Wells Fargo 2015 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2015 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and reduce the impact of climate

change. Our Environmental Solutions

for Communities five-year grant

program, begun in 2012, has funded

more than $9.8 million in grants

to more than 250 nonprofits to

date that promote conservation

and environmental sustainability

in communities across the U.S.

We work hard to make our

internal operations more ecient

by minimizing waste and using

renewable sources of energy.

Today, more than 20 million

square feet of oce space across

418 bank stores and other locations

is Leadership in Energy and

Environmental Design (LEED)

certified. The U.S. Green Building

Council recognized our leadership,

naming us the “green” building leader

among financial institutions in 2015.

More information about our

community eorts is available

in our Corporate Social Responsibility

Report at wellsfargo.com under

“About Wells Fargo.”

Earning relationships

with our shareholders

We also work to build long-term

relationships with our shareholders

and earn their confidence through

our performance over time.

We believe that we attract

shareholders and sustain

relationships through the many

long-term advantages that we oer

investors, including our leading

market share in cornerstone products;

diversified and balanced revenue

sources; strong risk discipline;

experienced management team;

and consistent culture.

These advantages and our

financial performance have enabled

us to continue to return more capital

to our shareholders than in the

previous year. I noted earlier that

in 2015 we returned $12.6 billion

through common stock dividends

and net share repurchases.

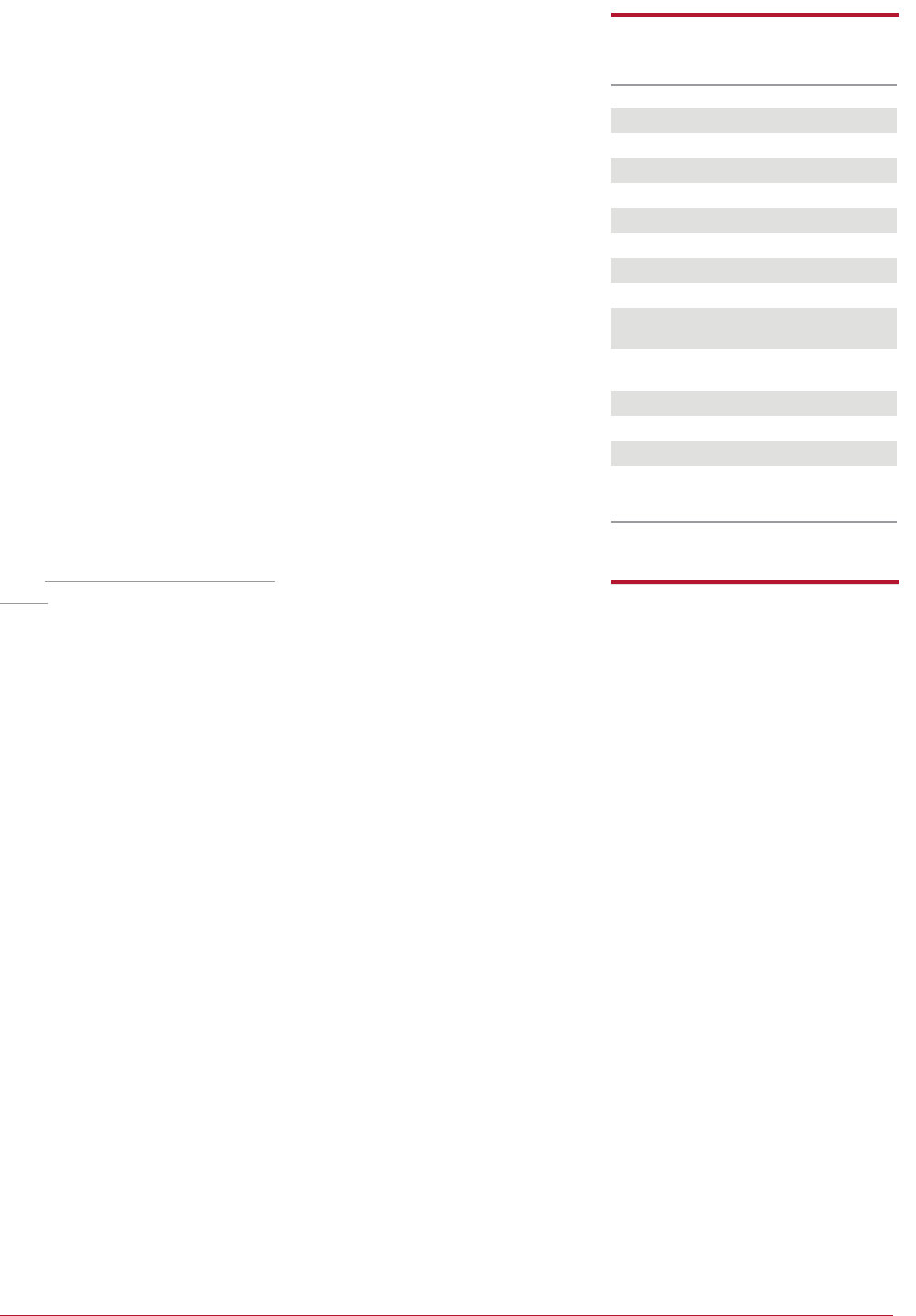

Further reinforcing the long-term

nature of our commitment, Wells Fargo

leads in total shareholder return among

our bank peer group over the past

five- and 10-year periods (ended

Dec. 31, 2015).

Actively preparing for the future

While we take great pride in the

relationships we are earning today,

and those we’ve earned over our

history, we are hardly anchored

to the past. The world is changing

rapidly, and one of the ways we

keep the customer at the center

of all we do is by innovating.

In addition to the six priorities

I mentioned earlier, which

we concentrate on daily, we have

identified four drivers that we

believe are critical to our

future success:

Creating exceptional

customer experiences

Customer experience is at the

core of our Culture of Caring focus,

in how we treat our customers and

each other. As our team members

do their jobs, they demonstrate

a positive and caring attitude for

customers every day. This mindset

is so important to our success that

I like to say we hire for attitude and

train for aptitude.

Exceptional customer experiences

also stem from a can-do mindset.

If there’s a better way, we’ll work

hard to find it for our customers.

For example, we enhanced the

account-opening process for our

retail banking customers in 2015

through our “Steps to Better Banking”

program. The program provides

information about how to avoid

service fees, explains choosing and

setting up numerous types of text

alerts, and oers other key resources

— all within an hour of opening

an account.

A third mindset of caring for

our customers is realizing that

at Wells Fargo, we are better together.

That means communicating clearly

with our customers, such as sending

timely alerts on account transactions.

And we provide free retirement

assessments and online educational

resources such as our Smarter

Credit™ center and My Money MapSM,

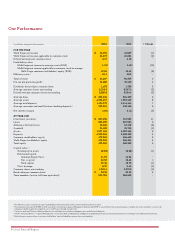

Total Shareholder Return (annualized)

Ended Dec. 31, 2015

5yr Rank 10yr Rank

Wells Fargo 14.7% 1 8.5% 1

Bank of America 5.4% 11 -7.6% 10

BB&T 10.5% 6 2.7% 5

Capital One 12.4% 2 -0.4% 6

Citigroup 2.0% 12 -18.6% 12

Fifth Third Bancorp 9.2% 8 -3.5% 8

JPMorgan Chase 12.1% 4 7.9% 2

KeyCorp 10.3% 7 -6.3% 9

PNC Financial 11.9% 5 7.1% 3

Services

Regions 7.9% 10 -9.5% 11

Financial

SunTrust 9.1% 9 -3.0% 7

U.S. Bancorp 12.1% 3 6.6% 4

S&P 500 (SPX) 12.5% 7.3%

KBW 9.1% -1.0%

Nasdaq bank

index (BKX)

Source: Bloomberg, includes share price

appreciation and reinvested dividends

an online tool that enables customers

to track spending, budgeting, and

savings in easy-to-understand charts.

We care deeply for our customers

and want to do all we can to help

them achieve financial success.

Digitizing the enterprise

We continue to make new

technology offerings and channels

available throughout our businesses.

Our customers have responded

enthusiastically to text and email alerts,

payment solutions like Apple Pay™

and Android Pay™, and pilots

of biometric customer authentication

for both business and retail customers

that we expect to roll out later

this year. We introduced the

yourLoanTrackerSM service in 2015

to allow our customers to monitor

the status of their loans throughout

the home-financing process using

their computer, smartphone, or tablet.

We are careful not to create new

technologies in isolation; the value

of innovation is when technology

is aligned. This means that all

of our distribution channels

— locations, phone banks, ATMs,

|2015 Annual Report