counterparty or exchange to manage our exposure to the

derivative with our customer. We earn income on this activity

based on the transaction price difference between the customer

and offsetting derivative or security positions, which is reflected

in the fair value changes of the positions recorded in net gains on

trading activities.

Customer accommodation trading also includes net gains

related to market-making activities in which we take positions to

facilitate customer order flow. For example, we may own

securities recorded as trading assets (long positions) or sold

securities we have not yet purchased, recorded as trading

liabilities (short positions), typically on a short-term basis, to

facilitate support of buying and selling demand from our

customers. As a market maker in these securities, we earn

income due to: (1) the difference between the price paid or

received for the purchase and sale of the security (bid-ask

spread), (2) the net interest income, and (3) the change in fair

value of the long or short positions during the short-term period

held on our balance sheet. Additionally, we may enter into

separate derivative or security positions to manage our exposure

related to our long or short security positions. Income earned on

this type of market-making activity is reflected in the fair value

changes of these positions recorded in net gains on trading

activities.

Wells Fargo & Company

91