Wells Fargo 2015 Annual Report Download - page 240

Download and view the complete annual report

Please find page 240 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

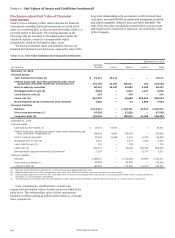

Note 17: Fair Values of Assets and Liabilities (continued)

Disclosures about Fair Value of Financial

Instruments

Table 17.19 is a summary of fair value estimates for financial

instruments, excluding financial instruments recorded at fair

value on a recurring basis as they are included within Table 17.2

included earlier in this Note. The carrying amounts in the

following table are recorded on the balance sheet under the

indicated captions, except for nonmarketable equity

investments, which are included in other assets.

We have not included assets and liabilities that are not

financial instruments in our disclosure, such as the value of the

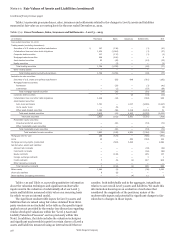

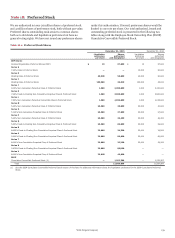

Table 17.19: Fair Value Estimates for Financial Instruments

long-term relationships with our deposit, credit card and trust

customers, amortized MSRs, premises and equipment, goodwill

and other intangibles, deferred taxes and other liabilities. The

total of the fair value calculations presented does not represent,

and should not be construed to represent, the underlying value

of the Company.

Estimated fair value

(in millions)

Carrying

amount Level 1 Level 2 Level 3 Total

December 31, 2015

Financial assets

Cash and due from banks (1) $ 19,111 19,111 — — 19,111

Federal funds sold, securities purchased under resale

agreements and other short-term investments (1) 270,130 14,057 255,911 162 270,130

Held-to-maturity securities 80,197 45,167 32,052 3,348 80,567

Mortgages held for sale (2) 6,064 — 5,019 1,047 6,066

Loans held for sale (2) 279 — 279 — 279

Loans, net (3) 887,497 — 60,848 839,816 900,664

Nonmarketable equity investments (cost method) 7,035 — 14 7,890 7,904

Financial liabilities

Deposits 1,223,312 — 1,194,781 28,616 1,223,397

Short-term borrowings (1) 97,528 — 97,528 — 97,528

Long-term debt (4) 199,528 — 188,015 10,468 198,483

December 31, 2014

Financial assets

Cash and due from banks (1) $ 19,571 19,571 — — 19,571

Federal funds sold, securities purchased under resale agreements and

other short-term investments (1) 258,429 8,991 249,438 — 258,429

Held to maturity securities 55,483 41,548 9,021 5,790 56,359

Mortgages held for sale (2) 3,971 — 2,875 1,098 3,973

Loans held for sale (2) 721 — 739 — 739

Loans, net (3) 832,671 — 60,052 784,786 844,838

Nonmarketable equity investments (cost method) 7,033 — — 8,377 8,377

Financial liabilities

Deposits 1,168,310 — 1,132,845 35,566 1,168,411

Short-term borrowings (1) 63,518 — 63,518 — 63,518

Long-term debt (4) 183,934 — 174,996 10,479 185,475

(1) Amounts consist of financial instruments in which carrying value approximates fair value.

(2) Balance reflects MHFS and LHFS, as applicable, other than those MHFS and LHFS for which we elected the fair value option.

(3) Loans exclude balances for which the fair value option was elected and also exclude lease financing with a carrying amount of $12.4 billion and $12.3 billion at

December 31, 2015 and 2014, respectively.

(4) The carrying amount and fair value exclude obligations under capital leases of $8 million and $9 million at December 31, 2015 and 2014, respectively.

Loan commitments, standby letters of credit and

commercial and similar letters of credit are not included in the

table above. The estimated fair value of these instruments

totaled $1.0 billion and $945 million at December 31, 2015 and

2014, respectively.

Wells Fargo & Company

238