Wells Fargo 2015 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

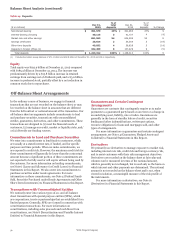

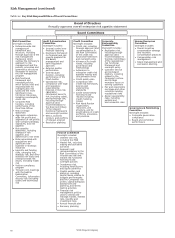

Risk Management (continued)

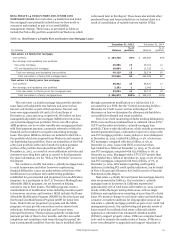

Table 16: Key Risk Responsibilities of Board Committees

Board of Directors

Annually approves overall enterprise risk appetite statement

Board Committees

Risk Committee

Oversight includes:

• Enterprise-wide risk

management

framework and

structure, including

through approval of the

risk management

framework which

outlines the Company’s

approach to risk

management and the

policies, processes and

governance structures

necessary to execute

the risk management

program

• Risk functional

framework and

oversight policies,

which outline roles and

responsibilities for

managing key risk

types and the most

significant cross-

functional risk areas,

including counterparty

credit risk

• Corporate Risk

function, including

performance of the

Chief Risk Officer

• Risk coverage

statement

• Aggregate enterprise-

wide risk profile and

alignment of risk profile

with Company strategy,

objectives, and risk

appetite

Audit & Examination

Committee

Oversight includes:

• Internal control over

financial reporting

• Disclosure framework

for financial and risk

reports prepared for

the Board,

management and

bank regulatory

agencies

• External auditor

performance

• Internal audit

function, including

performance of the

Chief Auditor

• Operational risk,

compliance with legal

and regulatory

requirements,

financial crimes risk

(BSA/AML),

information security

risk (including cyber),

and technology risk,

including through

approval (and

recommendation to

the Risk Committee)

of the relevant

functional framework

and oversight policies

• Ethics, business

conduct, and conflicts

of interest program

• Resolution planning

Credit Committee

Oversight includes:

• Credit risk, including

through approval (and

recommendation to

the Risk Committee)

of the credit risk

functional framework

and oversight policy

• Allowance for credit

losses, including

governance and

methodology

• Adherence to

enterprise credit risk

appetite metrics and

concentration limits

• Credit quality plan

• Compliance with

credit risk framework,

policies and

underwriting

standards

• Credit stress testing

framework and

results (including

credit modeling

issues)

• Risk Asset Review

organization,

resources, and

structure, and its

examinations of credit

portfolios, processes,

and practices

Corporate

Responsibility

Committee

Oversight includes:

• Reputation risk,

including through

approval (and

recommendation to

the Risk Committee)

of the reputational

risk functional

framework and

oversight policy

• Customer service

and complaint

matters, including

related to the

Company’s culture

and its team

members’ focus on

serving customers

• Fair and responsible

mortgage and other

consumer lending

reputational risks

• Social responsibility

risks, including

political and

environmental risks

Human Resources

Committee

Oversight includes:

• Overall incentive

compensation strategy

and incentive

compensation practices

• Compensation risk

management

• Talent management and

succession planning

Governance & Nominating

Committee

Oversight includes:

• Corporate governance

compliance

• Board and committee

performance

• Risk appetite

statement, including

changes in risk

appetite, and

adherence to risk limits

• Risks associated with

acquisitions and

significant new

business or strategic

initiatives

• Liquidity and funding

risks, emerging risk,

strategic risk, and other

selected risk topics and

enterprise-wide risk

issues, including model

risk

• Volcker compliance

program

• Through joint meetings

with the Audit &

Examination

Committee, information

security risk (including

cyber) and technology

risk

Finance Committee

Oversight includes:

• Interest rate risk,

including the MSR

• Market risk, including

trading and derivative

activities

• Approval (and

recommendation to the

Risk Committee) of the

interest rate risk and

market risk functional

framework and

oversight policies

• Investment risk,

including fixed-income

and equity portfolios

• Capital position and

planning, including

capital levels relative to

budgets and forecasts

and the Company’s risk

profile, capital adequacy

assessment and

planning, and stress

testing activities

• Financial risk

management policies

used to assess and

manage market, interest

rate, liquidity and

investment risks

• Annual financial plan

• Recovery planning

Wells Fargo & Company

60