Wells Fargo 2015 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

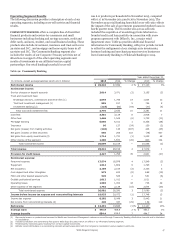

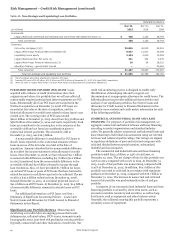

Contractual Cash Obligations

In addition to the contractual commitments and arrangements

previously described, which, depending on the nature of the

obligation, may or may not require use of our resources, we enter

into other contractual obligations that may require future cash

payments in the ordinary course of business, including debt

issuances for the funding of operations and leases for premises

and equipment.

Table 15: Contractual Cash Obligations

Table 15 summarizes these contractual obligations as of

December 31, 2015, excluding the projected cash payments for

obligations for short-term borrowing arrangements and pension

and postretirement benefit plans. More information on those

obligations is in Note 12 (Short-Term Borrowings) and Note 20

(Employee Benefits and Other Expenses) to Financial

Statements in this Report.

December 31, 2015

(in millions)

Note(s) to

Financial

Statements

Less than

1 year

1-3

years

3-5

years

More

than

5 years

Indeterminate

maturity Total

Contractual payments by period:

Deposits (1)

Long-term debt (2)

Interest (3)

Operating leases

Unrecognized tax obligations

Commitments to purchase debt

and equity securities (4)

Purchase and other obligations (5)

11

7, 13

7

21

$ 81,846

31,904

3,143

1,131

115

2,154

575

9,192

44,914

4,823

1,928

—

509

483

3,321

41,638

3,650

1,409

—

57

185

4,155

81,080

15,369

2,234

—

—

82

1,124,798

—

—

—

2,581

—

—

1,223,312

199,536

26,985

6,702

2,696

2,720

1,325

Total contractual obligations $ 120,868 61,849 50,260 102,920 1,127,379 1,463,276

(1) Includes interest-bearing and noninterest-bearing checking, and market rate and other savings accounts.

(2) Balances are presented net of unamortized debt discounts and premiums and purchase accounting adjustments.

(3) Represents the future interest obligations related to interest-bearing time deposits and long-term debt in the normal course of business including a net reduction of

$25.7 billion related to hedges used to manage interest rate risk. These interest obligations assume no early debt redemption. We estimated variable interest rate

payments using December 31, 2015, rates, which we held constant until maturity. We have excluded interest related to structured notes where our payment obligation is

contingent on the performance of certain benchmarks.

(4) Includes unfunded commitments to purchase debt and equity investments, excluding trade date payables, of $573 million and $2.1 billion, respectively. Our unfunded

equity commitments include certain investments subject to the Volcker Rule, which we expect to divest in the near future. For additional information regarding the Volcker

Rule, see the "Regulatory Reform" section in this Report. We have presented predominantly all of our contractual obligations on equity investments above in the maturing

in less than one year category as there are no specified contribution dates in the agreements. These obligations may be requested at any time by the investment manager.

(5) Represents agreements related to unrecognized obligations to purchase goods or services.

We are subject to the income tax laws of the U.S., its states Transactions with Related Parties

and municipalities, and those of the foreign jurisdictions in The Related Party Disclosures topic of the Accounting Standards

which we operate. We have various unrecognized tax obligations Codification (ASC) 850 requires disclosure of material related

related to these operations that may require future cash tax party transactions, other than compensation arrangements,

payments to various taxing authorities. Because of their expense allowances and other similar items in the ordinary

uncertain nature, the expected timing and amounts of these course of business. Based on ASC 850, we had no transactions

payments generally are not reasonably estimable or required to be reported for the years ended December 31, 2015,

determinable. We attempt to estimate the amount payable in the 2014 and 2013. The Company has included within its disclosures

next 12 months based on the status of our tax examinations and information on its equity investments, relationships with

settlement discussions. See Note 21 (Income Taxes) to Financial variable interest entities, and employee benefit plan

Statements in this Report for more information. arrangements. See Note 7 (Premises, Equipment, Lease

Commitments and Other Assets), Note 8 (Securitizations and

Variable Interest Entities) and Note 20 (Employee Benefits and

Other Expenses) to Financial Statements in this Report.

Wells Fargo & Company

57