Wells Fargo 2015 Annual Report Download - page 221

Download and view the complete annual report

Please find page 221 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

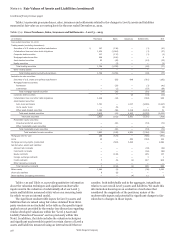

and valuation techniques used are appropriate. Once these

vendors are approved to provide pricing information, we

monitor and review the results to ensure the fair values are

reasonable and in line with market experience in similar asset

classes. While the input amounts used by the pricing vendor in

determining fair value are not provided, and therefore

unavailable for our review, we do perform one or more of the

following procedures to validate the prices received:

• comparison to other pricing vendors (if available);

• variance analysis of prices;

• corroboration of pricing by reference to other independent

market data, such as market transactions and relevant

benchmark indices;

• review of pricing by Company personnel familiar with

market liquidity and other market-related conditions; and

• investigation of prices on a specific instrument-by-

instrument basis.

Fair Value Measurements from Vendors

For certain assets and liabilities, we obtain fair value

measurements from vendors, which predominantly consist of

third-party pricing services, and record the unadjusted fair value

in our financial statements. For instruments where we utilize

vendor prices to record the price of an instrument, we perform

additional procedures (see the "Vendor-Developed Valuation"

section). Methodologies employed, controls relied upon and

inputs used by third-party pricing vendors are subject to

additional review when such services are provided. This review

may consist of, in part, obtaining and evaluating control reports

issued and pricing methodology materials distributed.

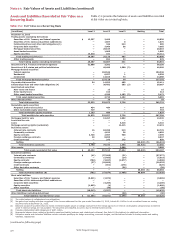

Table 17.1 presents unadjusted fair value measurements

provided by brokers or third-party pricing services fair value

hierarchy level . Fair value measurements obtained from brokers

or third-party pricing services that we have adjusted to

determine the fair value recorded in our financial statements are

excluded from Table 17.1.

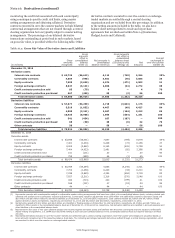

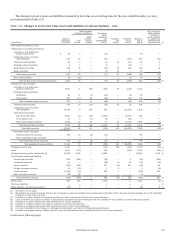

Table 17.1: Fair Value Measurements by Brokers or Third-Party Pricing Services

Brokers Third-party pricing services

(in millions)

December 31, 2015

Trading assets (excluding derivatives)

Available-for-sale securities:

$

Level 1

—

Level 2

—

Level 3

—

Level 1

—

Level 2

5

Level 3

—

Securities of U.S. Treasury and federal agencies

Securities of U.S. states and political subdivisions

Mortgage-backed securities

Other debt securities (1)

Total debt securities

Total marketable equity securities

Total available-for-sale securities

—

—

—

—

—

—

—

—

—

226

503

729

—

729

—

—

—

409

409

—

409

32,868

—

—

—

32,868

—

32,868

3,382

48,443

126,525

48,721

227,071

484

227,555

—

51

73

345

469

—

469

Derivatives (trading and other assets) — — — — 224 —

Derivatives (liabilities) — — — — (221) —

Other liabilities — — — — (1) —

December 31, 2014

Trading assets (excluding derivatives) $ — — — 2 105 —

Available-for-sale securities:

Securities of U.S. Treasury and federal agencies — — — 19,899 5,905 —

Securities of U.S. states and political subdivisions — — — — 42,666 61

Mortgage-backed securities — 152 — — 135,997 133

Other debt securities (1) — 1,035 601 — 41,933 541

Total debt securities — 1,187 601 19,899 226,501

Total marketable equity securities — — — — 569 —

Total available-for-sale securities — 1,187 601 19,899 227,070

Derivatives (trading and other assets) — 1 — — 290 —

Derivatives (liabilities) — (1) — — (292) —

Other liabilities — — — — (1) —

(1) Includes corporate debt securities, collateralized loan and other debt obligations, asset-backed securities, and other debt securities.

Wells Fargo & Company

735

735

219